Blockchain Companies Are Terrified Of Their Own Killer App

Share this article

“What is the killer app going to be?” Vitalik Buterin asked aloud in 2015, echoing the sentiment of many blockchain believers. Three years and a colossal bubble later, that question still doesn’t have a satisfactory answer, and many cynics still describe the blockchain as a “solution looking for a problem.”

After an exponential growth in market capitalization and an explosion of ICOs, the biggest real-life use for cryptocurrency is still gambling on unregistered securities. Of all the heady projects promising to turn finance on its head, the only one to actually do so is Ethereum, by giving us easier coin offerings.

Meanwhile, one of the best use-cases is staring us in the face. While most cryptocurrencies are doing their best not to be a security, security trading is one of the things a blockchain is actually good for.

And—for reasons we’ll get to shortly—it’s a problem which they can’t yet fully solve.

What’s the Use of Utility Tokens?

The big problem with last year’s ICOs (besides the scams) was that they were all trying to sell utility tokens.

Crowdfunding with a utility token is the digital equivalent of paying your mortgage with arrowheads or sacks of grain. Certainly, they might gain value in the future, but they’re not exactly investment vehicles. It’s a bit like building a new theater, and raising the money by selling tickets in advance.

What investors did not receive is a stake in the company, either in equity or a share of profits. As coin offerings fell under regulatory scrutiny, some resorted to legal acrobatics to remove anything that made their tokens look like an investment.

The result was bad for everyone: investors received tokens with diluted value, genuine utility tokens got lumped together with the securities, and issuers distanced themselves from their tokens. Authorities, as well as the public, became even more suspicious of ICOs and cryptocurrencies.

Securities and Blockchain: Made for Each Other

The point here is not to trash utility tokens. But the qualities of a good utility token do not necessarily make for a good investment, Steem is a pretty good utility token–people actually use it–but a terrible investment. And registering a utility token as a security can make it it impossible to use.

If you’re selling tokens to raise funds, the worst thing to do is take away the properties that make it a good investment. People who bought into “utility” and “payment” tokens run the risk of ending up like Ryan Coffey—who believed his purchase of XRP made him an investor, but whom Ripple seems to regard as a customer.

It’s ironic how much blockchain companies shy away from the S-word, considering that trading securities is one of the only proven use-cases so far. A token can do anything a stock can do—not only trading, but also dividends and shareholder voting. Complicated instruments like bonds, options, and derivatives, are fairly trivial to automate into a smart contract.

While some companies have digitized their stocks, there are big network advantages to hosting them on a shared blockchain rather than a multitude of centralized databases—not the least of which is the ability to do away with brokers and middlemen.

To give you an idea of how inefficient this process is, here’s the “straightforward process” of transferring stock to another person. Via TheNest:

Contact the firm that holds your stock for transfer paperwork. Most firms have their own unique paperwork to help you process a stock transfer.

Complete the stock transfer form. Provide the stock issuer name, the number of shares you wish to transfer, and the reason for your transfer. …

Verify whether you are required to get a Medallion Signature Guarantee. …Some institutions base their requirement for a Medallion guarantee on the number of shares that are transferred, but others use different standards.

Check for further documentation requirements….

Submit your stock certificate to your financial services firm along with your completed paperwork….

Here’s what it could take to send a stock token or equity token on a blockchain, if infrastructure is put in place:

-

Address.

-

Sign.

-

Send.

There are already signs that serious crowdfunding is beginning to pivot away from utility tokens. “Equity Token Offerings” or “Security Token Offerings” are already becoming the mold for major crowdsales—like Nex, Founders’ bank and the Maltese Security Token Exchange. Creating a token which bears equity and dividends adds extra complications but results in a better value offer to their investors.

What’s Missing For Security Tokens?

The preceding section has one large, glaring hole. In case you missed it: putting security tokens on a blockchain is a waste of technology. There’s no point putting stocks in fourteen-second blocks, if it takes a week to move them.

In the United States, and just about every other jurisdiction, the creators of security offerings are bound by strict due-diligence requirements. Know-Your-Customer (KYC) laws require filing the identity documents of their investors, and anti money-laundering (AML) requires them to know the provenance of their customers’ funds. Since the only way to process KYC-AML is by human inspection, security tokens are limited by the speed of a human eyeball.

That’s if they can move at all. In the United States, some securities are only available to wealthy investors, or cannot be traded at all. Consequently, when Indiegogo or Republic host an initial coin offering, you can’t actually use or move the tokens.

An Identity Solution

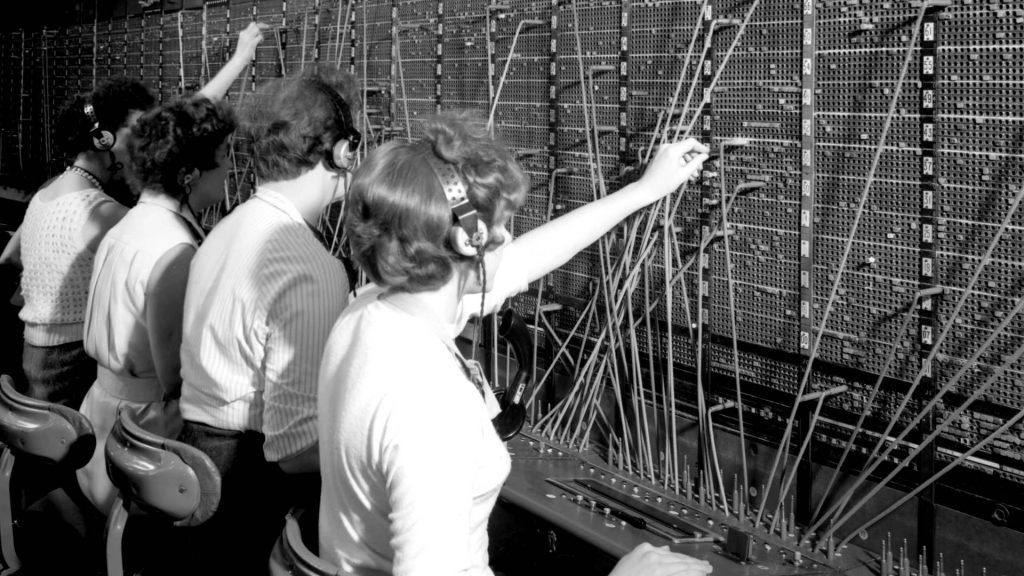

The problem isn’t crypto; the problem is the fact the machinery still has to pause for human intervention. It’s a bit like those old telephone exchanges in the 1920’s: you could send your voice to someone a thousand miles away, but you still had to spell their name out to a human operator.

The big barrier for tokenized securities (or one of them) is that these tasks can’t be done automatically–yet.

Imagine being given a set of non-tradeable tokens that can prove salient information to another party—your identity, your nationality, or even your income level—as reliably as showing them a drivers’ license.

This is speculative territory, but regulators are coming down the rabbit hole too. It was none other than Valerie Szczepanik, the SEC’s crypto head, who suggested that regulatory rules could be coded into smart contracts.

There are already projects seeking to develop regulation-compliant ID protocols. Without taking sides, Polymath is attempting to create a system for Security Token Offerings, for which only the verified addresses accredited investors can hold tokens – we covered one such use, in real estate, just this week. The Civic project is attempting to develop a decentralized proof-of-identity system, and the ERC-725 protocol has a similar goal in mind.

It would even be fairly straightforward for a well-motivated financial body to issue the blockchain equivalent of a medallion guarantee.

There are a lot more wrinkles to be ironed out before blockchain securities are safe to trade. Regular investors are likely to be scared away by the transparency of contemporary blockchains, as well as the irreversibility of transactions.

But, unlike the exotic business models employed by most ICOs, equity and stock trading are already anchored with real-world parallels. Considering how much time the crypto community has already spent moving thinly-veiled securities, trading licit ones should be a no-brainer.

The author is invested in several digital assets, including Ethereum.

Share this article