Bitcoin Not A Security, Chainlink Surges, McAfee On Decks - Sorry, DEX

McAfee is back, in case you missed him.

Share this article

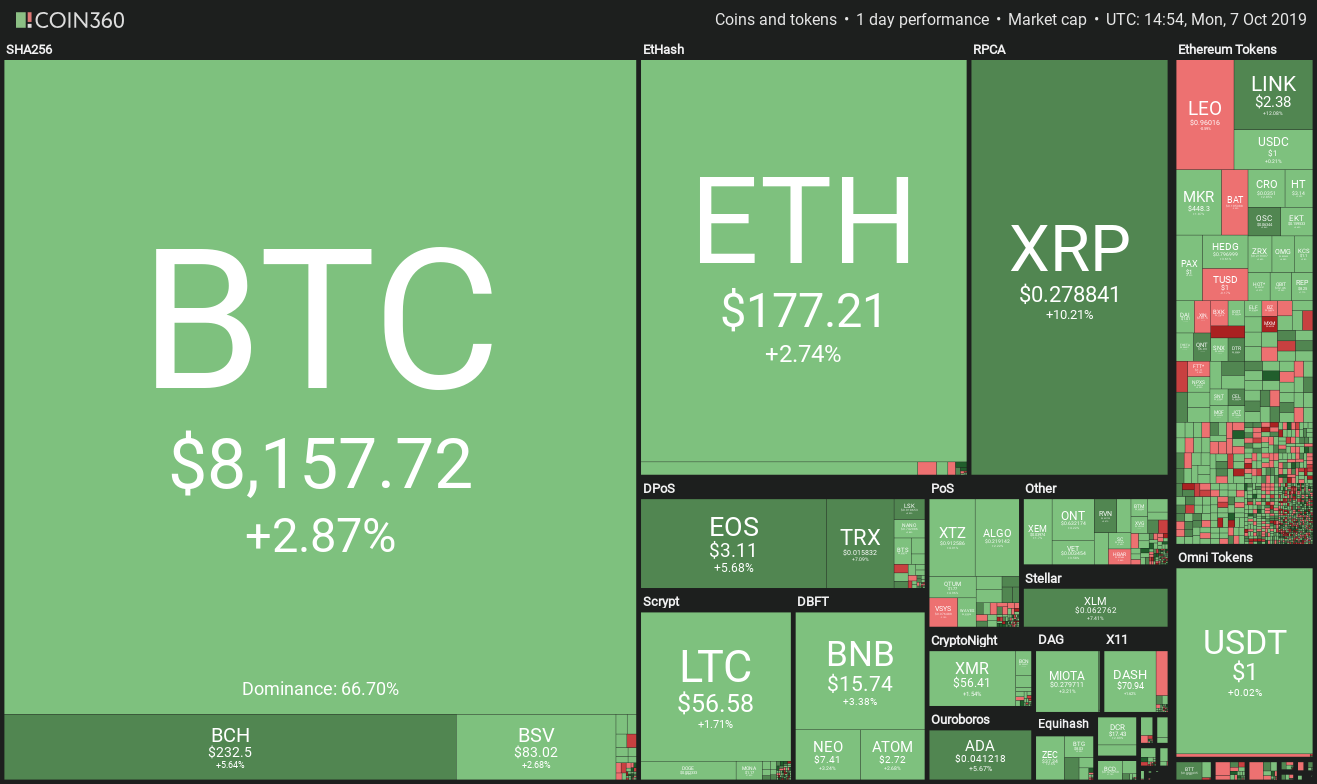

Today Bitcoin has recovered slightly, but the struggle continues. Altcoins are looking much better, as XRP, TRON, ADA and LINK post sharp gains. A full commentary on Bitcoin is below.

SEC officially states that Bitcoin is not a security – yes, we know.

In a letter addressed to Cipher Technologies, an asset management firm seeking to create a Bitcoin fund, the regulatory agent quelled any possible debate on whether Bitcoin could be a security.

The verdict is a resounding ‘no’, with the SEC arguing that it lacks a distinguishing feature of a security outlined in the Howey test. “We do not believe that current purchasers of bitcoin are relying on the essential managerial and entrepreneurial efforts of others to produce a profit,” the regulator explains.

Classifying BTC as a security would also open a Pandora’s box of legal consequences, due to its previous history. “For example, bitcoin would be an unregistered, publicly-offered security, and, among other things, it potentially would render the proposed fund an underwriter of bitcoin.” the SEC continues.

The news is not a particularly ground-breaking development and is unlikely to have affected markets, as Bitcoin was rarely involved in any of the debates surrounding the issuance of tokens. SEC representatives frequently stated in interviews and hearings that the agency did not consider Bitcoin a security.

This also confirms the classification made by Crypto Council Rating, the Coinbase-led consortium of U.S. exchanges, which has now been proven correct twice – both Bitcoin and EOS have turned out as predicted.

But while the news may be considered positive for cryptocurrencies as a whole, it is a heavy hit for Cipher. The letter slammed its proposal for a Bitcoin fund for using the security-specific N-2 Form, putting a hold onto a proposal that is pending since at least January 2018.

Chainlink continues DeFi-fueled surge

The LINK token is one of the top performers today, with a sudden 9% surge that contributed to a +33% weekly performance, by far the highest of any top cryptocurrency.

The run is likely due to a combination of positive fundamental drivers. Three separate partnership announcements were announced last week, with TomoChain, Parallel Markets and Cere Network all integrating Chainlink oracles in their blockchains. The week before that, the project also announced an integration with Binance API data.

The reason behind the latest surge could be anticipation for Mixicles. As explained in the Chainlink blog, they allow to increase the privacy of an oracle-based smart contract by separating the internal state change from the inputs and outputs of the operation. The feature is “very close to being live on the Ethereum Mainnet,” and will be a game changer for enterprise adoption, according to the company.

The timing of the news is somewhat off, as the post was released on Friday. Nevertheless, the plethora of announcements are enough to explain continuous interest and hype about LINK, propelling its surge.

McAfee Strikes Back

In a sudden marketing campaign developed over the weekend, the infamous John McAfee announced the launch of McAfeedex, which he promises to be a fully decentralized and private cryptocurrency exchange.

The exchange is poised for launch in a few hours, with McAfee urging people to try it out – although, this is from a guy who snorts bath salts and claims to live on a boat as a fugitive from justice, so #DYOR.

.https://t.co/1vUQ6AHHyE

.

Decentralized. Distributed. Open source.

No listing fees. No personal information. 0.25% taker fees. No maker fees. No deposits. Smart contract assurance – trustless. All Ethernet based tokens. EOS, Neo, and more coming soon. How did we do it? pic.twitter.com/AN8TZ02UAO— John McAfee (@officialmcafee) October 6, 2019

The news appears to have had an influence on TRON, of all things. A tweet confirming that the ETH-based DEX is “coming” to TRON has possibly triggered TRX’s 5% spike today, as the buzz in its community spread. Who’d have thought the TRON community could be so easily manipulated?

Nathan Batchelor on Bitcoin

Bitcoin is attempting to hold the $8,000 resistance level as we head into U.S trading session, after the cryptocurrency endured losses of around five percent over the weekend, with only a slight recovery so far today.

The recent decline in the BTC/USD pair found technical support from $7,750 level, with the cryptocurrency experiencing a bounce after sellers failed to break through the current monthly trading low.

Today I would like to discuss some key technical developments that have emerged since last week and also discuss a high-impacting fundamental news release that could negatively or positively impact the BTC/USD pair later this week.

Firstly, data from various brokerages in the retail sector are showing that BTC/USD long positions are dropping. Positioning data shows a notable drop to 65% net long BTC, from 82% net long BTC, just last week.

Why should we pay attention to this data ? The retail sector is notorious for getting the trend wrong, so this retail data is worth monitoring if traders flip to net short, especially as the retail crowd have been heavily Bitcoin long since the early summer.

Secondly, the Choppiness Index, which measures the strength of trends and also directionless movement, is showing that the BTC/USD medium-term downtrend is weaker that it was last week. The daily time frame is showing a 44.5 reading.

A reading of below 38.2 is considered a strong trend. The ideal scenario for BTC/USD bulls would be to see the pair recover above its 200-day moving average, with the indicator turning lower as price rises.

As regards to fundamental news, the decision for the Bitwise Bitcoin ETF is expected from the Securities and Exchange Commission this week. Expectations are very low that the SEC will approve a Bitcoin ETF, given recent remarks from the SEC. However, traders should be on-guard for volatility in the cryptocurrency market on the announcement.

A breakout from the $7,700 to $8,500 price range is currently need to shake-things-up from a technical perspective. We should expect that fundamental news will likely drive the BTC/USD technicals this week.

* Traders should expect a pick-up in trading volumes once the $7,700 to $8,500 price range is finally broken’.*

SENTIMENT

Intraday bullish sentiment for Bitcoin is neutral, at 46.50%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency has slipped, to 61.50%, but still remains positive.

UPSIDE POTENTIAL

Short-term analysis shows that bulls need to keep price above the $8,000 level to encourage bulls to test towards the BTC/USD pair’s weekly pivot point, around the $8,100 level.

Once above the $8,100, the $8,260 level provides the strongest form of near-term resistance. Bitcoin’s 200-day moving average, at the $8,500 level, marks a key area bulls need to break this week and also the top of the BTC/USD pair’s recent trading range.

DOWNSIDE POTENTIAL

Sellers have the upperhand while price trades below the $8,000 level, leaving the BTC/USD pair further exposed to bearish attacks towards the current monthly trading low.

Once below the $7,700 level, Bitcoin is on a slippery path from a technical perspective. The $7,100 and $6,600 level offer the only notable forms of technical support prior to the $6,000 level.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.

Share this article