Tesla Breathes New Life Into Bitcoin Bull Run

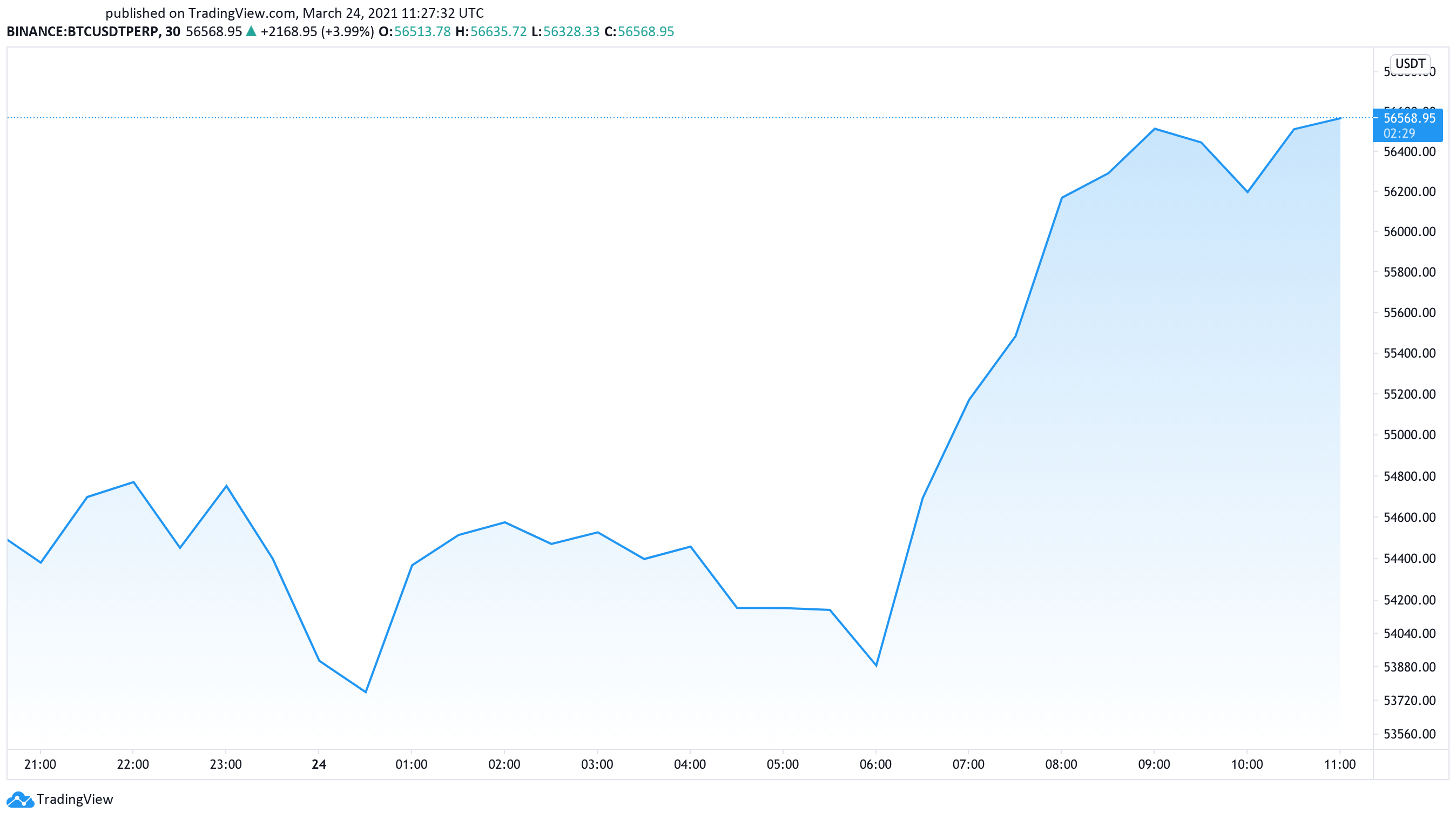

Bitcoin kicked off Wednesday's trading session on a high.

Key Takeaways

- Elon Musk stole the crypto spotlight after announcing that Tesla's customers can now make purchases using Bitcoin.

- Market participants have reacted positively to the news as BTC gained over $2,000 in market value.

- According to a prominent technical analyst, the cryptocurrency's utility will play a vital role in its march to $200,000.

Share this article

Bitcoin is back in the green after Tesla revealed that it began accepting the digital asset as payment. Now that BTC is closer to going mainstream, its price looks primed to move beyond the $62,000 all-time high.

Bitcoin Ready to Go Mainstream

Bitcoin shows no signs of slowing down despite the 12.50% correction that it endured in the past five days. Indeed, the flagship cryptocurrency has regained over $2,000 in market value over the last few hours.

The sudden bullish impulse came after Tesla’s CEO Elon Musk announced that customers can now purchase any of the firm’s electric vehicles using BTC. More importantly, Musk stated that the company uses an “internal and open-source software that operates Bitcoin nodes directly.”

Such infrastructure allows it to retain the BTC obtained from the car sales instead of converting the tokens immediately into fiat.

Tesla’s bold move would likely bring Bitcoin a step closer to mainstream adoption. Though the feature is only available to U.S. citizens, the firm said the feature would be available globally later this year.

Peter Brandt, the CEO of Factor LLC, believes that now that Bitcoin is “taking the role of a store of wealth and medium of exchange,” its long-term outlook looks better than ever. The 40-year trading veteran maintains that BTC is about half-way through the current bull phase.

Brandt expects that the pioneer cryptocurrency will reach between $180,000 and $200,000 by the last two quarters of the year, based on a long-term trend channel.

Though Brandt’s forecast may seem far-fetched, the fact that two out of five U.S. stimulus checks are expected to go into Bitcoin puts such a bullish target into perspective.

Bull Run Far From Over

Glassnode’s Reserve Risk metric adds credence to the thesis that Bitcoin is primed for new all-time highs.

This on-chain metric is used to track investors’ conviction on the digital asset as it moves through different cycles. Essentially, it compares market participants’ incentive to sell against the strength of holders who have resisted the temptation.

The Reserve Risk oscillator is currently at a value of 0.008, indicating that a move past this threshold will confirm the optimistic outlook. Indeed, when this metric rose above the 0.008 mark in the last three bullish cycles, Bitcoin skyrocketed by a whopping 674%, 674%, and 377%, respectively.

According to Glassnode, as prices continue to increase, more holders would be inclined to spend their BTC. Such a market behavior represents a “wealth transfer from long-term holders to new buyers.”

When the Reserve Risk index is at a value equal to or greater than 0.02, investors should be wary of a potential market top.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

Share this article