Does Crypto Gravitate Towards "Economically Free" Countries?

Crypto Goes Where Freedom Blows

Share this article

History is full of cautionary tales, provided by inept governments attempting to limit economic activity. While limiting commerce seems to come instinctively to some politicians, the gradual rise of prosperity appears to be linked to the expansion of economic freedom. In other words, prosperity and freedom seem to go hand in hand.

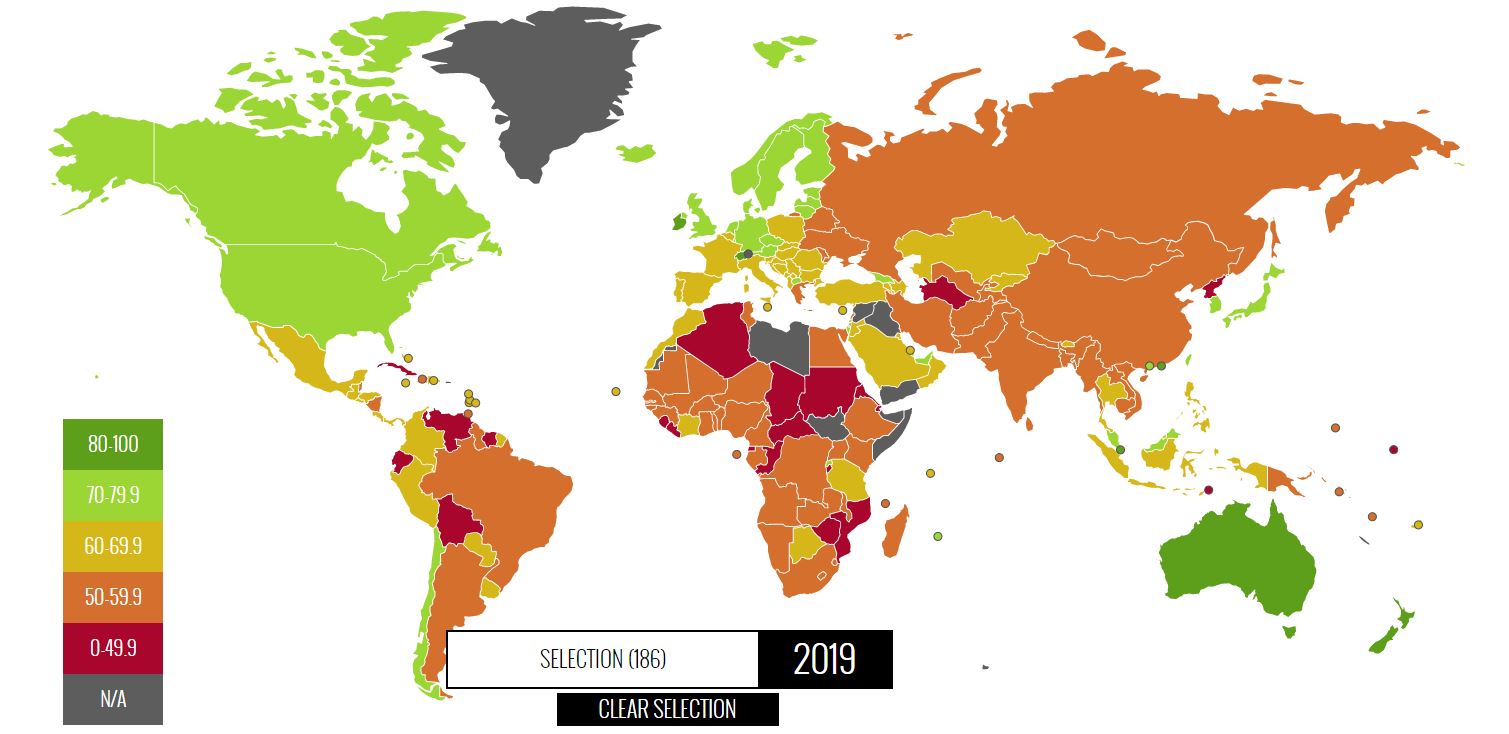

The Heritage Foundation, a conservative think tank based in Washington, D.C., produces an annual Index of Economic Freedom. The index ranks countries along a spectrum of free, mostly free, moderately free, mostly unfree, and repressed.

The 2019 index has just six countries in the “free” category. Unsurprisingly, three of those are cryptocurrency hubs, and another two crypto-tolerant, with a regulatory framework around digital assets and exchanges.

The Four Pillars and Twelve Factors of The Heritage Foundation

The index of economic freedom measures twelve qualitative and quantitative factors of economic freedom, neatly distributing them among four pillars: Rule of Law, Government Size, Regulatory Efficiency, and Open Markets.

The think tank believes:

The six economies judged “free” by those measures in the current index are, in order, Hong Kong, Singapore, New Zealand, Switzerland, Australia, and Ireland. Hong Kong retained its number one position from the 2018 index, with it and Singapore handsomely outranking third-placed New Zealand.

Three Out of Four Ain’t Bad

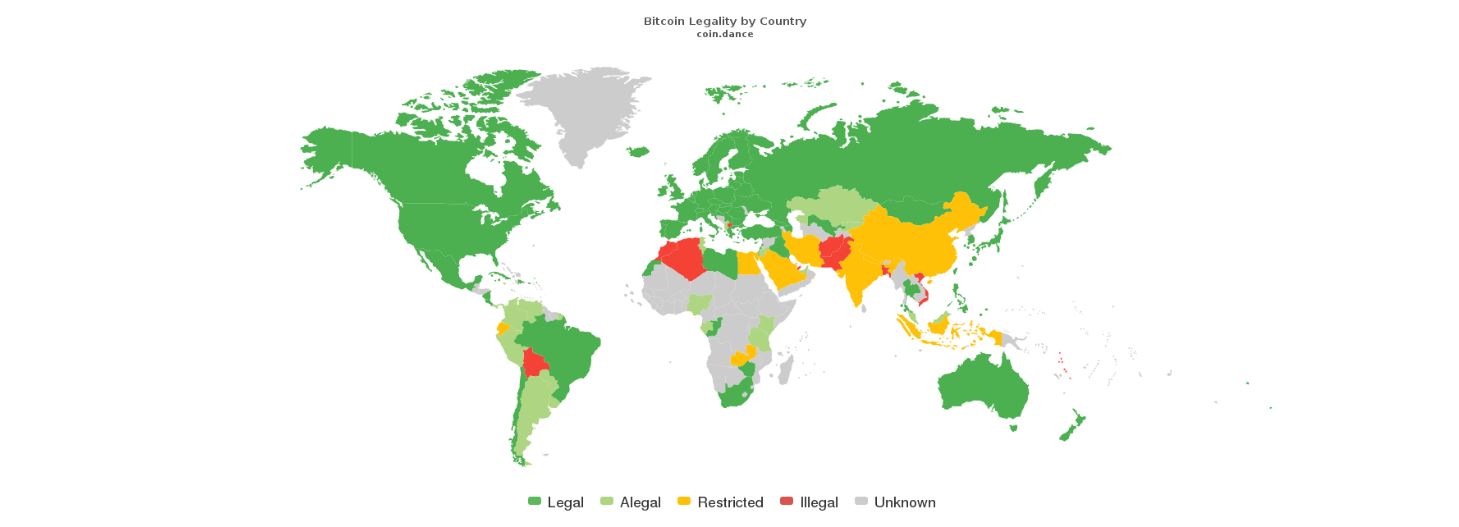

Regulatory attitudes toward cryptocurrency range from embracing, tolerant, suspicious, to downright hostile. Hong Kong, Singapore, Switzerland, and Malta are the four most widely recognized crypto hubs in the world, with Malta providing a full legislative landscape to attract exchanges and other crypto entities.

Zug leads the Swiss drive for the expansion of the digital asset sector, although it is fair to say many of the cantons in Switzerland, especially around Geneva, are quite some distance behind. (Swiss banks lag even further).

Were it not for fears of encroaching mainland Chinese influence, Binance would possibly have remained in Hong Kong. The Chinese special administrative region has long held a reputation for encouraging entrepreneurship and innovation. Singapore has also sought to be the friendliest jurisdiction for fledgling crypto startups.

Cryptocurrency, while not widely accepted in Australia, enjoys a healthy ecosystem of exchanges and legal clarity around digital currencies. The controversial Cryptopia exchange was based in New Zealand, a deeply progressive country edging toward full legal and tax clarity for cryptocurrencies.

The Outliers

There is a certain congruence to the idea that where economic freedoms are respected, new innovations, particularly those that potentially threaten the existing monetary order, are also welcome.

If we are to draw parallels between crypto-friendliness and degrees of economic freedom, the two major outliers in the index are Malta and Japan. Malta ranked 41st as a “moderately free” country, with little change from 2018’s index. The Mediterranean archipelago is often referred to “Blockchain Island” for its crypto-friendly regulations.

Japan came in 30th, in the “mostly free” category. Japan has always been a substantial driver of crypto’s growth, and was also home to Mt. Gox, the first major exchange. Japan has always been considered one of the easiest countries in which to spend crypto. The Japanese government was the first to define virtual currencies by law, which it did in an April 1st amendment to the Payment Services Act of Japan (PSA).

David Otto, International Media Coordinator at the Japan Blockchain Conference explains:

The Bad Guys

According to Coin Dance, bitcoin (and by extension, presumably all digital assets) is illegal in Afghanistan, Algeria, Bangladesh, Bolivia, Pakistan, Macedonia, Saudi Arabia, and Vietnam. (It is important to bear in mind that FATF pressure on Pakistan recently forced the Khan government to recognize cryptocurrency).

The Heritage Foundation ranks almost all of these countries from “mostly unfree” or “repressed,” with only two scoring higher. The Republic of Macedonia is the freest ranked among them, at 33rd in the world.

Where bitcoin is restricted, in American Samoa, China, Egypt, India, Indonesia, Morocco, Nepal, Qatar, and Zambia, the freest country is Qatar, ranked “mostly free” at 28th in the world. Indonesia is a distant second at 56. China, once bitcoin’s most fertile playground, has clamped down notoriously on the entire sector. It comes in as the 100th economically freest country in the world – mostly unfree.

What Do We Make of All This?

It is not too much of a stretch to suggest that openness to change and innovation, even at the risk of relinquishing control, indicates a spirit of economic freedom that would lead to the acceptance of cryptocurrency. Despite the exceptions to the rule in Japan, Malta, Qatar, and Macedonia, The Heritage Foundation’s rankings suggest a strong correlation between crypto legality and economic freedom.

Some may argue the data merely points to a developed country/developing country divide. However, the status of “illegal” and “restricted” as outlined by Coin Dance identify countries where legislative actions have been taken to classify bitcoin. There are a number of nations where crypto lacks a legal status at all. In those jurisdictions, bitcoin is classified as “alegal.”

Most telling in all this is that three of the four primary virtual currency hubs in the world are among the tiny number of countries measured as economically free. That should both hearten and reassure crypto fans that they’re on the right side of history.

Share this article