Institutional Investment May Be Behind Boom in Bitcoin Whale Wallets

Growth in the number of wallets with over 1000 BTC in the last 30 days outpaced growth in all of 2020. Institutional investors may be behind the sudden boom in high-net-worth BTC balances.

Key Takeaways

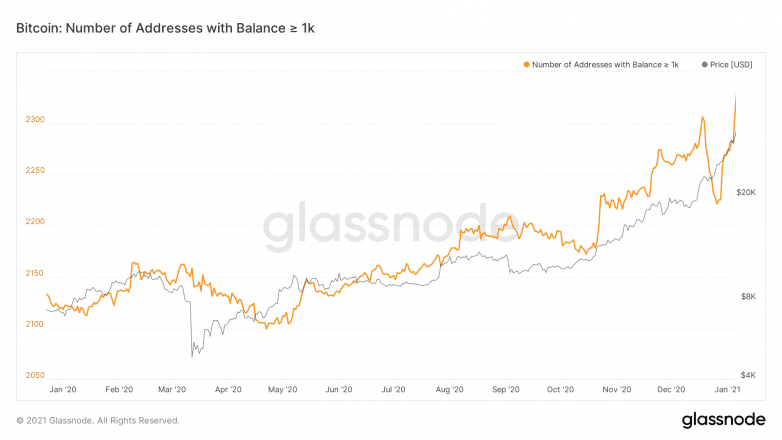

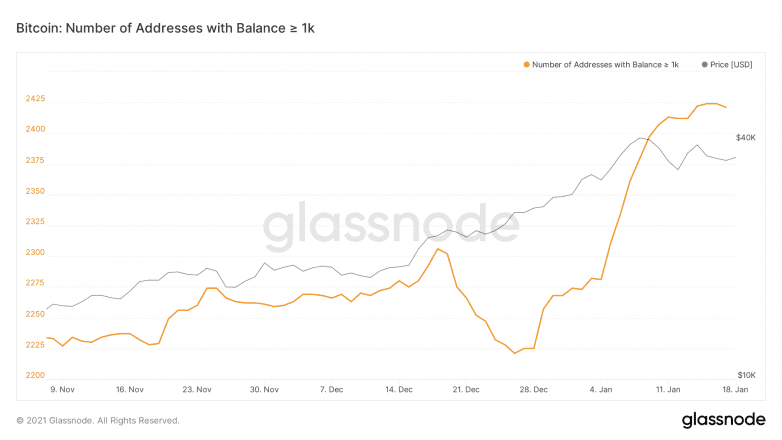

- From Jan. 1 to Dec. 31, 2020, the number of wallets with over 1,000 BTC grew 6.9%.

- The number of wallets with over 1,000 BTC grew 7.6% in the last 30 days alone.

- The data helps strengthen the case many analysts are making for a prolonged bull run.

Share this article

The Bitcoin bull run may just be beginning, and Glassnode data indicates that institutional investors and high-net-worth investors are leading the charge.

On Jan. 1, 2020, there were 2,118 wallets with a balance of over 1,000 BTC. On Dec. 31, 2020, that number had grown to 2,268, a 6.9% increase.

That data alone looks promising to those building a case for further upward price momentum. However, from Dec. 1, 2020, to today, growth in these high-net-worth wallets has exceeded 7.2%.

There were 2,259 of these wallets at the start of last month compared to 2,421 today, a major increase in just six weeks.

Institutional Money Behind Bitcoin Boom?

This data was brought to light by Arcane Research, an analytics firm that posted their data on Twitter ahead of a wider report due for release tomorrow.

Arcane measured wallet growth from Jan. 1 to Dec. 1, 2020, showing 6.7% growth in more than 1,000 Bitcoin wallets.

Institutional buying?🏦

The number of addresses holding at least 1000 BTC has skyrocketed lately.

The growth from January to December last year: 6.7%

The growth from December until today: 7.2%Read more in our weekly report tomorrow: https://t.co/xlQH8LeQyH

Data: @glassnode pic.twitter.com/Gkn6dxH5Cd

— K33 Research (@K33Research) January 18, 2021

Arcane’s Head of Research, Bendik Schei, spoke to Crypto Briefing to provide more details on the findings.

“The number of addresses holding at least 1,000 BTC has skyrocketed lately, and there are no signs of whales selling their bitcoin,” said Schei.

The Arcane Research report may point to big players entering the market, and Schei stated “it is not unreasonable to assume that this is institutional buying.”

Schei offered an alternative explanation, saying the data could be partially due to large players in the space restructuring their holdings. However, this seems unlikely.

“We have not seen any particular signs of this activity based on Glassnodes numbers,” said Schei.

Share this article