Sushiswap Enables 300% APR Reward for New Yearn Finance Vault

The new Yearn Finance vault will lock Curve Finance's CRV tokens forever for maximum yield.

Key Takeaways

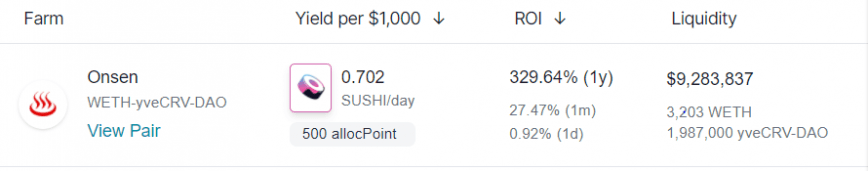

- The highest yielding pool on Sushiswap is WETH-yveCRV-DAO yields an annual percentage return of 329.64%.

- To obtain yveCRV tokens, CRV tokens are locked “forever” in Yearn Finance vault.

- The partnership between Yearn Finance and Sushiswap is fostering the liquidity growth on the stablecoin DEX Curve Finance.

Share this article

The highest yielding pool on Sushiswap leverages the extra returns from a new Yearn Finance vault, locking Curve Finance’s governance token forever.

Yearn Finance Rewards Come at a Cost

The partnership between Yearn and Sushiswap has enabled lucrative SUSHI rewards for the liquidity provider (LP) token of the new pool, yveCRV.

The entire process involves three DeFi platforms: Curve Finance, Yearn Finance, and finally, Sushiswap.

A new vault on Yearn Finance, the Yearn veCRV “Backscratcher” Vault, locks Curve’s governance token CRV forever and yields returns in Curve’s 3pool liquidity provider token 3CRV. The vault is built by leading DeFi programmers in Andre Cronje and Banteg from Yearn Finance.

Every week, liquidity providers can claim their vault rewards as 3Crv. While Curve’s annual fee returns are around 8.1%, the yveCRV vault yield is 10.1%.

2/ The yveCRV vault takes your CRV tokens, and essentially locks them forever, but still allows you to claim your share of those fees pic.twitter.com/VMNHfYkbBi

— 0xdef1 (@0xdef1) February 6, 2021

The liquidity provider token for the Yearn vault is yveCRV. Unlike other LP tokens, the yveCRV cannot claim liquidity tokens since the tokens are locked eternally.

The vault has a “perpetual claim on Curve DAO admin fees across all Yearn products.” Curve Finance earns its fee from stablecoin exchanges on the decentralized exchange.

Curve Finance’s CRV staking is time-based, meaning the LP token veCRV, which allows users to “unstake” or withdraw CRV, is unlocked over a period of four years. The Backscratcher vault will perpetually add liquidity by re-staking every four years.

The locked CRV will be used to boost rewards on Curve Finance.

Liquidity, Just Add Sushi

The partnership between Sushiwap and Yearn—established as part of the various other Yearn mergers—is powering the vault’s liquidity.

The Yearn Vault’s liquidity token yveCRV does not entitle the owner to any withdrawal claim. Nonetheless, the WETH-yveCRV-DAO pool is currently yielding 328.64% annual returns on Sushiswap–the highest for the DEX.

The incentive on Sushiswap is driving up the demand for yveCRV.

The Yearn vault is yielding higher rewards for CRV stakers of 2%; in comparison, the corresponding SUSHI return is more than ten times the highest liquidity pool—ETH-WBTC pool—of over 300% or 0.7 SUSHI per day for every $1,000. Naturally, the market expects the returns to normalize as liquidity increases.

Indeed, the pool carries the risk of reducing rewards with time. However, the Sushiswap-Yearn partnership may continue to offer lucrative SUSHI rewards to build a large pool for the token.

Meanwhile, new users can get their principal amount back by exchanging the yveCRV for WETH. Active DeFi user Cryptoyieldinfo (alias) tweeted:

“Here we start to see the competitive strength of the $YFI $SUSHI $CREAM partnerships. They will be dominating defi for the long-term.”

Pickle Finance, another partner of Yearn Finance, also joined Sushiwap with a new yveCRV-ETH “Pickle Jar” ( a “Pickle Jar” analogous to vaults on Yearn Finance) that would compound SUSHI rewards from the WETH-yveCRV vault and also enable PICKLE rewards.

Disclosure: The author held Bitcoin at the time of press.

Share this article