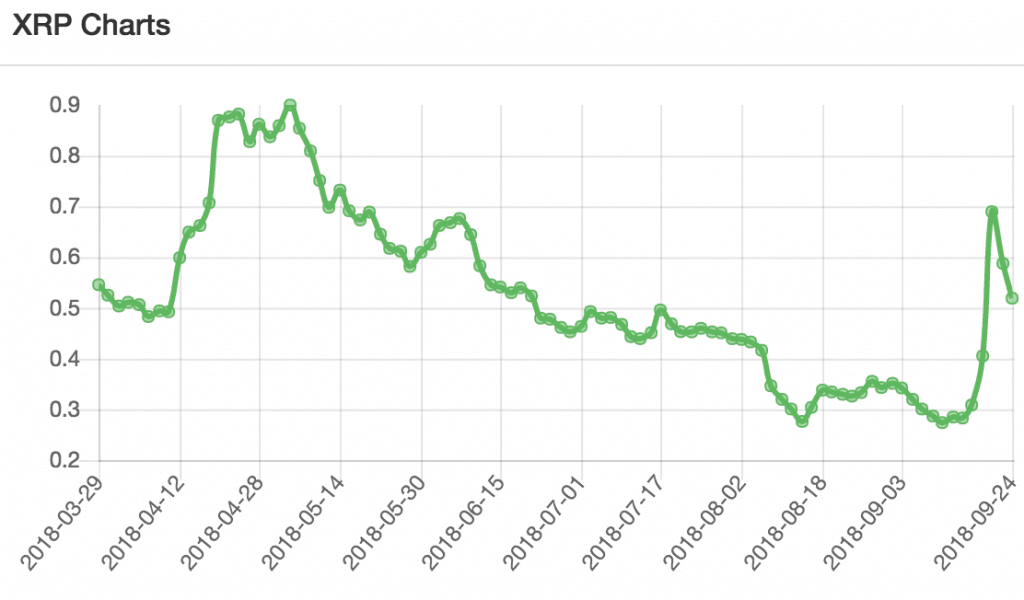

After XRP Went Crazy, Is Stellar Next?

Share this article

XRP just wrecked the crypto china shop, but there may be another bull right behind the Ripple run. As the market sweeps up the wreckage and fragments, one question is still looming: is Stellar lumens next?

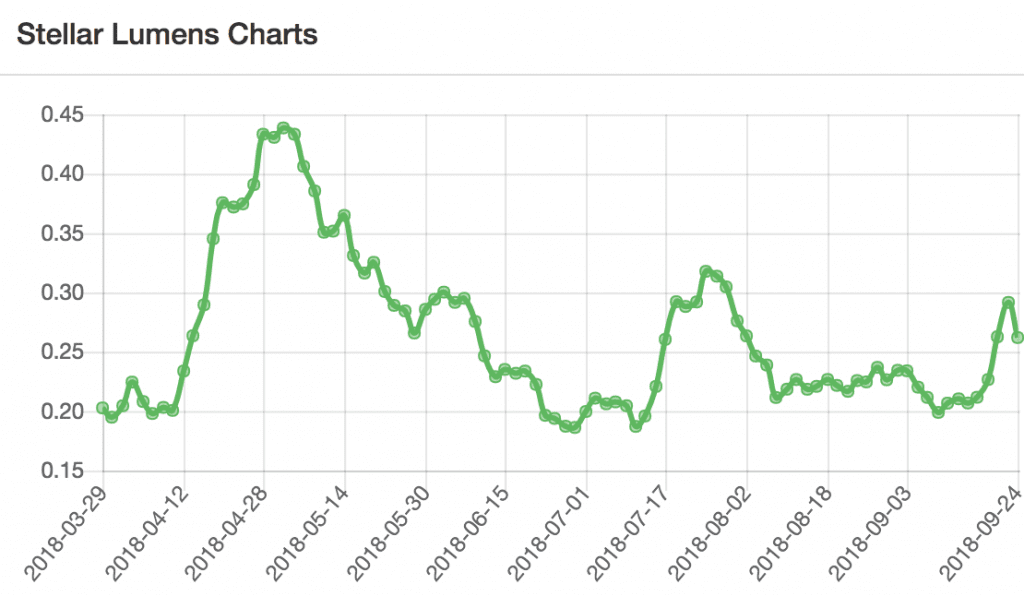

Although Ripple predates Stellar by several years, the tokens of the two protocols act more more like twins than ordinary siblings. Except for rare outbreaks, XLM prices typically remain glued to half the price of XRP. Although Jed McCaleb, the creator of both protocols, left Ripple on apparently unfavorable terms, the newer protocol inherited very similar uses and use-cases: both are targeted at banking and legacy finance with fast, low-fee and highly scalable ledgers.

But there are also significant differences that may clear the way for a future Stellar run. While the XRP token was the first-mover, Stellar has a sizable latecomer advantage as well.

The Next Ethereum?

Although both Stellar and Ripple are ostensibly positioned as payment technologies, only one of them is also suited for dApps and token sales.

While it’s technically possible to host an initial coin offering on Ripple tech (and some adventurous companies have done so) the company’s ledgers are more aimed at upsetting MoneyGram rather than the Nasdaq.

Stellar, though also a payments platform, has shamelessly eyed Ethereum’s position as the de facto platform for token offerings and flaunted its advantages. These include negligible fees, a built-in decentralized exchange and token-for-token atomic transactions.

Stellar XLM Readies for the STO wave

But there’s no expectation that humdrum utility tokens are going to lead the next encierro. As Crypto Briefing has previously reported (and many others have agreed) utility token offerings may well be on their way to becoming investment has-beens.

The Stellar protocol is already pivoting towards regulatory-compliant security offerings. DSTOQ, a Vanautu-licensed Stock Exchange, announced the launch of a peer-to-peer security token marketplace on the Stellar protocol earlier this summer.

We’ve previously waxed poetic about Polymath and Civic as important bricks for future security platforms, although they do not escape Ethereum’s limitations. Stellar, in contrast, seems to have been built with these limits in mind.

A built-in compliance protocol allows financial institutions to add AML requirements, if they wish, and issuing assets on Stellar “can be performed by a crypto-beginner,” as Viktor Krekotin points out. Moreover, he adds:

It is also possible to limit access to asset ownership on the Stellar network through requiring trustline authorization by an issuing account (one action). This feature helps implement KYC easily and reliably as opposed to Ethereum…

A Favorable Regulatory Outlook For Stellar?

Speaking of securities, this might be a time to address crypto’s lurking pachyderm-in-the-corner. Although Ripple has done as well in the courtroom as it has in the marketplace, that hasn’t diminished perceptions that XRP may ultimately fall on the wrong side of the SEC.

As we know the Stellar Foundation is not defending itself from angry XLM investors, nor has its PR agency issued circulars to distance itself from the lumens token. That doesn’t necessarily mean a regulatory green light, but at least Stellar doesn’t have flashing red-and-blue lights in the rearview mirror.

This is still largely speculative, but the market is already leaning heavily in favor of the kinds of tokens for which Stellar has a marked advantage. Given that 2017’s bull-run started because of the ICO’s advantages—and crashed because of their limitations— it seems likely that more advanced tokens will also play a part in the next one.

Assuming that XRP’s good week was not, as some writers have speculated, the work of professionals, last week’s bull run occurred in spite of ongoing securities concerns. If XLM does succeed as a platform for next-generation STO’s, the next bull run will be because of those concerns.

The author has investments in both Stellar lumens and XRP.

Share this article