Economist Warns of "Bitcoin Aristocracy" Ruling the World

Economist Dr. Jon Danielsson envisions a zero-sum game for Bitcoin where for crypto to "succeed," the world must perish.

Key Takeaways

- Dr. Danielsson stated that support of Bitcoin is based in "mysticism," comparing Bitcoin to stamps or beanie babies.

- He claimed that Bitcoin must be used for commercial transactions to be successful.

- The article warned of wealth disparity created by high Bitcoin price points, ignoring the huge disparity of the world we already live in.

Share this article

Dr. Jon Danielsson, the Director of the Systemic Risk Centre at the London School of Economics, has written one of the most bearish takes on Bitcoin to date — but his argument may have missed a few key points.

BTC Is Not a Safe Haven

Danielsson wrote that “most of us would not want to live in a society where bitcoin [sic] succeeds.”

He stated that without providing a valuable service, investing in crypto is like “collecting stamps or beanie babies,” adding:

“The bitcoin [sic] enthusiasts are quite vague on what success means beyond rising prices, they seem more fond of arguments wrapped in mysticism than basic economic logic.”

Danielsson wrote that Bitcoin must be used in commercial transactions to be successful, saying all other use cases depend on it. He went as far as describing BTC’s success as a zero-sum game. It either replaces current transaction mediums like the Euro, Pound, Yen, and so on, or it utterly fails.

Use cases beyond this, such as a safe haven asset, are superfluous, according to Danielsson.

In his argument, he also cited Dr. Mohammed Cheema, a Senior Lecturer in Finance at the University of Waikato. In Cheema’s article, he pointed to research that crypto is viewed as risky, citing himself as his own source, before adding that BTC is not a safe haven — and he’s right.

There is little hard evidence that Bitcoin is currently a safe haven asset. Indeed quite the opposite.

During the March 2020 crash, BTC fell as hard as the rest of the global markets. Moreover, analysts within and without the crypto industry have reminded that a small allocation can improve a portfolio’s efficiency.

But does Bitcoin need to be commercially transacted like Visa to be successful? For many, a hedge against inflation suffices. And if one considers this objective, then BTC has certainly achieved its goal.

Of all assets, Bitcoin was the best performing in 2020.

Is Bitcoin Successful?

Danielsson clarified with Crypto Briefing that Bitcoin’s use case as a hedge against inflation requires people to continue to invest in Bitcoin, and this argument is perhaps more compelling.

Bitcoin could displace gold, thats not what bitcoin advocates claim to want, nor likely.

Hedging against inflation only works if people keep on buying bitcoin. Otherwise its like collecting art. It needs some economic function, now missing.https://t.co/BchMr4OF7s https://t.co/jKasXOpOSx

— Jon Danielsson (@JonDanielsson) February 26, 2021

However, this ignores Bitcoin’s other economic functions.

Bitcoin can be used to transfer value peer-to-peer at any time, day or night, circumventing the banking system’s weekend limitations. It has also played a key role in environments where financial censorship is common such as Russia, Belarus, and many other nations.

Though unpolished, Layer 2 solutions like Bitcoin’s Lightning Network also envision an effective payments solution for the leading cryptocurrency.

Danielsson’s colleague and head of research at Blockchain.com, Dr. Garrick Hileman, weighed in to point out some of the argument’s apparent flaws.

Based on how Bitcoin is predominantly used today, the terms “cryptoasset”, “digital asset” or “digital commodity “ are more correct and useful labels for #Bitcoin than its original “cryptocurrency” label.

— Garrick Hileman (@GarrickHileman) February 26, 2021

Hileman’s thesis makes sense in the context of large corporate investors like Tesla and MicroStrategy using Bitcoin to counteract the downside risk of fiat. Both CEOs have been vocal in their worries about asset and fiat inflation. They are not seeking a cash alternative in these investments, as Danielsson supposes.

He writes:

“The value proposition for bitcoin is that it will displace fiat money – the dollar, euro, renminbi and all the others – either fully or partially. As I argue below, I think it is inevitable that it will be ‘either, or’ – either full displacement or no displacement, complete success or failure.”

Finally, Danielsson issued a dire warning of a new global elite rising from Bitcoin’s success in this regard.

BTC Wealth Distribution Is Problematic

Danielsson envisioned a future in which Bitcoin has fully displaced fiat currency, saying:

“The current owners of bitcoin will become the wealthiest people in the world, rivalling the kings and emperors that ruled over empires in centuries past. They literally will own all the money. They can buy anything they want.”

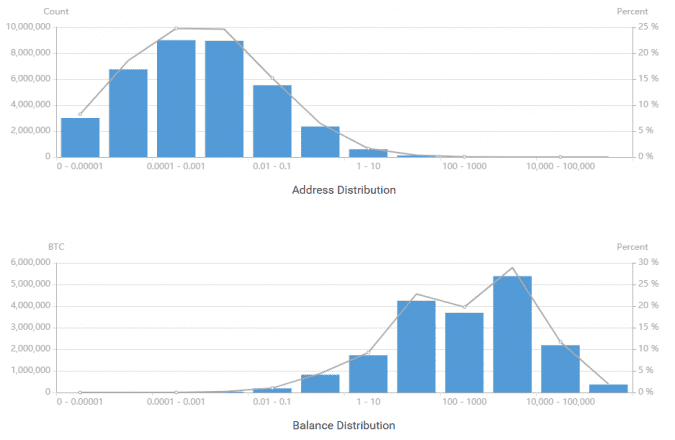

This argument fails to mention the world currently operates this way. The richest 1% are on track to control two-thirds of the world’s wealth. In the United States, 1% of the population controls 38% of the wealth. Still, it cannot be denied that Bitcoin may follow a similar fate.

Wallet distribution metrics suggest that an outsized portion of BTC’s supply is in the hands of just 2% of wallets.

Danielsson does outline one real problem with Bitcoin. Is it cash, or is it a speculative asset?

While the whitepaper envisioned a form of digital cash that would decentralize finance and perhaps shake up the balance of power, these days, Bitcoin’s role as a store of value and a hedge against inflation has seen the “M1” use case for the cryptocurrency take a back seat.

Unlike many traditional assets, however, it’s very easy for people from all walks of life to invest in BTC and trade it peer to peer or hold it as a store of value.

Disclosure: The author held Bitcoin at the time of press.

Share this article