Tether's Stablecoin Supply Makes Room for Bitcoin Bulls

Before Bitcoin crossed the critical $9,000 barrier, Tether's stablecoin, USDT, has seen an uptick in issuance. The data suggests that investors are turning to USDT to prepare for further price appreciation in the broader crypto markets.

Key Takeaways

- USDT's market cap has ballooned by 85% since crypto bottomed in March 2020.

- Investors waiting to deploy capital have fuelled demand for USDT.

- Bitcoin still needs to cross $10,500 to reverse a trend which began in June 2019.

Share this article

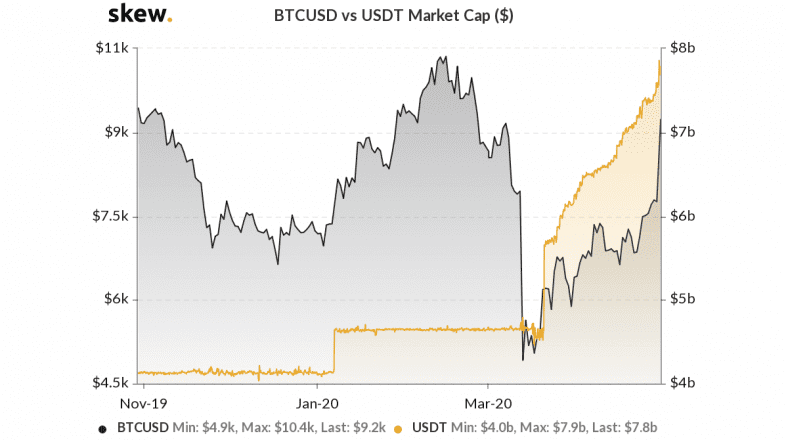

Tether’s market cap in the last two months has increased by nearly $3.6 billion, which is more than the amount issued between all of 2015 and mid-2019. With crypto markets gaining momentum, investors may be systematically buying more USDT to trade for Bitcoin.

Buying Bitcoin with Tether

The rise of stablecoins has made investing in cryptocurrency much easier. Investors and traders no longer need to waste precious time converting their fiat to crypto. Instead, they can keep their funds parked in stablecoins that mimic the price of fiat.

Since the market hit bottom in March 2020, the total amount of Tether’s stablecoin, USDT, has nearly doubled from $4.2 billion to $7.8 billion, recording an 85% increase.

Tether’s market cap has been in an uptrend for over a month, and Bitcoin’s price has moved with it.

Stuart Hoegner, General Counsel at Bitfinex, told Crypto Briefing:

“We are gratified by the recent market demand for USDT, which remains the most trusted, liquid, and popular stablecoin in the ecosystem.”

With the halving in approximately 12 days, bullish sentiment is starting to kick in, as the fear & greed index doubled over the past week. As crypto asset prices climb higher, the fear of missing Bitcoin’s price appreciation, or FOMO, is taking shape.

Large investors may be pushing their cash reserves to stablecoins so they can position themselves to enter the market appropriately. Hoegner added to this thesis and said:

“Possible reasons for the new inflow of fiat and demand for stablecoin issuance might include users wishing to buy other digital assets and using stablecoins as a low-friction on-ramp (as we believe they always have).”

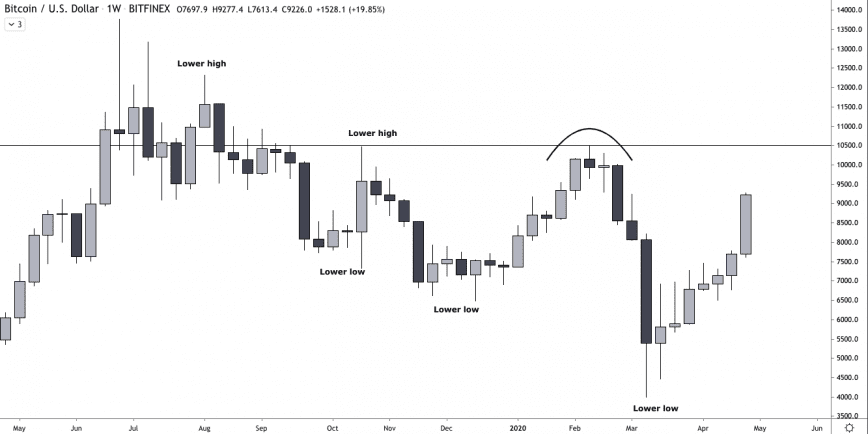

While different investors employ varying methods, a common way to identify bullish market trends is if price stays above previous lows while making new highs.

Market structure has been bearish since the top in June 2019. To reverse this, the price must sustain above $10,500, which is Bitcoin’s last high, set in February 2020.

If this were to occur, a continued rush of capital to the top cryptocurrencies would be inevitable as it would confirm Bitcoin is on a long-term bullish tangent.

Share this article