Ethereum: Five Years Leading the Blockchain Revolution

It’s been a long journey since the Ethereum Genesis block was created. From ERC-20 tokens to the famous ICO bubble and the DeFi craze—here is a summary of what Ethereum has to celebrate so far.

Key Takeaways

- Ethereum genesis block was mined on July 30, 2015, and has made substantial progress since then

- Over its five year lifetime, Ethereum served as a source of the majority of trends in the cryptocurrency space

- The network is the most tried and tested Layer 1 platform in the blockchain industry

Share this article

Ethereum is the oldest smart-contract platform in the blockchain space. While many of the concepts the team utilized were not novel at the time, Ethereum was the first to implement them in a decentralized manner at scale.

The network significantly expanded the blockchain’s capabilities, creating use cases beyond merely sending transactions. Consequently, the project’s ecosystem and the entire market started to grow at breakneck speeds. The majority of the existing blockchain projects originated on Ethereum.

Although the platform has issues with its technological limitations, governance, and the speed of development, it still remains at the forefront of the market’s narrative shifts. Besides Initial Exchange Offerings, the activity that moved the markets had their spark on Ethereum. Time will tell whether Ethereum continues to remain in the market’s spotlight, but its history is essential to understanding the current state of the space.

Early Days of the Ethereum Frontier

An active participant of the Bitcoin community since 2011 and a co-founder of Bitcoin Magazine, Vitalik Buterin, wanted to make more use out of the blockchain technology. In 2013, he published a paper introducing Ethereum.

The idea got the attention of more senior developers and tech professionals, and the team behind the project started to form. Initially, there were Gavin Wood, Charles Hoskinson, Anthony Di Iorio, Mihai Alisie, and Amir Chetrit. Many of them later pursued other endeavors in the blockchain space. For instance, Charles Hoskinson founded Cardano.

In 2014, the team was busy with the network’s development. The founders registered the Ethereum Foundation in Zug, Switzerland, in July 2014. Shortly after the registration, the team conducted the Initial Coin Offering (ICO), which lasted from July to September 2014. Back then, 1 BTC could buy up to 2,000 ETH.

The development process that started back in 2013 finally resulted in the launch of Frontier, the beta mainnet of the Ethereum network, on July 30, 2015. The Genesis block was mined, and the system started to function in the real world. Around that time, an essential organization to the Ethereum’s ecosystem, MakerDAO, was founded. It still remains the cornerstone decentralized autonomous organization (DAO), providing a way to borrow DAI stablecoins.

In less than a month since the rollout of Frontier Augur, the leading platform for prediction markets conducted a crowdsale. It was the first ICO for an Ethereum-based project. However, it still wasn’t one of the typical ICOs which started to flood the market down the road.

Shortly after Augur’s token sale Fabian Vogelsteller, formerly an Ethereum developer and currently the founder of LUKSO, proposed a standard interface for tokens called ‘ERC-20.’ ERC-20 was the crucial development that promoted one of the blockchain’s killer features: fundraising.

A Blockchain Fraught with Forks

The ICO wave started to take off at the beginning of 2016. Ethereum featured smart-contract capability, which enabled projects to automatically raise funds in ETH and distribute ERC-20 standard tokens to investors in exchange. Projects like Golem and FirstBlood emerged using the new model. Still, the fundraising craze wasn’t yet at full steam.

Meanwhile, Ethereum went out of the beta mainnet stage. The transition to the mainnet called Homestead happened in March 2016.

A month later, the world saw the emergence of the most popular DAO, which was prosaically called “The DAO.” Despite the novel and enticing concept of decentralized governance through the smart-contracts, The DAO turned out to be the thing that might have killed Ethereum.

The DAO raised more than $150 million by May 2016, making it the most massive honeypot on the blockchain at that moment. At the same time, it turned out that one of the project’s functions could be exploited. Eventually, the exploit was used to steal 3.6 million ETH.

The aftermath of The DAO hack led to contradictions within the Ethereum’s community. The community faced a choice of whether they would reverse the effect of the hack by performing a hard fork or leaving things as they were. Eventually, the majority of the network’s users voted for the hard fork.

After the hard fork took place in July 2016, some of Ethereum’s users stuck to the old chain, where the funds were still on the hacker’s address. And Ethereum Classic was born, splitting the Ethereum community. The tests for Ethereum didn’t end there. During the $30 million wallet hack, the network experienced DDoS attacks, so the team had to perform two more hard forks. Although the team’s response was adequate, ETH didn’t finish 2016 on a positive note price-wise.

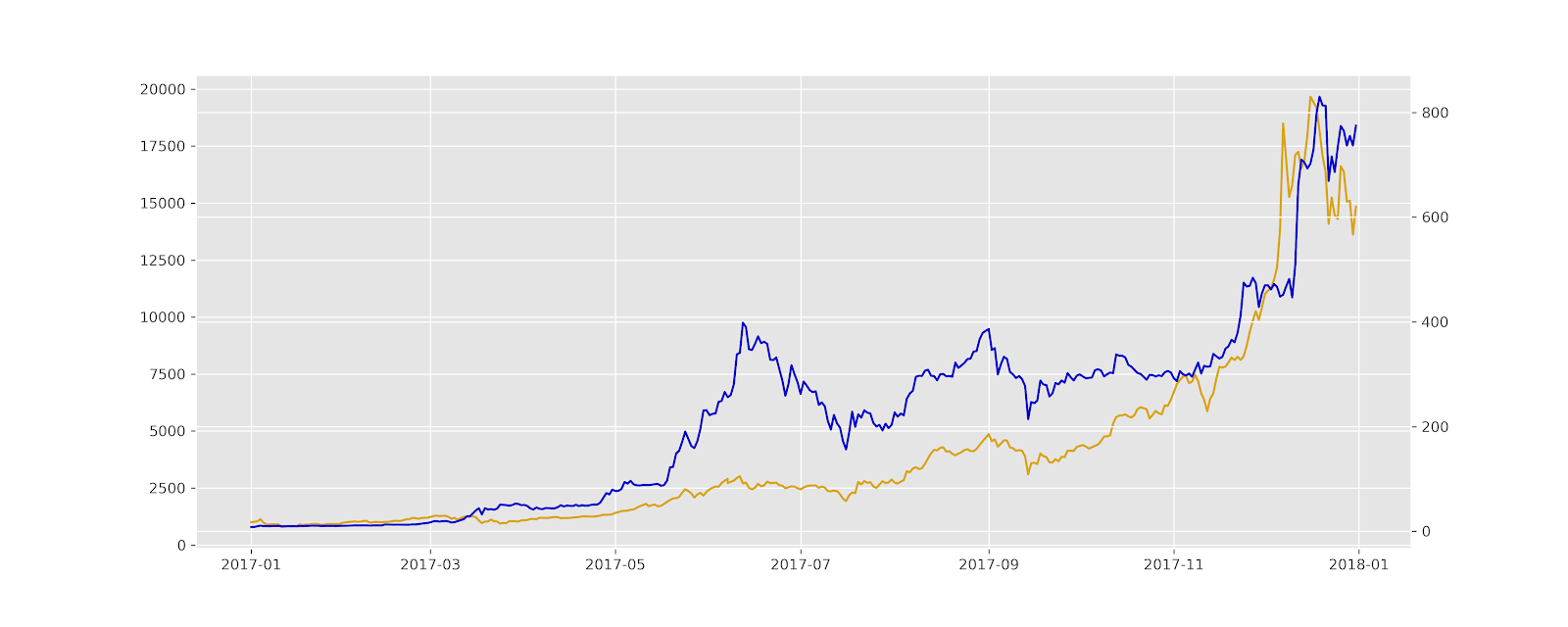

In 2017, though, things started to pick up. During the Summer, both Bitcoin and Ethereum began to grow in price after a muted start. BTC was getting mainstream attention, which translated to Ethereum. Also, more projects started to raise money via ICOs.

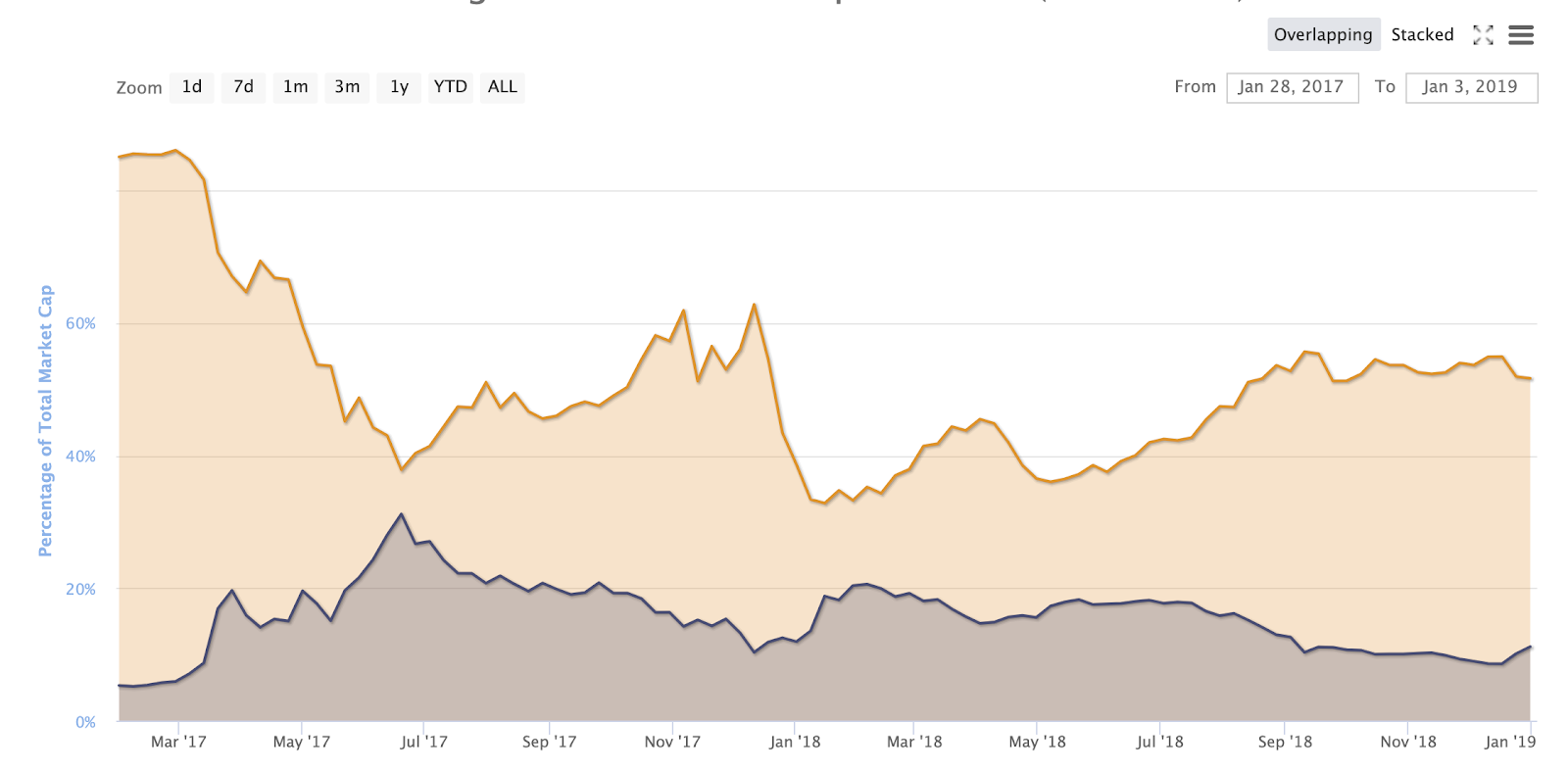

The altcoin market, primarily fueled by Ethereum, was growing faster than Bitcoin did. Ethereum could have become the world’s largest cryptocurrency. However, the “flippening” —the reversal of BTC and ETH by market cap—didn’t happen. Though it was a close call.

Meanwhile, the growing on-chain activity started to manifest itself. The network then (and now) used proof-of-work (PoW) consensus, which meant slow throughput and increasing transaction fees. ICOs started experiencing the so-called “gas wars,” where users competed for allocation by paying exorbitant transaction fees.

To the Moon and Back with Byzantium

The community awaited scalability solutions, and they came. Byzantium hard fork conducted in October 2017, brought support for sidechains and Zero-Knowledge off-chain solutions.

Shortly after, in November 2017, Vitalik Buterin presented a proposal for the next iteration of the platform dubbed “Ethereum 2.0.” The concept involved a gradual transition from the slow PoW to the much faster PoS. He also spoke about extending scalability by dividing the network’s computation into segments, or “sharding.”

Still, as no real improvements were made, the network finally came to a halt. A popular decentralized app (dApp), CryptoKitties, brought Ethereum to a near standstill. By that time, the market was falling into the euphoria stage. Both BTC and ETH were rallying as the mainstream retail investors rushed in.

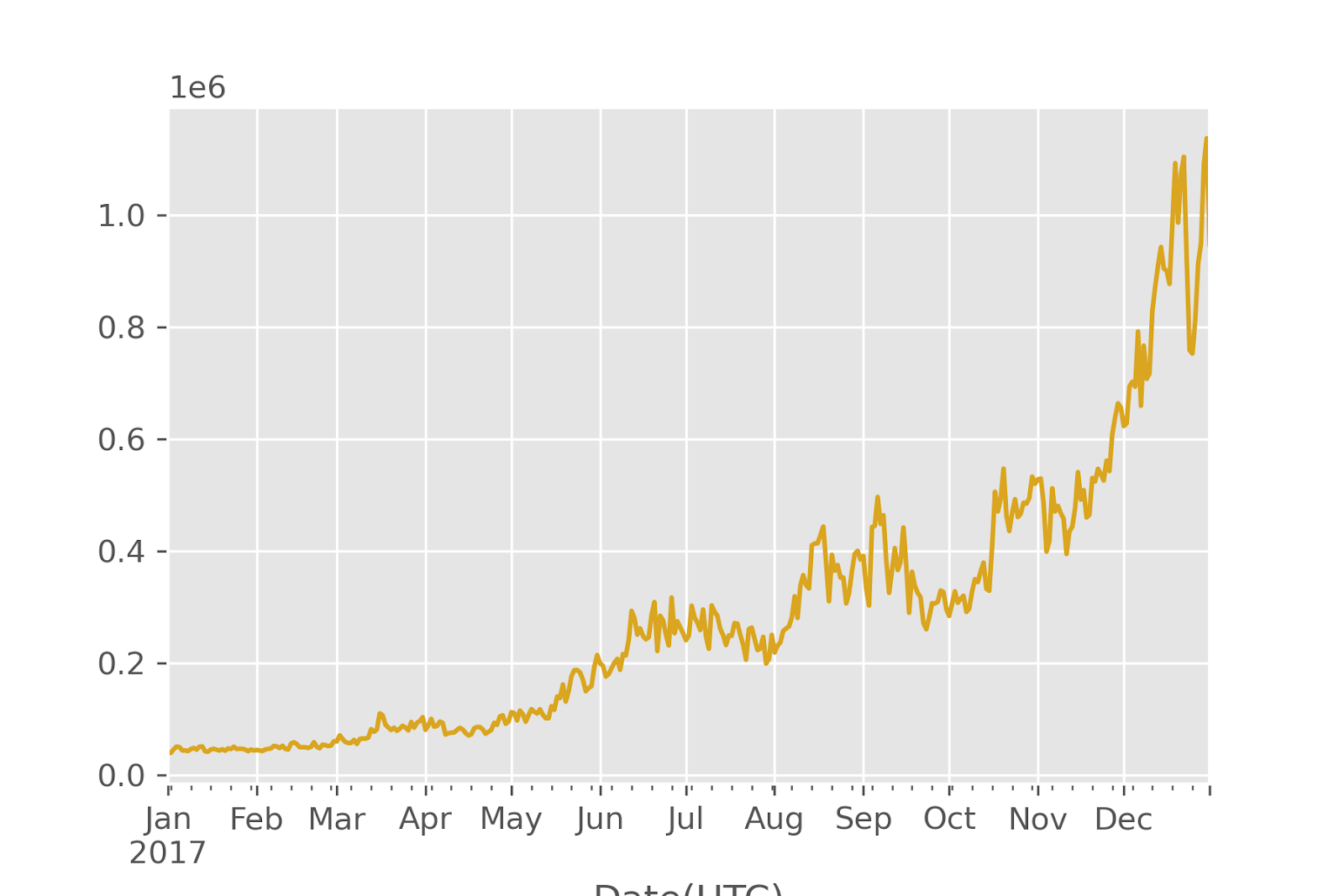

In 2017 Ethereum acted as a proving ground for blockchain-based fundraising. The market saw almost 500 ICOs, which raised over $9 billion. However, the bubble eventually popped at the beginning of 2018 (shortly after Bitcoin was pushed down by a new-born breed of short-sellers).

While the bubble was deflating, the hope for a rebound remained. ICOs didn’t slow their pace; in fact, there were almost five times more token sales in 2018 than there were in 2017.

Meanwhile, Vitalik Buterin continued to support optimistic community members by providing more information about the looming scalability improvements during a conference in May 2018. Still, the rebound never materialized and optimism started to dry up. The ICO concept received a substantial volume of criticism, mainly for its inability to place responsibility on the development teams to act in the interest of token holders.

By that time, ICO teams had huge Ethereum holdings left from the fundraising. Like the rest of the market, the teams likely believed in an ETH rebound but eventually lost faith. Consequently, large liquidations began in August 2018 and increased until the end of the year.

While ETH took a severe hit price-wise, Ethereum’s community started to lose faith as well. In Fall, 2018, Vitalik Buterin revealed that the long-awaited transition to the faster consensus would take years to develop.

As the negativity piled up, ETH eventually gave in, outlining a gloomy future for the project.

BUIDL: Constantinople, St. Petersburg, and Istanbul

The market wasn’t happy with the ICO model fostered by Ethereum. Exchanges like Binance saw an opportunity. The first Initial Exchange Offering of 2019, BitTorrent, happened in January and was a huge success. The market rushed for IEOs, quickly forgetting about ICOs. Ethereum lost its spotlight, but it was a good time for the team to double down on building. And the team did just that.

In February 2019, the Constantinople and St. Petersburg hard forks brought the network cheaper computation, faster verification of smart contracts, and other scalability improvements. Since Ethereum 2.0 was far away, the team and the developer community focused on off-chain solutions.

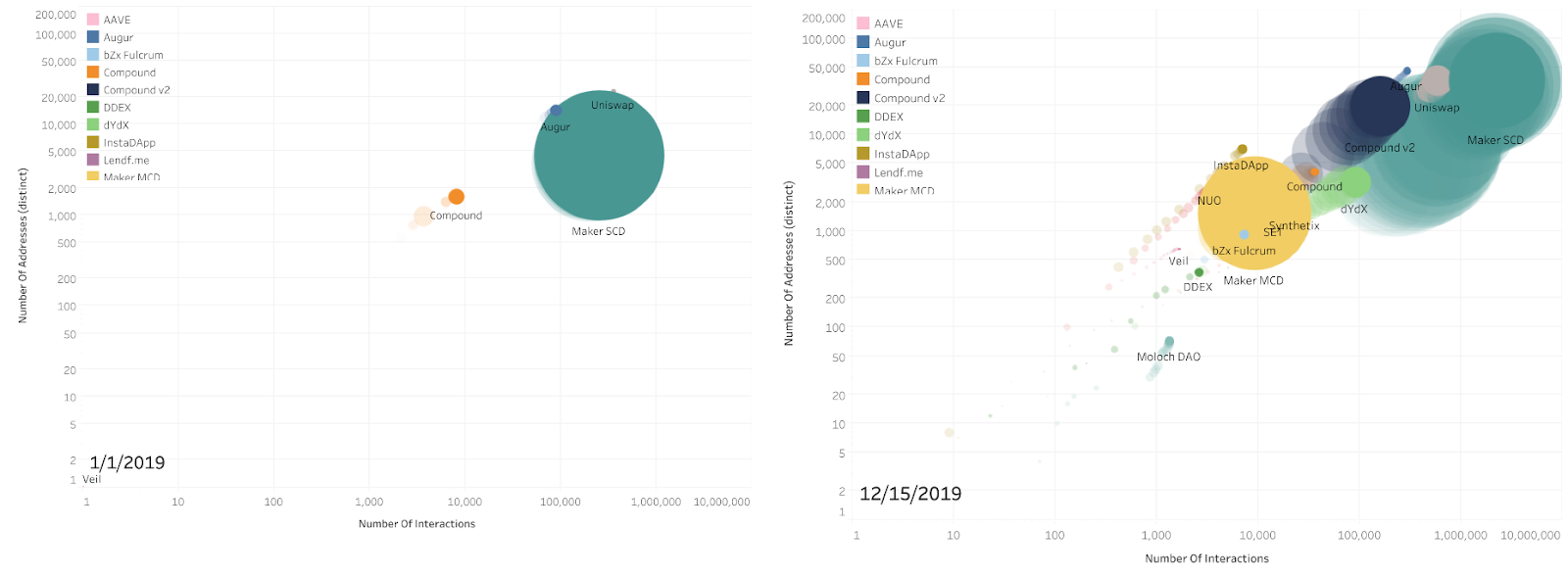

Meanwhile, some of the projects launched on the platform also evolved. The dApp ecosystem expanded, and decentralized finance (DeFi) played a major role in growth. The number of DeFi apps significantly increased throughout 2019.

In December 2019, the team conducted another hard fork Istanbul, which brought more scalability and privacy improvements to the PoW Ethereum chain. Most of the upgrades addressed Layer 2 support.

The development of Ethereum 2.0 continued as well with several testnets around Phase 0, a dummy chain that will act as a baseline for the new blockchain. Still, no practical success was achieved on the 2.0 front, and PoS Ethereum continued to fall short of expectations.

Overcoming the Global Crisis with Stablecoins and DeFi

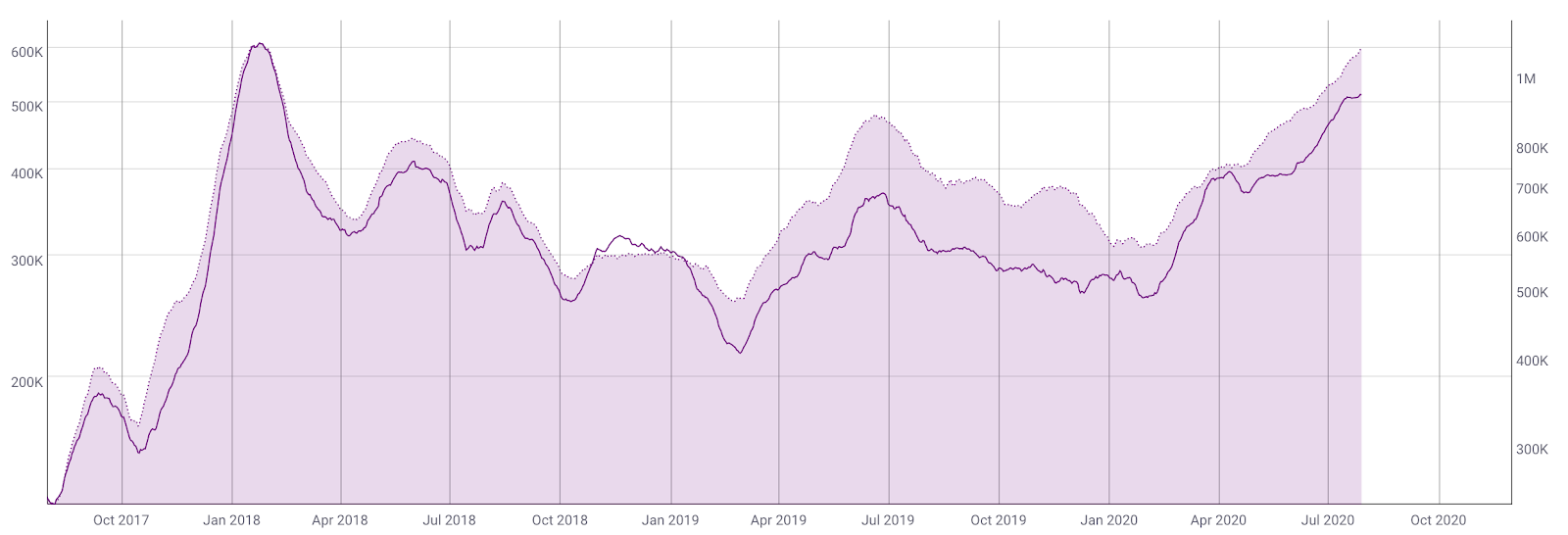

Going into 2020, Ethereum was strong. Despite taking a nosedive along with the entire crypto market in March, Ethereum rebounded quickly. And it’s not just the price that has grown.

Substantial issuance of stablecoins and a surge in DeFi activity created positive momentum for Ethereum’s on-chain metrics. As billions of freshly printed USDT and other stablecoins moved onto the system and yield farmers are turning around billions of dollars across DeFi dApps. Today, Ethereum enjoys the level of activity it last saw during the 2017-2018 bull run.

Unsurprisingly, the surge in the network activity reintroduces the congestion problem. However, this time Ethereum is much better equipped technologically than it once was. With the tools developed throughout the years and with the help of Layer 2-focused projects, like Matic, Ethereum can gradually move most of its activity off-chain.

Moreover, Ethereum 2.0 is about to come to reality in less than a week with the finalized testnet scheduled for August 4, 2020. While it doesn’t mean that the full-scale PoS Ethereum is guaranteed to come soon, it’s an important milestone. If the team doesn’t delay the testnet launch, it will boost confidence in the project’s future.

Ethereum, to Infinity and Beyond?

Ethereum has a long history of successes and failures, longer than any cryptocurrency besides Bitcoin on the market. This history of getting scars in the real world made the project more resilient and provided the community with valuable experience.

Although the experience does not guarantee success, it creates an advantage. While other Layer 1 can learn from Ethereum’s past mistakes, no one knows what the future holds. Hence, if the network keeps occupying the market’s spotlight, it will likely face new challenges faster than others. If it can overcome these challenges, it will also be the first blockchain to experience mainstream success.

Share this article