Is Q4 The Savior For Crypto? Bitcoin Prices Thrive Following Q3 Slumps

Bitcoin tends to gain in the last months of the year.

Share this article

As we head towards the end of 2019, it’s worth taking a look at how bitcoin prices tend to perform in the final quarter of the year. Depending on which academic discipline you believe in, history either repeats itself… or is a poor indicator of the future.

After over a decade of existence, bitcoin now has a reasonably well-established pattern of price behavior. It doesn’t always play out in the same way, and it’s still too young to demonstrate beyond all reasonable doubt which periods are anomalies and which are ingrained into its price patterns.

But as fundamentals such as fiat slumps, negative interest rates, and trade tensions place upward pressure on BTC prices, there may be a few extra reasons for optimism as the New Year approaches. As always, do your own research: crypto has yet to provide a guarantee to anyone. But historically speaking…

Quarter Four is Good for Bitcoin

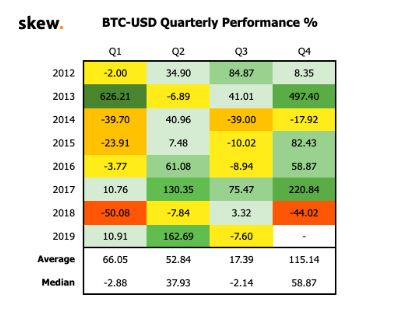

Since 2012, fourth quarters tended to be good for bitcoin, with average price gains of over one-hundred-and-fifteen percent, according to Skew, a data and analytics company and derivatives trading platform. That compares with traditionally dampened spirits in third quarters, which have netted, on average, price gains of around 17 percent.

From Q1 2012 to Q3 2019 so far, there have been five quarters where bitcoin enjoyed triple-digit growth against the U.S. dollar. Two of them happened in 2013. Two of them happened in fourth quarters (including one in 2013 of just under 500 percent).

Over the same period, bitcoin has suffered negative price action in eight quarters. Three of those occurred in the third quarter, including this year’s Q3 so far, which saw a seven percent drop-off. The median performance for third quarters since 2012 has been negative. The equivalent figure for Q4 periods is over 50 percent.

Are There Any Anomalies?

Bitcoin historians might point to Q4 2017 and Q4 2018 as anomalous periods in bitcoin’s price action. The end of 2017 marked a period of irrational exuberance for bitcoin and altcoins alike: in Q4 of that year, bitcoin rose against the U.S. dollar by over 220 percent.

A year later, bitcoin plunged almost 45 percent between October and December. Crypto advocates may point to the end of 2018 as signaling the end of a year-long winter for the crypto economy that put the parabolic 2017 bubble in its place.

But what perhaps 2017 and 2018 were anomalies? If 2017 was the year of irrational exuberance, 2018 was the year of irrational fear. As a thought exercise, it might be instructive to recalculate the averages with those years excluded.

Quarter four in 2017 was the third-strongest period of price growth for bitcoin. The same quarter in 2018 was the second-worst. Hypothesizing that irrational sentiment drove those figures and removing them from the equation could help smooth the numbers out and draw out some patterns.

Ironing Out the Extremes

Staggering insights emerge when we make these calculations. The average Q3 bitcoin price growth is ten percent. In quarter four, bitcoin rose an eye-popping 125 percent on average from 2012 to 2016.

If more information is assumed to produce more knowledge, later periods are likely more telling than earlier periods. By canceling out the extreme bullish and extreme bearish sentiment in the better-informed market periods of 2017 and 2018, bitcoin’s average gains in quarter four are tenfold those of quarter three. Even more telling is the persistence of bitcoin’s price growth in Q4 periods.

If we only remove 2017 figures, bitcoin still grows at an average of 97 percent in fourth quarters. If we remove only 2018, retaining the feverish end of 2017, that figure is still only slightly higher than the overall average, at 141 percent.

However, to demonstrate caution, we removed the more extreme Q4 price periods to prevent it from weighting the averages too far in Q3’s favor.

This is notable because two Q3 periods of 84 and 75 percent growth, respectively, remain included in the calculations.

In short, quarter four tends to be historically positive for bitcoin, even with outliers removed. As the third quarter of the year concludes, this may be another cause for optimism as recession looms closer on the horizon.

Share this article