Extreme Bitcoin Crash Exacerbated By Rock-Bottom Sentiment

Sentiment fell to an all-year low

Share this article

While yesterday’s Bitcoin crash took traders by surprise, sentiment analysis shows that the floor had been crumbling beneath their feet for some time.

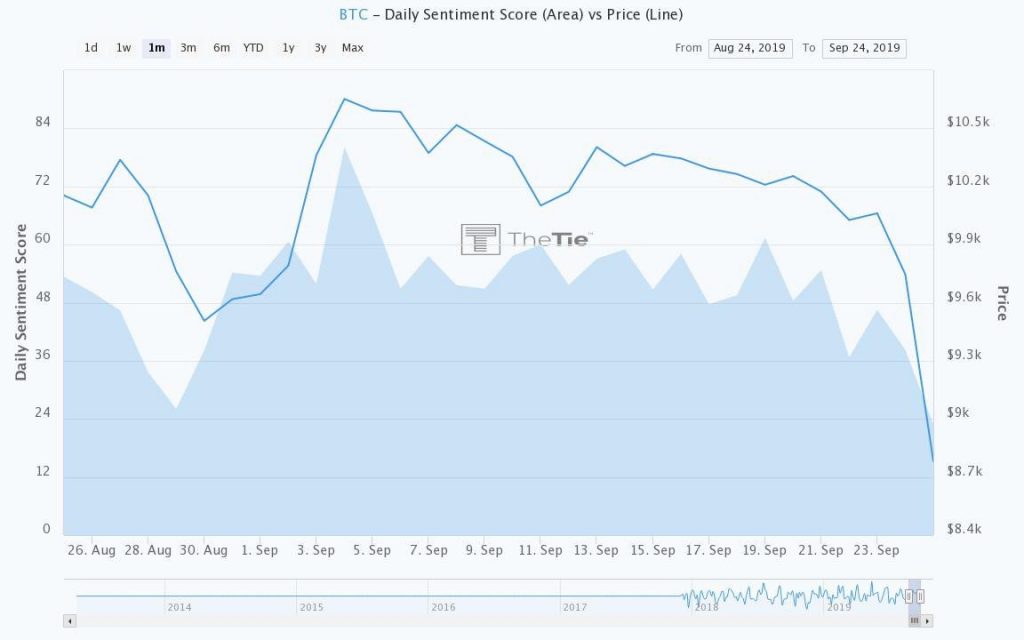

Data from The TIE show that Bitcoin’s daily sentiment score, which measures the number of positive or negative conversations on Twitter, has been declining for the entire month of September.

After reaching a high around 80 earlier this month, sentiment had already turned negative in the days before Bakkt launched. At the time of writing BTC sentiment is down to 22.8, the lowest level since the crash in November.

Falling sentiment coincided with the sell-off, in which Bitcoin dived from the $10,000 range. BTC traded at $8,400 at press time, 15% below the week’s opening prices.

The sudden slide was likely a reaction to the lower than expected volumes following the Bakkt launch on Monday. “[T]raders who were expecting fireworks…were left disappointed as the exchange only managed 28 BTC of volume during its first nine hours of operations,” explained Ross Middleton, CFO of the decentralized exchange DeversiFI.

After more than a month of range-bound trading near the $10,000 level, it was only a matter of time before BTC had a major breakout, as SIMETRI analysts predicted earlier this week.

“[E]ither side was always going to result in a large move,” Middleton said. The drop below $9,500 triggered a series of stops, as well as the liquidation of roughly half a billion dollars’ of leveraged long trades on BitMEX.

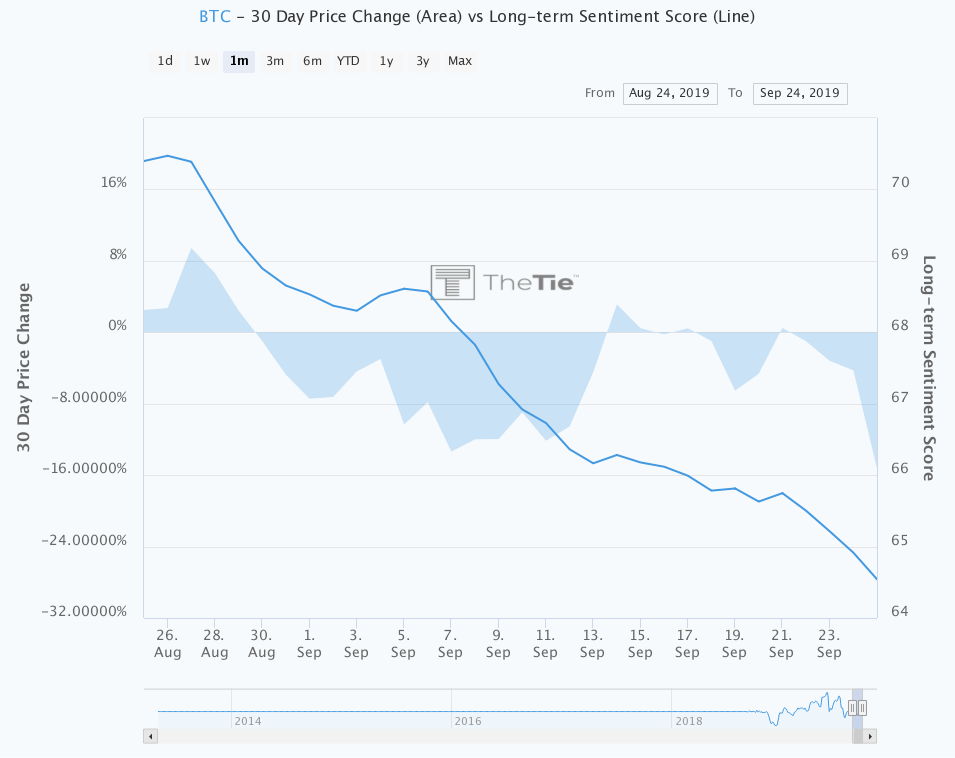

But although Bakkt might have been the catalyst, sentiment had been turning against Bitcoin long before this week, said Joshua Frank, co-founder and CEO of The TIE.

“We saw a very extended period of very low twitter activity around bitcoin (tweet volumes were crashing) and the market had become more negative on the coin,” Frank explained.

Other market-watchers concurred on the lackluster opening as the most immediate catalyst for yesterday’s crash.

“The disappointing BAKKT opening signals to the crypto community that institutions are less ready to invest in BTC at scale than was supposed,” said Celsius Network CEO Alex Mashinsky, “which means the price was probably too high and due for a correction.” The fall was probably accelerated by short-sellers and momentum traders, Mashinsky added.

Bakkt was not the only bearish headline for the industry. “The delay of another Bitcoin ETF decision and the news KIK is shutting its messaging app…to fight the SEC added to negative sentiment,” said Middleton.

Timing is everything. Had Bakkt launched during the summer, when the Bitcoin sentiment score was riding at well above 70, the market could have recovered quickly. “Negative sentiment and continued decreases in retail participation likely made the drop a lot more significant,” Frank added.

Investors hoped for Bakkt to reinvigorate the market, and a strong showing on Monday could have provided validation that institutional investors are moving into the asset class. But actual volumes failed to meet those expectations, sparking multiple sell-offs.

“The market will recover,” Frank predicted, “but I don’t see any significant catalysts that will drive upwards movement at this point.”

Share this article