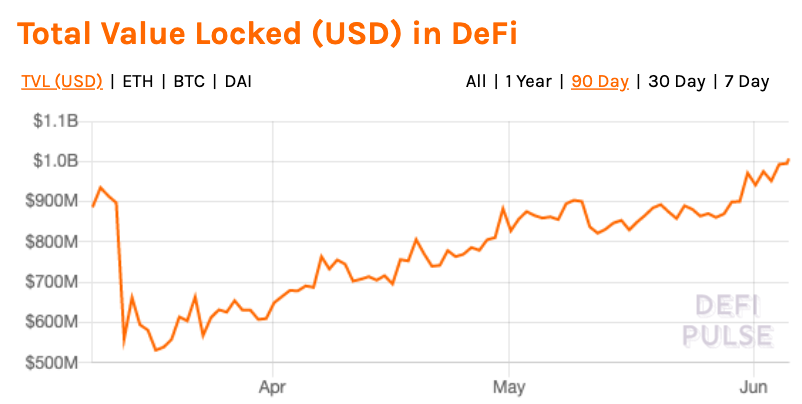

Ethereum's DeFi Back at $1 Billion, Maker Leads the Charge

Despite slips and starts, rising digital asset prices have helped the DeFi space return to over $1 billion in value locked in.

Share this article

Ethereum’s DeFi is once again at $1 billion of value locked with MakerDAO accounting for over half of this amount. Other notable growth from Aave and Set Protocol continue to bolster DeFi’s value too.

DeFi Propelled by Rising Prices

As DeFi surges on the tail of improved sentiment in crypto markets, lending protocols and decentralized exchanges are thriving as speculative activity grows.

Most of the value locked in DeFi comprises of Ether and stablecoins.

ETH’s 85% price appreciation since April 2019 could be the primary driver for this surge, as more traders use lending protocols to increase their leverage in spot market positions.

Aave, a flash loan platform, has seen tremendous growth, with total liquidity rising from $20 million in March to over $80 million at the time of press.

The protocol’s growth is a result of offering borrowers the option of taking a loan at a variable or stable rate. This mechanism has, in part, fuelled higher lending rates for Aave.

Set Protocol, an automated investment protocol on Ethereum, grew from less than $2 million of locked value to over $15 million in six months.

Uniswap and Bancor released upgrades to their protocols in these last few months too. These decentralized exchanges (DEXes) face stiff competition from Balancer, which launched roughly two months ago and already has over $12 million of liquidity.

With several DeFi-centric layer 2 scaling solutions launching on Ethereum mainnet in the last week, optimism for Ethereum’s DeFi stack continues to grow.

Share this article