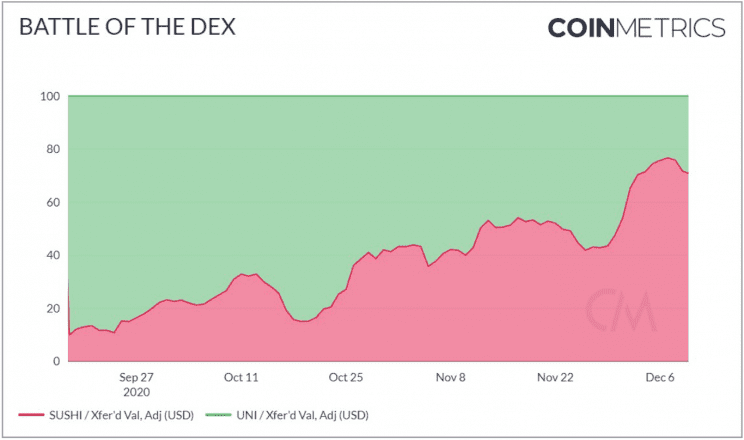

SUSHI Handles Twice As Much On-Chain Value As UNI

Blockchain activity shows SushiSwap's SUSHI token is moving more value than Uniswap's UNI token.

Key Takeaways

- Sushiswap's SUSHI token is handling more on-chain value than Uniswap's UNI token, at a ratio of 70-30.

- Liquidity mining on SushiSwap could be behind this trend.

- Though the SUSHI token handles more value, Uniswap's exchange handles more volume and liquidity.

Share this article

SushiSwap’s SUSHI token has begun to handle more on-chain value than Uniswap’s UNI token, raising questions about competition between two top-ten DeFi exchange protocols.

Finding the Right Balance

Of the combined value transferred by the two tokens, SUSHI tokens are currently responsible for 70% of that value. Meanwhile, UNI tokens are responsible for 30% of that value.

However, this metric is just one of many ways of measuring each platform’s dominance. Strictly considering each exchange’s overall trading volume, Uniswap handles far more volume than SushiSwap does. Uniswap handles about $346 million per day, while SushiSwap handles about $45 million. As such, the overall trading ratio is 11:9, in favor of Uniswap.

In short, though investors may prefer Uniswap as an exchange, the crypto market is moving a larger amount of SushiSwap’s native token—a difference that must be accounted for.

Liquidity Mining Matters

SUSHI’s token may be moving more value because SushiSwap offers greater support for liquidity mining—a process by which token holders can earn each platform’s native token.

Uniswap ran liquidity mining for two months, from Sept. 18 to Nov. 17, and distributed 20 million UNI during that period. It is not clear that the exchange will continue to offer this feature, as a vote to continue liquidity mining with lower rewards has failed to meet quorum.

SushiSwap, however, still offers liquidity mining in all pools, with one provider earning 0.25 to 1.67 SUSHI per $1,000 yield. The appeal of liquidity mining may be responsible for SushiSwap’s advantage.

Liquidity mining likely drives up the appeal of the SUSHI token, though other factors may be at play as well.

Inflation Also Matters

In order to distribute tokens via liquidity mining, each platform must issue new tokens or release previously locked tokens into circulation. This results in inflation.

At launch, Uniswap’s model distributed 150 million UNI to early users, which added to its initial liquidity mining rewards of 20 million UNI. Uniswap’s treasury currently holds more than 130 million UNI ($500 million), which will be unlocked over the coming years.

SUSHI’s supply, on the other hand, has a much more complex inflation model that has been criticized by analysis firms such as Glassnode. If that inflationary model does not work effectively, its liquidity mining rewards may decline in value in the long term.

In short, offering high liquidity mining rewards is an important part of competition, but doing so necessitates inflation. Those two considerations must be balanced by both protocols.

At the time of writing the authors held BTC, ETH, UNI, ADA, BAT, IOTA, and less than $15 of other altcoins.

Note: this article was edited to correct an inaccuracy in Uniswap’s treasury distribution.

Share this article