Why Bitcoin? Separation of Money and State

Part 7: Bitcoin is new money, new representation, and new accountability.

In this series on Bitcoin and money, Crypto Briefing takes a deep dive into the complexities of the modern monetary system and how Bitcoin, as the ultimate hard money, can serve as a solution to many of its problems.

In Part Seven of the series we consider the concept of separating money and state, and what the repercussions might be if elected representatives were forced to keep to campaign promises—and divulge campaign donors—through blockchain technology. The full nine-part series is available here.

From Centralized to Decentralized

Based on the topics we have examined thus far, it appears that a large-scale move from the currently heavily-centralized economic model to a more decentralized system needs to materialize. The current monetary system is deeply flawed and is due for change at a fundamental level. Such a transformation is nothing short of a massive paradigm shift in the way the world’s economies and governments interact.

History has proven that economies will always return to hard money—money that can not easily be printed ad infinitum—with value assigned by free market forces, not imposed by central powers.

As mentioned in Parts One (on history) and Two (on gold), we have seen this shift take place time and time again throughout millennia in gold and other rare metals. Now, the potential for a further shift has emerged with the technological innovation of Bitcoin.

Central powers have made every effort to keep the current fiat currency paradigm afloat, with interest rate manipulation that, whilst occasionally bobbing upwards during short-lived periods of quantitative tightening, inevitably digs further toward zero, and beyond, into negative values.

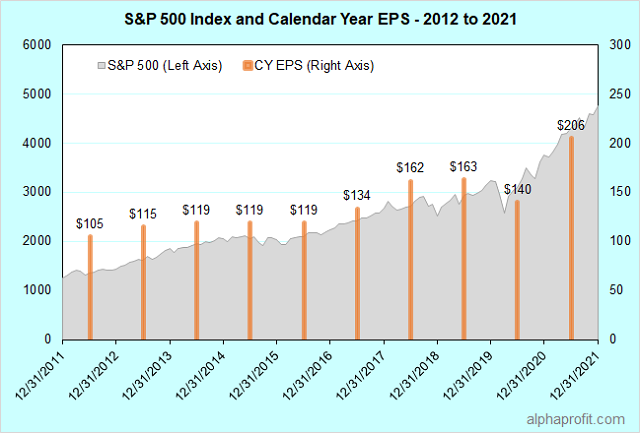

Quantitative easing is the go-to tool that is repeatedly launched in the hopes of bailing out too-big-to-fail businesses, keeping stock markets bubbly.

Combined with fractional reserve banking, these economic tools result in rampant inflation that trickles down and is then amplified at the expense of the poorest in the economy, as per the phenomenon of the Cantillon effect, examined in Part Four of this series (on the banking system).

Central banks and their affiliated financial institutional cronies continue to do their best to keep the monetary center close at hand, even in what are claimed to be capitalist, free-market economies.

Separation Of Money And State

A decentralized, hard money can provide solutions to fix rigged economies, despite the best efforts of centralizing forces, who would otherwise continue to draw wealth in toward themselves, away from the larger population.

Hard money renders quantitative easing impossible. With hard money as the fundamental layer of the economy, market value can only be determined through the difficulty associated with producing a scarce asset. Hard money therefore exhibits an inherent value, dictated by its scarcity, rather than one that is dictated by central powers.

Thus, a hard money can be traded freely throughout a market, requiring no coercion from authorities.

Like the printing press before it, Bitcoin enables the free circulation of information that was once barricaded behind gatekeepers, who hold the reins of power and wealth. With the innovation of Bitcoin, money—a scarce asset as well as a store of information—can be circulated between all willing traders without the possibility of interference from central powers.

This provides a grand opportunity for the separation of money and state.

Much like the separation of church and state before it, the separation of money and state offers a more just and egalitarian economic system for society. Such a system would be built on the principles of truly decentralized capitalism, as opposed to the corrupt and centralized capitalism of cronies and corporate monopolization.

Paraphrasing Thomas Jefferson, “make no law respecting an establishment of [money], or prohibiting the free exercise thereof…”

ShapeShift CEO Erik Voorhees explains the immorality of a centralized and violently-enforced form of money:

“Money is absolutely as fundamental to our lives as religion, and for many people, it is far more fundamental to their lives as religion. It affects how your life unfolds. The choices that you make about money dictate the ramifications of your life and those around you. And so, to have an institution like money so controlled by a central entity—by a monopoly—is absurd. It is immoral. We should get rid of it.”

While the notion of free competition among market participants has long been accepted and touted as the key characteristic of successful capitalist societies, the same principle does not seem to be widely accepted when it comes to money.

For a market to truly be a free market economy, the means of storing and exchanging value must also be allowed to compete freely, without interference from governing powers.

As it would be (and in many places, is) immoral for governments to restrict the practice of certain religions, or conversely to force particular religions upon citizens, we might consider that it is similarly immoral to coerce citizens to strictly utilize state currencies for the storage and exchange of value, particularly in a system that is purported to be a free market economy.

Bitcoin is Peaceful Protest

In this sense, Bitcoin acts as a form of peaceful protest against the violence that is inexorably tied to the fiat currency economy.

A powerful demonstration of peaceful protest against government corruption and over-reach was seen in Hong Kong in the summer of 2019. Protesters deliberately enacted a bank run to attack the economy, withdrawing $70 million in Hong Kong Dollars in a single day, converting the currency to American dollars.

Moving to another nation’s currency would not entirely solve the problem the protesters were attempting to solve, however. Trading the funds for the non-fiat Bitcoin would move the value from fiat currencies to hard money and would enhance the citizens’ sovereignty over their own money.

The Chinese government maintained a degree of control as long as citizens held their funds in fiat currencies: NewsBTC noted that “Chinese banks are likely to push their ATMs out of order to circumvent the protesters’ withdrawal requests. The state could also seize the cash upon arresting its holder on a typical suspicion of causing riots. That has left Hong Kong protesters with a few options to safeguard their money from the police, [one of] which is bitcoin.”

To truly be out of reach of government control and potential confiscation, it is evident that some Hong Kong citizens were taking advantage of Bitcoin’s permissionless and censorship-resistant attributes, as NewsBTC continued to discuss:

“A portion of money already out of the banking system has landed itself in the emerging cryptocurrency markets, according to LocalBitcoins.com. The peer-to-peer crypto marketplace noted a spike in trading volume coming from the Hong Kong region. Within a few weeks, the volume surged from HK$3 million to HK$6 million. That sparked rumors that Hong Kong wealthies [sic] were tunneling their capital offshore by using Bitcoin’s decentralized asset-transfer infrastructure.”

Thus, Hong Kong’s citizens were empowered through the act of freely exchanging and storing value in a non-fiat currency. This act simultaneously disarmed corrupt powers and was made possible by the simple acquisition of decentralized hard money.

This, of course, is just one example, but it points to the power of Bitcoin as a hard money that can not be confiscated or shut down through violent or coercive methods.

We have previously examined how hard money reduces the capacity for military aggression (in Part Four), and its ability to limit the collusive efforts of central banks and financial institutions. Such a monetary innovation has far-reaching implications beyond the realm of protest.

It enables truly free competition, open markets, and innovation on a scale that has not yet been possible due to the constraints of state-controlled money.

Blockchain As Government

Due to Bitcoin’s existence as software, the application of the technology behind it extends well beyond money, to a wide range of possibilities. The function of government, in particular, is an often neglected element of distributed ledger technology, frequently overshadowed by the monetary aspects of the innovation.

Representative governments have long been the standard best-case-scenario attempt at achieving what is envisioned as democracy. Voters select individuals they feel best represent their needs and wants to advocate on their behalf in government. Decisions are then made by this much smaller group of representatives on behalf of voters, rather than by the entire population.

The system of representative democracy has proven to be practical. A relatively small number of individuals can make decisions far more efficiently than a population of millions would be able to do with any degree of efficiency. Having millions of individuals voting on policy after policy would be ridiculously costly and slow.

This system has its share of drawbacks, however. Firstly, the limited available candidates might not truly represent the vast diversity of individuals in a nation or state. In a two-party system like the government structure of the United States, choice is severely limited and in reality only represents a fairly narrow range of ideologies.

With the winner-take-all approach to democracy, many citizens end up on the losing side of the equation for years, or even decades, at a time. (And sometimes, due to archaic mechanisms like the Electoral College, the loser-takes-all.)

That’s not to mention the fact that representatives often fail to stay true to their word and do not consistently represent voters as they may have promised they would while on the campaign trail. Politicians often fall to influence from corrupting forces, whether it be in the form of powerful lobbies, corporations, donor influence, or personal aspirations.

A governance system that incorporates distributed ledger technology, like that made available via the software protocol of Bitcoin, would allow for direct democracy without the need for representatives in many cases.

Citizens could directly vote on policies in a decentralized system. Such a system would not require representatives to vote on behalf of citizens for many situations, at least not nearly to the same extent as the current system does. Instead, votes would be conducted via blockchain protocols that could be used to propose policies and then to enable voting on an immutable and tamper-proof distributed ledger.

Blockchain protocols have many potential applications for fixing problems currently inherent in political systems. (It’s one reason this website devotes a section to ‘Governance’.)

For example, the usage of distributed ledger technology could offer greater transparency and accountability for campaign contributions. Whereas the current system attracts “you scratch my back, I scratch yours” back-room deals between campaign donors and representatives, a Bitcoin-funded campaign would offer complete transparency.

If donors were required to donate to political campaigns via a public, open ledger system, all donations could be checked, preventing corruption and undue influence from certain influential campaign donors. This could eliminate the shell games political parties play with current funding practices.

Smart contracts—automatically executed programs that are enacted once designated conditions are met—could be extremely useful in governing processes. Such tasks can be built into blockchain protocols to be used for automated payments, for example, upon the completion of certain requirements. Smart contracts could enable the enactment of certain policies once required conditions are met, such as reaching a given voting threshold.

The accountability of government representatives could be increased significantly if smart contracts were used as a means of enacting promised policies automatically once a voting process was completed.

It’s clear to see then, that the implications of a Bitcoin-based economy extend far beyond our basic ideas about money.

The technology has the ability to fundamentally change the manner in which society functions, from the storage and exchange of value to the manner in which we are governed.

Most importantly, it allows for the free and open exchange of information in a way that simply was not possible prior to its invention.

In Part Eight of this series we consider the societal changes that could emerge as a direct result of transitioning to a Bitcoin / blockchain economy—with special attention to the redistribution of wealth which, while preserving the values of a free market economy, could help to restore some semblance of balance to the capitalist model of government.