How to Mine Ethereum: Complete Guide for Beginners

Ethereum mining is a great way to better understand cryptocurrency and gain valuable technical know-how while earning consistent profits.

Share this article

Ethereum depends on mining or “proof-of-work,” meaning that individual users competitively contribute computing power to validate blocks and transactions. They also earn ETH in the process.

Though Bitcoin originally introduced mining, it is increasingly hard to profit from Bitcoin mining. As a result, Ethereum mining has become a compelling alternative for crypto users, especially for mainstream computer components.

Before getting started, it’s important to consider costs, profits, and requirements.

Ethereum’s Mining Algorithm

Ethereum currently uses a mining algorithm called Ethash.

For practical purposes, this simply means that Ethereum is moderately ASIC-resistant. ASICs built specifically for Ethereum mining will not perform much better than high-end, general purpose GPUs. This also means that ASICs built for Bitcoin mining will not mine Ethereum efficiently.

Ethereum’s mining algorithm may change in the future. Developers are debating whether to introduce ProgPOW, which could give Ethereum ASICs less of an advantage over GPUs. Whether you plan to mine with a GPU or an ASIC, you’ll need to purchase a device before you start.

Device Profitability

Efficient mining devices have a high hashrate (MH/s), meaning that they will solve calculations quickly and earn more ETH. Energy efficiency (W) is also important, as power bills cut into profits.

Several high performance GPUs are commonly used right now:

- GTX TitanV 8, 656 MH/s, 2150W, selling at ~$3000

- RTX 2080 8, 552 MH/s, 2430W, selling at ~$800

- GTX 1080Ti 8, 440 MH/s, 2150W, selling at ~$1000

There are also a few high-performance Ethereum ASICs on the market, including:

- Innosilicon A10 Ethmaster, 485 MH/s, 850W, ~$5650.00

- Innosilicon A10 Ethmaster, 365 MH/s, 650W, price unknown

- Bitmain Antminer E3, 180MH/s, 760W, ~$1260, may become obsolete in Oct. 2020

Upcoming ASIC models include:

- Zhejiang Microcomputer V10, 2200 MH/s, 1500W, price unknown

- Linzhi, 1400 MH/s, 1000W, price unknown

The top-performing devices yield daily revenue of $5.00 to $9.00 as of April 2020. Taking into account energy costs, profits for the same devices yield net profits between $3.00 to $6.00.

Profits and revenue are subject to change based on fluctuating ETH prices and personal electricity costs. Up-to-date information can be calculated on sites like F2Pool, CryptoCompare, or WhatToMine.com.

Upfront Costs

Though higher hashrates offer greater revenue, it is important to consider upfront costs, depreciation, and electricity efficiency. It may take years to recover the initial “price tag” cost of any device, whether it is a GPU or an ASIC.

Unfortunately, ASICs can become obsolete quickly. If developers decide to change Ethereum’s mining protocol, an ASIC may even become useless. Even if developers do not make a deliberate change, ASIC manufacturers may have trouble providing up-to-date firmware, as seen with Bitmain’s Antminer E3.

Unlike ASICs, GPUs can always be resold, because they are useful for gaming and system performance in general. Constant mining can cause GPUs to wear out without proper maintenance and cooling, which can greatly reduce their resale value—but they are usually easier to resell than ASICs since they can be put to other uses outside of mining.

It is also possible to mine Ethereum with low-end, past-generation, or integrated GPUs. However, the profit margin may be very small, and electricity costs may cause you to lose money overall. As such, it’s important to know your cost of electricity before getting started.

Gradual Changes

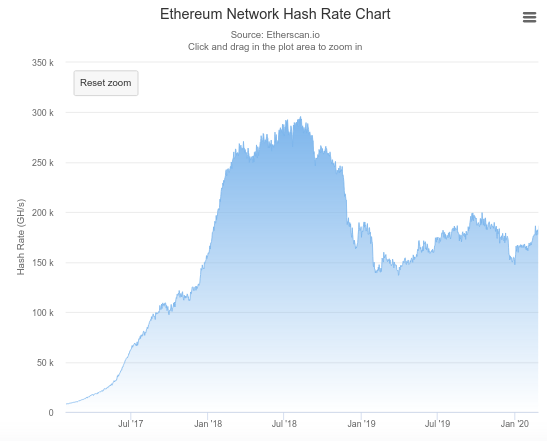

Ethereum’s mining protocol and network is changing gradually, and those changes affect profits. On a positive note, Ethereum’s total hashrate has declined since November 2018, meaning that Ethereum mining is less competitive in a relative sense.

However, mining rewards have also fallen. In February 2019, Ethereum’s Constantinople hard fork reduced block rewards from 3 ETH to 2 ETH, making mining less profitable in absolute terms. It’s likely to continue to decrease.

Similarly, a “difficulty bomb,” which will make it harder to mine each block, may be set off soon, though it has been delayed in several recent updates including January 2020’s Muir Glacier upgrade.

These two changes are meant to discourage mining and make way for staking. Ethereum 2.0 will introduce staking, but it has been delayed continually and will not replace mining entirely at first—meaning that Ethereum mining should remain viable for quite some time.

Pool Mining

“Solo mining” is unlikely to discover a block, meaning that individual miners must join a pool. Mining by yourself may mean waiting months, or even years, before getting a payout.

As part of a mining pool, you will share profits with other miners and pay fees. Though this will reduce your rewards slightly, usually amounting to 0.2-2%, you will also earn rewards on a much more regular basis.

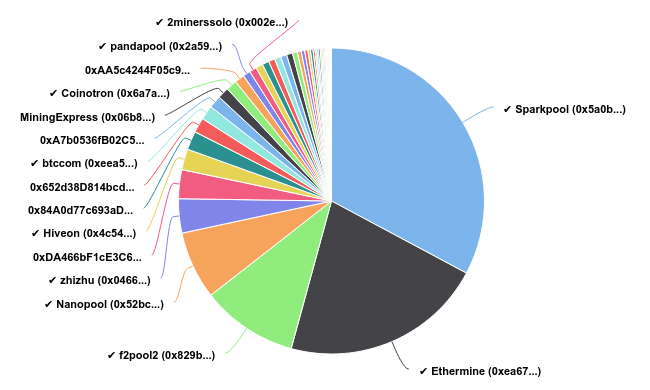

The largest pools include Sparkpool, Ethermine, F2pool, and Nanopool:

Each pool has slightly different fees, payout models, and payment thresholds. Typically, fees are around 1%, and you will need to earn roughly 0.1 ETH before cashing out. However, even with these restrictions it’s usually worth it to have more consistent earnings.

You’ll also need to install mining software and configure it according to your mining pool’s instructions. Ethminer, CGMiner, Claymore, Geth, and Phoenix Miner are all popular and freely available. Be sure to download from an official or reputable website to avoid phishing scams.

Cloud Mining Ethereum

Instead of buying your own ASIC or GPU, it’s also possible to rent Ethereum hashpower from a remote provider. NiceHash, Genesis Mining, Minergate, CCG Mining, and IQ Mining all provide this service.

Cloud mining has some appeal: you don’t need to maintain or set up your hardware, pay electricity costs, or consider how many hours per day you will spend mining. You simply need to buy a contract.

Unfortunately, cloud mining services are not as transparent or accountable as mining pools. You will need to pay up front—which is a risk, as cloud services may go out of business or improperly manage their funds. NiceHash, for example, recently declared that it is unable to repay victims of an attack.

Though there are many vocal critics of cloud mining services, they remain fairly popular. However, in general, it’s near-impossible to earn consistent profits through cloud mining. The only way to earn money through mining is by maintaining an efficient machine with affordable hardware and a low cost of electricity.

Altcoin Mining

Ethereum is not the only Ethash-based coin. It is also possible to mine Ethereum Classic, QuarkChain, Ellaism, Expanse, EtherGem, Ubiq, Ether-1, Dubaicoin, Callisto, EtherSocial, and Metaverse. These altcoins provide the opportunity for even larger profits.

Though it is possible to mine the most profitable Ethash coin at any given moment, Ethereum is generally the most profitable option. Fortunately, you are not limited to Ethash-based coins. Dual miners like Claymore allow you to mine Ethereum alongside non-Ethash coins like Decred or Siacoin. This can increase profitability.

Predicting which altcoins will rise in price is another strategy. However, this is extremely difficult, and if it were possible, it may be more efficient simply to buy those counts when prices are low. Nevertheless, mining altcoins is a good way to build a position in altcoins without having to buy them from sometimes dubious cryptocurrency exchanges.

In Summary

Ethereum mining is a viable option, especially when compared to Bitcoin mining. Advantages include:

- Reasonably high profits

- GPU mining support, at least for high-end GPUs

- Several coins to mine and dual mining support

- Plenty of mining pools to choose from

There are also some negative qualities:

- High upfront costs for GPU and ASIC devices

- Uncertainty around the future of ASIC miners

- Rising difficulty and falling block rewards

- Staking may replace mining in the next few years

In all, mining is a great way to better understand cryptocurrency and gain valuable technical know-how. If done correctly, it’s possible to earn consistent profits while building a portfolio of cryptocurrency holdings.

Share this article