Yield Farming's Biggest Winners are Ethereum Miners, but Not for Long

Mining ETH is much more profitable than BTC, but it may not be that way for long.

Key Takeaways

- At the start of the year, Bitcoin mining was far more profitable than Ethereum mining.

- This changed once Compound announced COMP liquidity mining, kicking off a mini bull run for DeFi on Ethereum.

- Ethereum miners were the biggest winners of yield farming, from a risk-adjusted basis.

- With layer two solutions imminent, the Ethereum mining boom is expected to come to a mid-term halt.

Share this article

Ethereum miners are making tremendous profits, even eclipsing the earnings of lucrative Bitcoin miners. But as the network moves toward layer two solutions, will ETH miners be able to sustain their high earnings?

DeFi Propels Ethereum Miners

Bitcoin is the most capitalized and liquid cryptocurrency, making the BTC mining industry much larger than that of other cryptocurrencies. Over the last few months, however, Ethereum has outpaced Bitcoin to become the most profitable digital asset to mine.

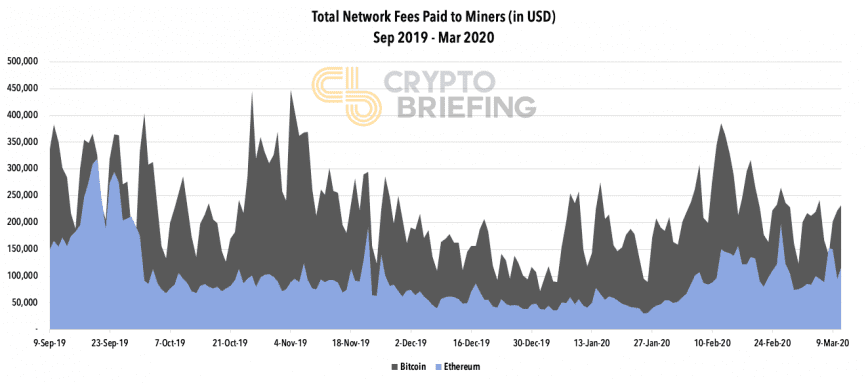

At the start of the year, Bitcoin miners were earning between $100,000 to $360,000 a day in fees, as well as over a million dollars a day in block subsidies.

Ethereum miners, on the other hand, were making between $40,000 to $150,000.

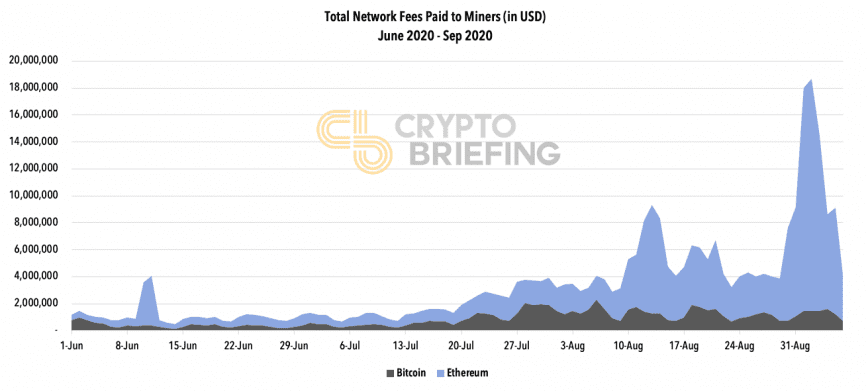

Come July, and the situation had flipped. Ethereum miners were consistently raking in more than $600,000 in fees, with block rewards only growing more valuable with ETH’s price appreciation towards the end of the month.

Meanwhile, Bitcoin’s block reward halving in May reduced the primary source of revenue for miners.

In July, the daily average fee income for Bitcoin miners was $810,000. For Ethereum miners, this figure was 35% higher at $1.09 million a day.

The catalyst for Ethereum’s usage explosion can be traced back to the beginning of Compound’s liquidity mining. Although liquidity mining and yield farming existed before COMP’s launch, it marked the start of a real DeFi bubble.

From mid-June onwards, DeFi became the center of attention for the broader crypto market.

However, this boom came at a literal cost. Ethereum miners were financially thriving, but who was responsible for it?

Users were paying between $10 and $100 to confirm a transaction on Ethereum. Many people were priced out, and the rest paid these high fees because the profit from doing so was higher. For perspective, the average gas cost was eight gwei between April and June, and over 120 gwei in August.

Layer two solutions that reduce dependency on the Ethereum blockchain are nearing completion. This upgrade will reduce the cost of using DeFi.

The current revenue burst for Ethereum miners is thus expected to be short-lived. But as more layer two solutions get deployed, profits will slowly revert to current levels and higher.

Share this article