Bitcoin Struggles As BAT And ETC Lead The Charge

Bitcoin is dangerously close to falling below $10,000 while altcoins recover.

Share this article

The cryptocurrency market has somewhat stabilized, presenting a predominantly green landscape as Bitcoin struggles to stay above the psychological $10,000 marker.

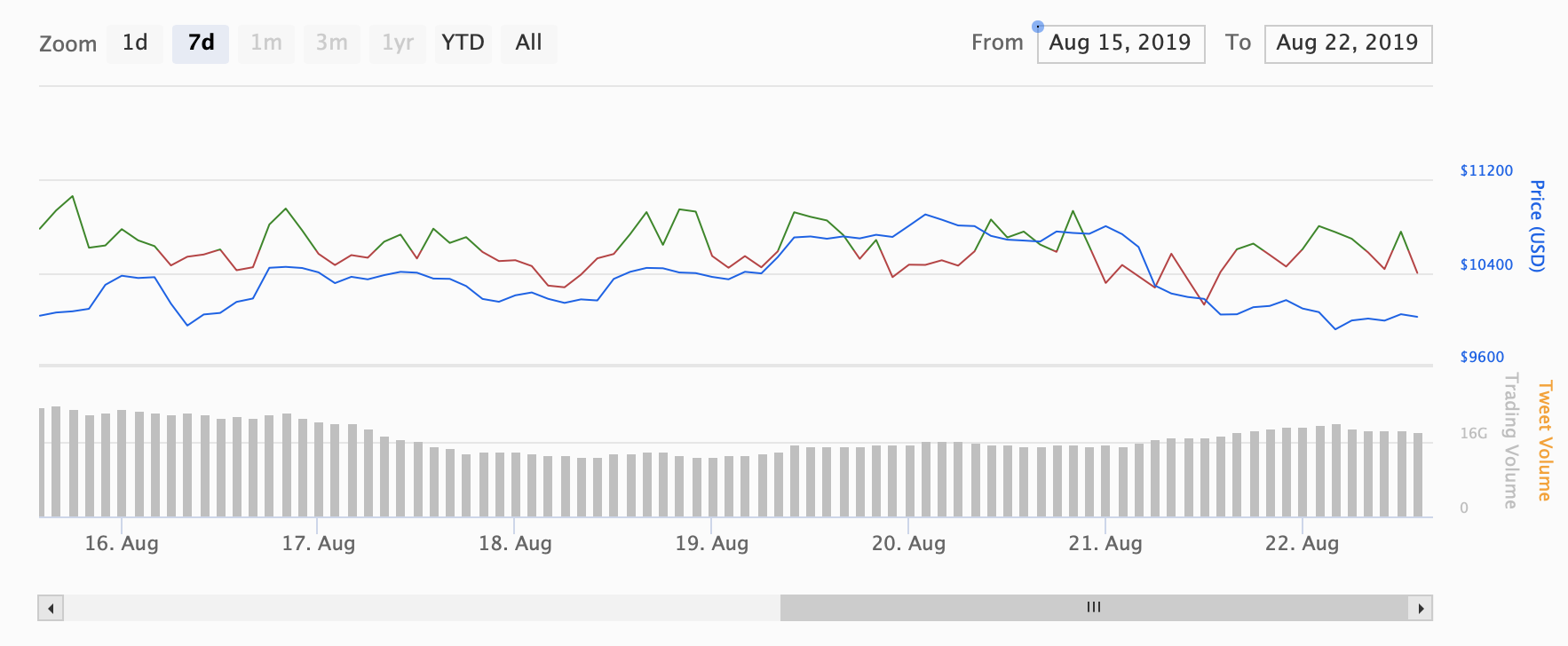

Sentiment for Bitcoin has seen a moderate improvement towards a strongly neutral outlook.

Despite this overall lukewarm performance, proponents of Bitcoin’s store of value potential have reason to rejoice today. According to a report by Digital Asset Data, BTC is increasingly gaining correlation with the broader asset markets – positively with gold, and negatively with the stock market.

With a recession looming on the global economy, Bitcoin could fulfill the role of a “safe haven asset,” to which investors flock during uncertain economic times.

Altcoins see recovery with ETC and BAT leading

The rest of the cryptocurrency market is seeing strong corrections from yesterday’s fall, with two strong outliers making significant gains.

Basic Attention Token is strongly reacting to its new listing on Kraken, a popular and reputable exchange which scored highly on TheTIE’s exchange transparency grid. BAT has gained more than 15% on yesterday’s price, while curiously its partner-in-listing WAVES has registered a much more modest 4%.

The stark difference can be explained by the contribution of other fundamental drivers, with BAT recently launching the much-anticipated online tipping feature in its browser.

The other outlier is none other than Ethereum Classic, which after an against-the-grain rally on Tuesday has continued today with a 14.6% gain. The total 7-day performance is a solid +21%, by far the highest in the top-50.

As before, it’s difficult to give a meaningful explanation of the rally. The upcoming ETC Atlantis hard fork is scheduled in about 22 days, too far ahead to justify any price action, though the final confirmation was released on Monday. The run is likely to be due to a combination of factors, including possible whales entering ETC positions.

The rest of the altcoin market is seeing moderate recoveries, with IOTA, TRON and Cardano gaining 8%, 6.32% and 6.42% respectively as the rest average on 3-4%.

Technical Analysis: Nathan Batchelor on Bitcoin

The technicals for Bitcoin remain fairly weak as we move into the U.S trading session, following a bearish daily price close below the psychologically important $10,000 level. The only saving grace for Bitcoin bulls is that sellers have been unable to break below last week’s trading low, just above the $9,450 level.

The decline in Bitcoin has so far extended down towards last Friday’s swing-low, at $9,750, although at present we are not seeing any further selling interest below this important technical area. If we continue to see this level defended, we should expect a possible bounce back towards the $10,275 to $10,300 area.

Paralysis appears to have set in across a number of other top cryptocurrencies, as sellers are unable to force the next bearish leg lower in Ethereum, Litecoin and Ripple, while buyers are unable to rally price away from fairly depressed levels.

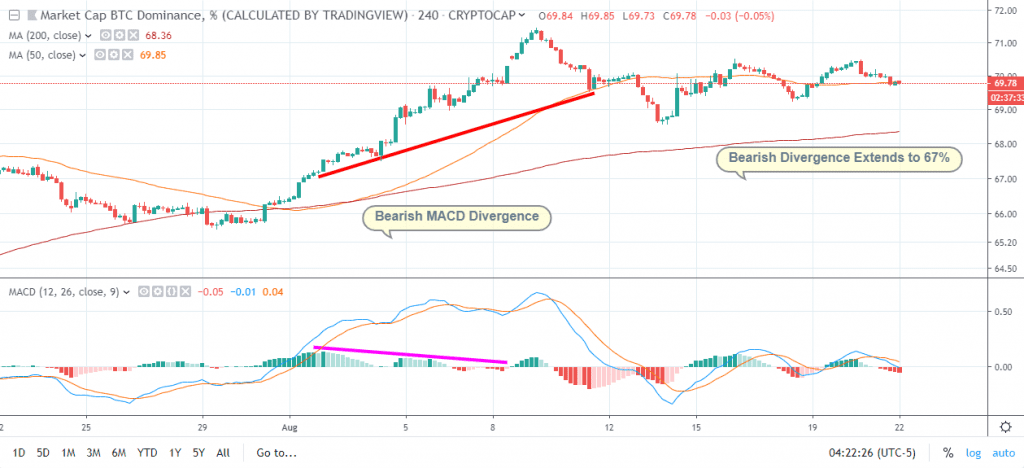

I recently analyzed a chart of Bitcoin’s overall market dominance, which is at levels not seen since July 2017, and uncovered some interesting facts. Firstly, the four-hour time frame shows negative price divergence, pointing to a possible drop in Bitcoin’s market dominance back towards 67 percent.

Secondly, I see that no meaningful technical resistance until the 77 percent mark if we see a sustained breakout above 70 percent in overall market dominance. And finally, a large bullish triangle pattern suggests Bitcoin’s overall mark dominance could peak around 82 percent at some point.

*It is safer to trade around the edges at present, as essentially we have moved back to Bitcoin’s monthly price open.*

SENTIMENT

Intraday bullish sentiment for Bitcoin has taken another tumble, at 31.00%, according to data from TheTIE.io – while the long-term sentiment indicator remains steady, at 70.05% positive.

Bitcoin remains highly susceptible to price manipulation. Bitcoin whales have the opportunity to easily manipulate its price, generating sell-offs in the market. In recent days, there have been several large transactions, such as this latest one at BitMEX, which may be the reason for the recent drop.

UPSIDE POTENTIAL

Failure to recover the losses incurred during the later part of Wednesday U.S trading session is certainly weighing on the current upside potential for Bitcoin at the moment. Buyers’ overall inability to stage a meaningful bounce from the $10,000 level is hinting that moves higher are now likely to be weak, unless we see a fundamental driver emerge.

Short-term bulls will be focused on the $10,280 level today if we see price move above the most recent swing-high, at $10,180. Key near-term technical resistance for the BTC/USD pair above the $10,280 level is located at the $10,380 and the $10,550 levels.

DOWNSIDE POTENTIAL

The downside for Bitcoin is going to accelerate if we see the $9,750 support level broken over the coming sessions, leaving the $9,450 and $9,100 level exposed to another downside attack. This certainly has the potential to spill significantly lower if the July monthly low is breached.

Despite the strong decline earlier this week, the Relative Strength Indicator has yet to move into oversold territory across both the four-hour and daily time frames, which is fairly ominous for Bitcoin.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.

Share this article