Burning Money: Are Coin Burns Effective At Raising Crypto Prices?

Share this article

Coin burning is a method by which cryptocurrencies keep their market value high and attempt to offset inflation. When a large portion of a coin’s supply is removed, that coin experiences heightened demand, and as a result, the coin’s price goes up.

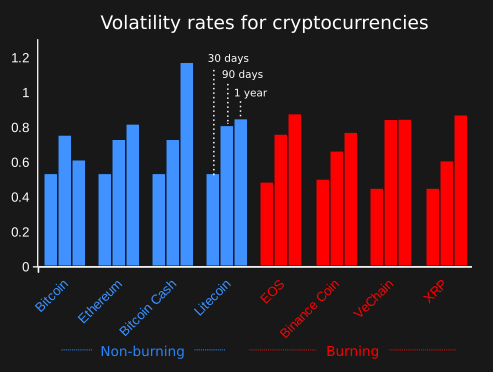

At least, that’s how it works in theory. In practice, any price increases that occur immediately after a coin burn usually get lost in the noise. The effects of coin burns are usually overshadowed by the long-term price volatility of the entire crypto market, as shown below:

Since most coins experience very similar price changes, it’s hard to say which ones have gotten the best results from coin burning. With that in mind, we’ll look at several burn strategies that have been enacted – and whether some of those strategies are better than others.

Burning the Circulating Supply

Many cryptocurrencies burn tokens that are in circulation – that is, they eliminate tokens that are being traded or held by investors. This means that the organization that issues the cryptocurrency must buy it back from coinholders and exchanges.

Binance does this a few times per year: its 7th coin burn destroyed 830,000 BNB ($16 million) in this way. VeChain and TRON use a similar model as well. This strategy has one advantage:the size of the burn is largely determined by market forces and price action.

The downside is that these burns do not always attract a lot of attention, and the results can be minimal. After two years, Binance has burned about 6% of its BNB supply. TRON, meanwhile, intends to burn $20 million worth of TRX over one year, adding up to 1.7% of its total supply.

Burning the Non-Circulating Supply

Sometimes, coin burns remove tokens that are not in circulation, such as tokens that are allocated to team members, early investors, or the project itself. EOS, for example, recently burned an account containing 34 million EOS (~$150 million) following a community vote.

Binance, meanwhile, has burned 808,000 BNB that was allocated to its team, thereby removing $24 million from Binance Coin’s supply. Presumably, it is easy to burn a large amount of funds in this way, since the funds in question are often located in just a few large accounts.

However, since these tokens are not in general circulation, this sort of burn should not have a large effect on the market (or on prices). This is complicated even further by the fact that there is no universal agreement on what constitutes a coin’s “circulating supply.”

Burning During Each Transaction

Some cryptocurrencies burn tokens during every transaction. VeChain, for example, burns about 70% of its VTHO tokens, which are used to pay for transaction fees. (VTHO should not be confused with VeChain’s primary VET token, which is being burned via buybacks.)

Ripple follows a similar strategy: it burns about 0.5 XRP per minute, which adds up to more than 250,000 XRP per year (though this is subject to change). This strategy has a few things in its favor: it’s very easy to coordinate, and it shouldn’t have any unexpected results since it plays out slowly.

By spreading small burns across many transactions, this strategy should prevent any short-term market cap drops. It should also reduce confusion and misunderstanding among investors, thereby preventing secondary effects such as “panic selling” and other irregular activity.

Unofficial Burns, Dead Addresses, and Lost Coins

Bitcoin and Ethereum are not issued by a central organization or project. Since these coins are mined by a community, there is no group capable of planning an official coin burn. Instead, rules and algorithms prevent too many tokens from being created in the first place.

That said, wealthy groups can take it upon themselves to carry out a burn. Antpool, a popular mining pool, began to burn Bitcoin Cash transaction fees in 2018. This was extremely controversial, and there was plenty of disagreement over whether this was a legitimate way to boost Bitcoin Cash’s value.

Coins can also be destroyed inadvertently, as occurs whenever individuals lose access to their wallet addresses. Some estimates suggest that up to 3.8 million BTC has been permanently lost. Even if this is accidental, it is effectively the same as burning 20% of Bitcoin’s supply.

Price-Targeted Burning

Some cryptocurrencies have managed to fine-tune their burning strategy in order to achieve a specific price. Tether and other stablecoins continually burn (and create) tokens, and the end result is that stablecoin prices always rest around the $1.00 market.

This strategy isn’t generally applicable: Tether relies on U.S. dollars as collateral, and this allows it to achieve stability. Though the full process is quite complex, Tether’s coin burns basically reflect the fact that U.S. dollars are moving out of its reserves.

This means that coin burns reflect, not dictate, Tether’s stability. As such, most cryptocurrencies cannot target prices as precisely as stablecoins do. Furthermore, even stablecoins experience minor price fluctuations, as burns cannot always keep up with market activity.

Do Coin Burns Really Work?

It seems safe to say that, if nothing else, coin burns aren’t doing any harm to cryptocurrency prices. After all, if coin burns did produce extremely undesirable results, the projects that rely on coin burns would end the practice.

The fact that many crypto projects have stuck with their original burning strategy is a good sign—especially since coin burns don’t seem to have immediately noticeable effects on coin prices. This is partly due to the fact that many strategies involve burning tokens on a small scale.

That’s not a bad thing, though: the full impact of coin burns should become more apparent over the next several years, assuming that cryptocurrencies stay dedicated to their strategies. Of course, coin burns could go out of style at any moment as well, so it’s hard to say exactly what will happen.

Share this article