Do Retail Investors Trump Institutions On Futures Trading?

Futures volume figures are tricky.

Share this article

Bakkt’s disappointing start was not well received by the market. The platform succeeded in generating considerable hype before launching, only to flounder once it was made available.

The dissatisfaction was soon felt, as Bitcoin lost 20% of its value in a couple of days after the launch. It would be wrong to pin the entire blame on Bakkt – markets are a complicated machine, where Bakkt only exacerbated existing trends.

But the evident failure of Bakkt may have cast some doubts on the entire concept of institutional investment. After all, the largely retail-driven BitMEX has more than two billion dollars in daily volume, while Bakkt struggles to reach two million – seemingly showing institutions are not interested.

The reality is a bit more complicated though, and several factors converge to make BitMEX’s actual figures lower, and institutional trading figures higher.

Bakkt’s marketing campaign may have tried to position it as the only bastion of institutional investment in cryptocurrencies, but that is far from the truth.

Meet the fire to Bakkt’s ICE

Bakkt was created by Intercontinental Exchange, the world’s third-largest exchange, known for purchasing a by-then somewhat decrepit NYSE in 2013. The second place is occupied by the Chicago Mercantile Exchange, ICE’s arch-rival in futures and other markets, where cryptocurrency is just another battleground.

CME launched Bitcoin futures trading all the way in late 2017, more than eight months before the first Bakkt announcement. The significant head start allowed CME to gain a large market share, especially as the other competitor, CBOE, withdrew its futures offering in 2018.

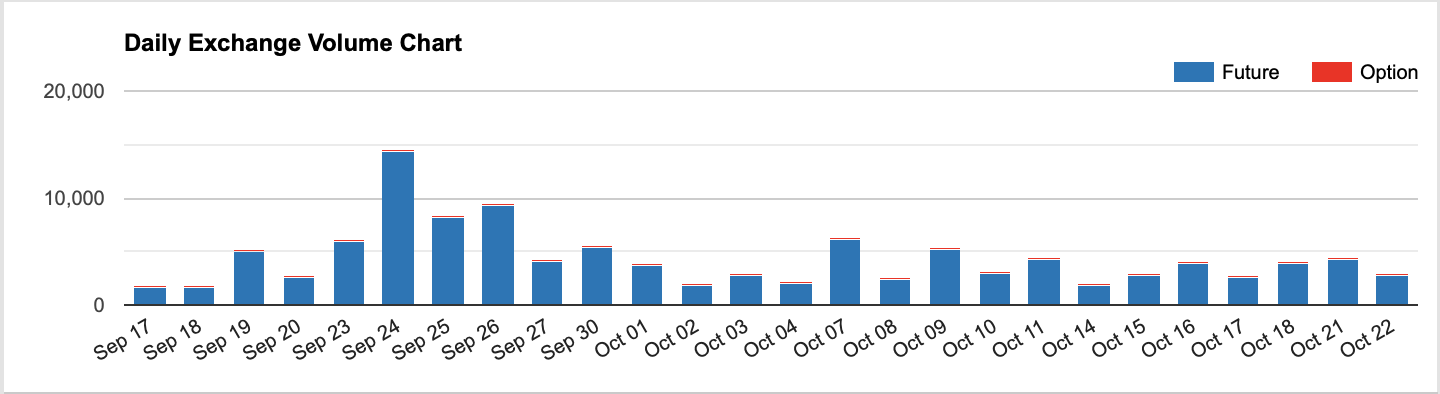

The graph shows that CME’s volume generally trends at 3,000 contracts traded, with each futures contract being for 5 BTC. The total amount is thus approximately $120M, a far more respectable figure than Bakkt’s current average.

https://twitter.com/BakktBot/status/1186994187721494529

Bitcoin futures of course pale in comparison to CME’s gold market, which saw more than 300,000 contracts traded on Monday. Each contract is for 100 troy ounces, bringing the total volume to 44 billion dollars.

ICE on the other hand appears to have almost zero volume on its gold futures, as strange as that may sound. Almost all of its gold offerings, including the Daily Futures and 100oz fail to show historic data and report zero trading volume, with the exception of Mini-Gold Futures, at a weak volume of 28 contracts. While it could be a data aberration, Cotton and Brent futures show realistic volume values.

It seems that ICE is somewhat weak in metals futures markets, possibly due to their physical delivered nature. Bakkt’s struggles seem to be part of a systemic trend for ICE.

Volume statistics need perspective

Futures are by their definition short-term bets, playing on the differences between the anticipated price and the actual performance. For any given futures contract volume, only a small part of its value changes hands upon maturity.

That could in theory allow to make a bet with a $1b contract without committing a single dollar. But that opens the two parties to walk-away risk, should the situation turn unfavorable for one of them. This is why all exchanges require a minimum margin of coverage of the contract’s face value, ranging from 3% to 12% for traditional markets.

But cryptocurrency’s highly volatile nature led CME to require the maintenance of a $15,000 margin for its ~$40,000 Bitcoin contract, equal to 38%. In leverage terms, this is a measly 2.63x, as compared with BitMEX’s 100x and Binance’s 125x.

As highlighted by Skew, higher leverage naturally swells up the contract volume.

Derivatives volumes in cryptos are mostly a function of leverage

Most visible with Bitflyer as FSA reduced max leverage from 15x to 4x in May pic.twitter.com/1Y9LDzENEg

— skew (@skewdotcom) October 15, 2019

And that means that CME’s $120M volume is covered by at least $45M in margin, while BitMEX’s coverage could be as low as $20M.

The gap between institutional and retail investors suddenly doesn’t seem as large, at least when discussing futures.

Share this article