Market Commentary: Sell The News

Bitcoin fundamentals are growing, but not the price.

Share this article

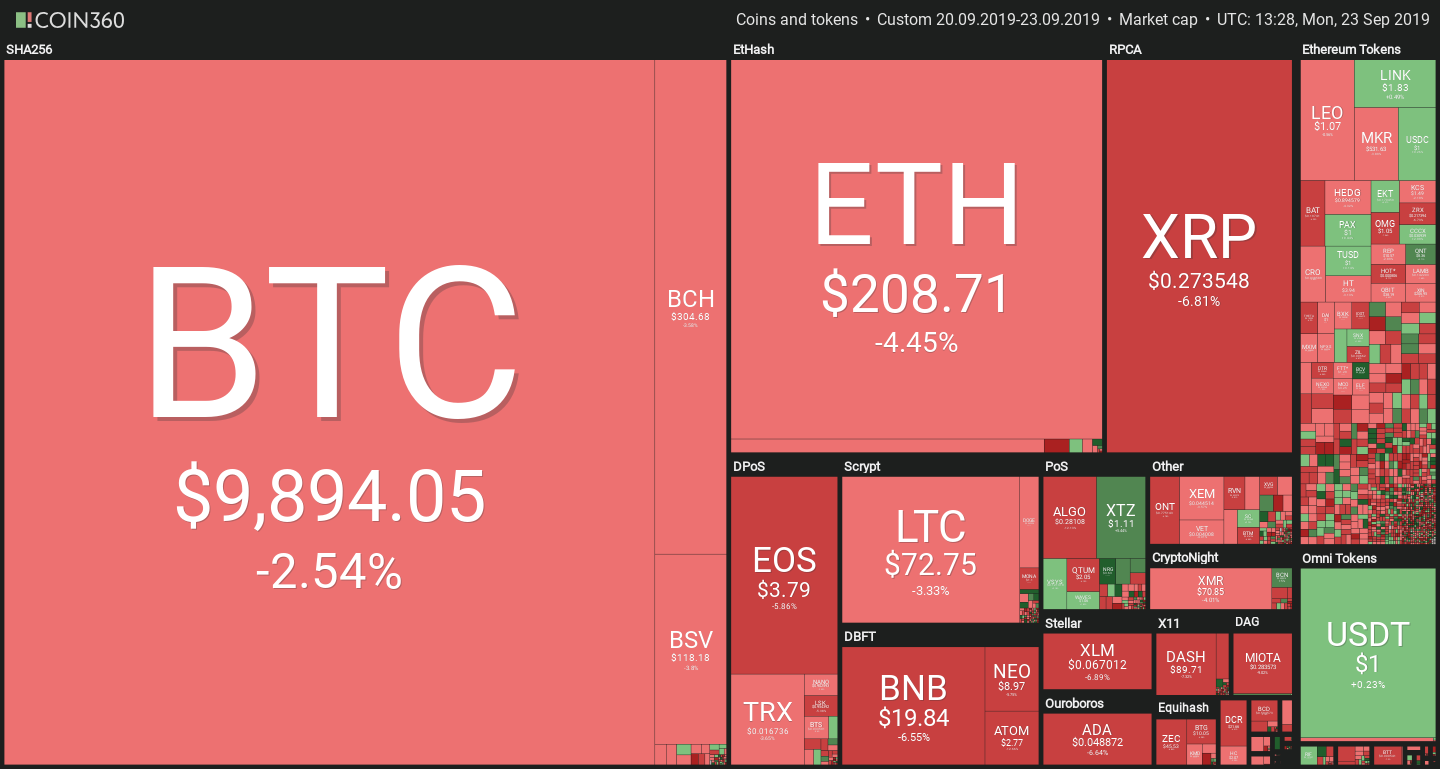

Bakkt is finally open for futures trading, but Bitcoin’s spot market doesn’t seem to have taken notice. Average spot prices for the leading cryptocurrency have again fallen below $10,000.

The rest of the cryptocurrency market is likewise posting moderate losses this weekend. Ethereum fell by 4.45%, EOS by 5.85% and XRP by 6.81%. BNB continues its downward plunge with a -6.55% trading loss, while Tezos reconfirms itself as an outlier by posting a 5% gain.

Bitcoin sees small fundamental improvements

Two researchers from University of Edinburgh conducted a formal verification of Lightning Network security. The researchers are likely to be the first to analyze technical aspects of LN architecture, especially its relation to Bitcoin. As stated in the paper, the scientists were motivated to fix the “dire state of affairs” that no such analysis existed while the network was already operational.

The results are positive, confirming that Lightning Network is exactly as secure as Bitcoin in theory, based purely on formal specifications. Practice is a different matter, as a recent bug sent Lightning operators in a scramble to update their node software. Nevertheless, this is still a positive development for Bitcoin’s scaling solution.

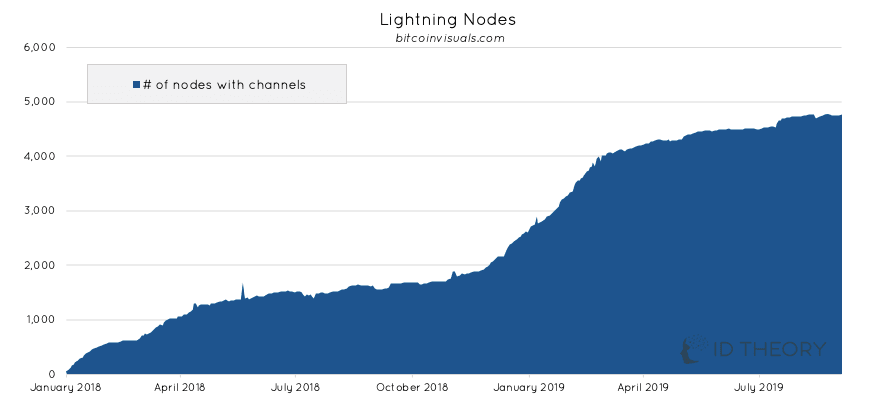

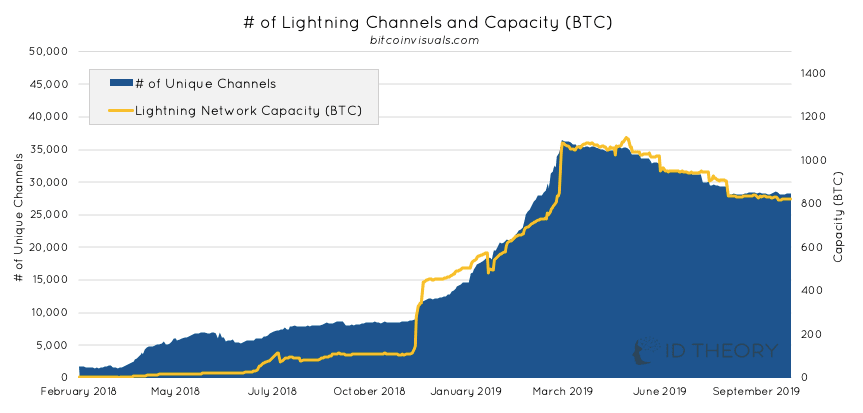

Slightly less positive are the actual adoption figures for LN, which appear to be largely flat, as noted by ID Theory.

While the number of nodes continues has increased by 0.4% this week, the total capacity is still far below its March 2019 heights.

Progress is still visible though, with a 0.7% growth in unique channels this week.

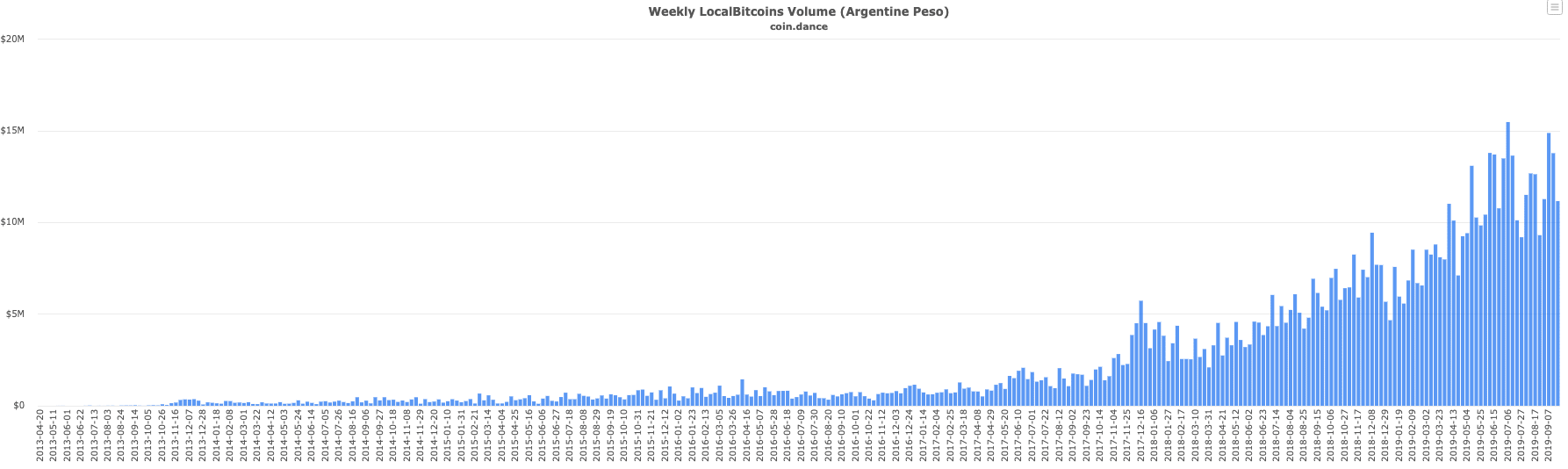

At the same time, BTC is seeing an uptick in usage across South America. Leading the pack are Venezuela and Argentina, both suffering strong crises for their national currency. LocalBitcoins is continuing to establish new highs in Bolivars and Pesos this year, an especially relevant figure for the comparatively stable Argentina.

Binance gets more listing shade

While most of the market awaited the launch of Binance.US, the Malta-based exchange has drawn more attention for its listing fees. According to Digibyte founder Jared Tate, Binance asked him for $300,000 and 3% of all DGB as a fee for launching the coin on the exchange.

CEO Changpeng Zhao shrugged off the complaint on Twitter. This isn’t the first time that Binance has been criticized for its listing fees, which it has pledge to donate to charity.

The latest complaint coincided with a gradual fall-off of BNB, which lost roughly 8% since the tweet. The token is still in a depressed trading mode after the exchange closed to U.S. traders, but the launch of Binance.US could help soften the fall.

Bitcoin Commentary By Nathan Batchelor

Bitcoin is trading back under the $10,000 level as we head into the U.S trading session, with the BTC / USD pair showing very few signs of a strong directional bias over the weekend. The first recorded trading volumes of the physically delivered Bitcoin futures contracts on the Bakkt platform are reported to be fairly light.

At present, I am not reading too much into these reports. As I noted on Friday, the technicals largely suggested that one more minor pullback under the $10,000 level was due, despite the recent recovery back towards the $10,375 level.

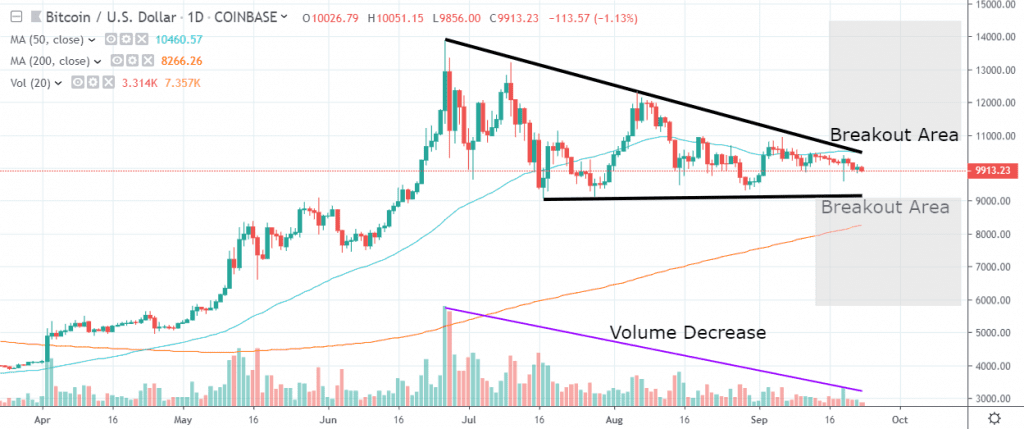

The technicals for Bitcoin now show that the cryptocurrency is getting closer and closer to a major technical breakout. The descending triangle pattern, in which Bitcoin has been trapped for a long period of time, has narrowed, with the bullish breakout point now located at $10,450 level.

With this in mind, we should pay extremely close attention to the BTC / USD pair if it does start to firm above the $10,000 level this week, as a major bullish breakout will not be far away. Technical traders will seek confirmation once above the triangle pattern, with two daily price closes likely to be the bullish trigger.

The actual nature of the descending triangle pattern is also interesting, as these patterns are typically considered to be bearish or continuation patterns. However, Bitcoin is still in an uptrend and trades well above its 200-day moving average, which is currently located around the $8,250 level.

In my opinion, once a breakout does occur, the cryptocurrency is going to experience a significant pick-up in trading volumes. This is also a major characteristic of descending triangle pattern, a lack of volume inside the triangle, but a strong up-tick in trading volumes once a valid breakout occurs. Certainly, interesting times are ahead as the BTC / USD pair approaches a directional breakout.

* It is very important that bulls maintain the BTC / USD pair above the $9,700 level this week to encourage a breakout from the large descending triangle pattern. *

SENTIMENT

Intraday bullish sentiment for Bitcoin is fairly weak, at 45.00%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency is also down slightly, at 65.00 % positive.

UPSIDE POTENTIAL

The current weekly pivot point for the BTC / USD pair is located at the $9,965 level. However, short-term technical analysis on the four-hour time frame shows that the BTC / USD pair will become more bullish once above the $10,150 technical area.

The previously mentioned descending triangle pattern on the daily time frame is converging around Bitcoin’s monthly pivot point, making the $10,420 to $10,450 a potentially explosive technical area to watch for a breakout this week.

DOWNSIDE POTENTIAL

The low for Bitcoin has currently extended down toward the $9,850 level, although short-term technical analysis shows the recent decline could still extend towards the $9,800 level.

Weakness under the $9,600 level is likely to trigger heavy technical selling this week, leaving the bottom of the descending triangle pattern exposed, around the $9,150 level.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.

Share this article