FTX Joins Top 5 Crypto Exchanges by Volume

Innovative derivative products push the Hong Kong-based exchange up the rankings

Share this article

Cryptocurrency exchange FTX has become the fifth largest exchange by volume on the back of presidential betting tokens and leverage coins. Assets like TRUMP and XRPBEAR contracts have entered the fray.

FTX Pushed to the Front

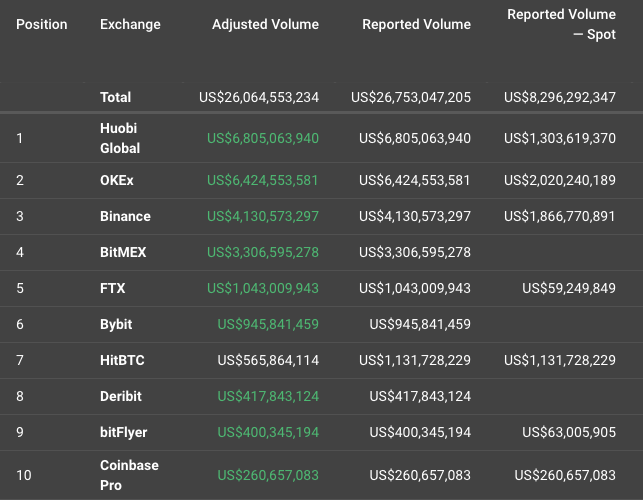

FTX is now the fifth largest exchange by adjusted trading volume in the world, according to the company’s Vice President Brian Lee.

FTX has positioned itself just below BitMEX with $1.1 billion both in reported and adjusted trading volume. Huobi Global ranked the first, with $6.9 billion in adjusted volume, while OKEx, Binance, and BitMEX saw a $6.5, $4.2, and $3.7 billion volume, respectively.

While the exchange doesn’t even rank among the top 30 on most other data aggregators, FTX claims that its advanced screening methodology allows it to filter through what it deems “fake volume” from exchanges, coming as close as possible to the true trading volume, it claims.

The data aggregation was done by the Alameda Research, a quantitative cryptocurrency trading firm that owns FTX, and is described in detail in the company’s volume report.

The exchange’s foray into crypto stardom comes just days after its native token, FTT, saw a major surge. The $200 million market cap coin has seen its price rise 35% since the beginning of the year, most likely due to the popularity of the company’s presidential betting tokens.

TRUMP Coins and Leveraged Tokens See Success

Introduced in January, FTX’s President 2020 coins allow users to bet on the upcoming U.S. presidential election. The exchange currently lists six coins, each one representing one of the presidential candidates: Donald Trump, Joe Biden, Bernie Sanders, Michael Bloomberg, Elizabeth Warren, and Pete Buttigieg.

The TRUMP, BIDEN, BERNIE, BLOOMBERG, WARREN, and PETE coins are futures contracts that expire to $1 if the underlying candidate wins the 2020 general presidential election. If the candidate loses the election, the contract is set to expire to $0.

Sam Bankman-Fried, the CEO of FTX, said that the coins’ price was set to easier to understand the contract and calculate the odds—if a coin is worth $0.50, that means that the market believes there is a 50% chance its underlying candidate will win the election.

However, while the volume of the President 2020 coins has surged in the past month, Bankman-Fried said that it still represents a small percentage of FTX’s overall volume. Speaking on the Coinist podcast, he explained that most of the exchange’s volume comes from its other derivative products—leveraged tokens.

The exchange lists 93 BULL and BEAR tokens, each offering 3x leverage. For example, FTX’s EOSBULL is an ERC-20 token that provides returns that corresponds to three times the daily return on EOS. Likewise, the EOSBEAR token seeks a return of -3 times the daily return of EOS.

That means if EOS goes down 1%, EOSBEAR goes down 3%. The leveraged tokens get their exposure to the underlying asset through perpetual futures.

Two weeks ago Binance listed four FTX leveraged tokens—EOSBULL, EOSBEAR, XRPBULL, and XRPBEAR. Expect more financial innovation as exchanges vie for this lucrative segment of traders.

Share this article