Shutterstock cover by WHYFRAME

Crypto Trading Strategy: How to Use Funding Rates to Buy the Dip

One little-known strategy can help investors gain an edge when trading cryptocurrencies.

The cryptocurrency market has entered a new bullish cycle. Following the Black Thursday crash in March 2020, more than $900 billion have flooded the industry. Some of that money has also been following a key crypto trading strategy.

The massive capital influx has been fueled primarily by the havoc that COVID caused on the global economy. And as institutional investors try to hedge against inflation, this new asset class emerged as an alternative to the traditional financial system.

Still, rushing into this booming market isn’t without serious risk. Regardless of current bullish conditions, timing exhaustion points for various tokens is a critical skill.

By anticipating the ideal moment to sell the top and buy the dip, crypto investors and traders can maximize their profits while reducing the risks.

Selling the Top, Buying the Dip

According to Alex Krüger, a renowned technical analyst, timing execution in a bull market can be easy when employing the right strategy. One such strategy gaining traction among traders is looking at perpetual swaps’ funding rates.

As a rule of thumb, favorable funding rates indicate that market speculators are growing optimistic as long traders pay short traders’ funding. Conversely, negative funding rates suggest that investors are leaning bearish and short traders pay funding to long traders.

Krüger maintains that funding rates of 0.1% or higher every eight hours are “unsustainable.” When this happens, market participants have entered a state of euphoria, leading to steep corrections.

He advises investors to take partial profits or refrain from opening long positions when funding rates are high due to this signal’s strength in identifying a local top.

However, when perpetual swaps’ funding rates hover around 0.01% or lower every eight hours, it can be considered a positive sign. Krüger believes that investors must employ technical analysis alongside flat to negative funding rates to buy the dip.

“When perpetuals’ funding is flat to negative (negative is best) and/or perpetuals-spot basis is negative, one has a green light for buying. Stagger orders if unsure about the level,” said Krüger.

Applying Key Crypto Trading Strategy

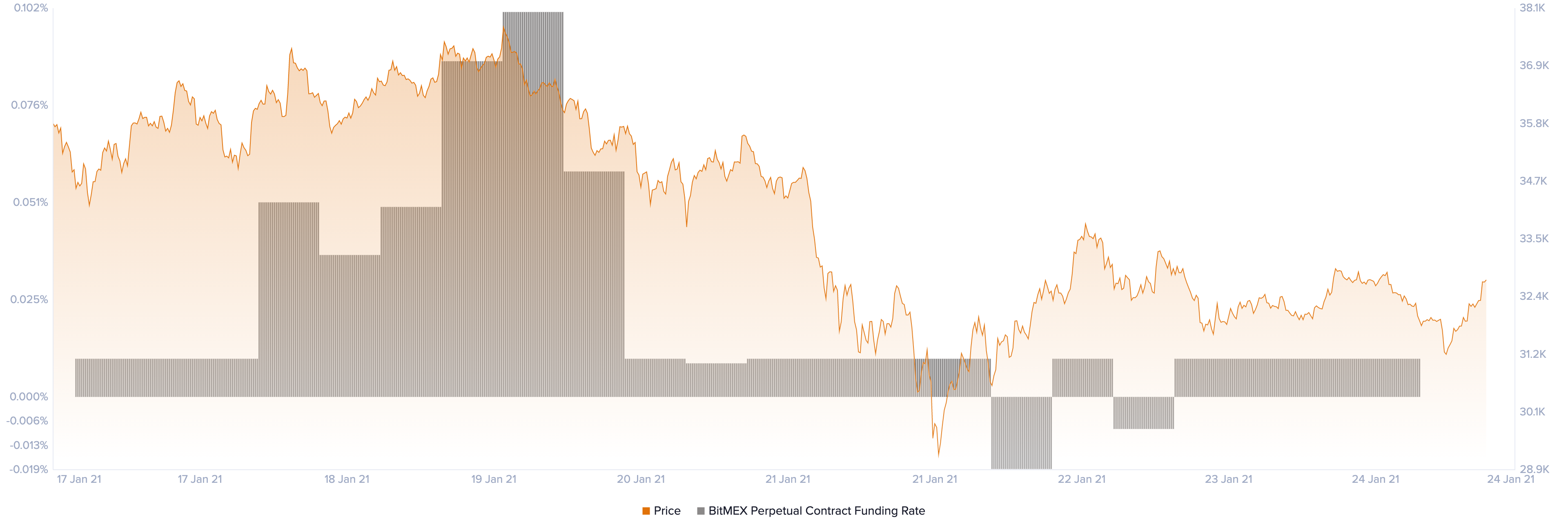

When looking at Bitcoin perpetual swaps’ funding rates over the past week, Krüger’s thesis holds.

On Jan. 19, BTC was trading at a high of nearly $38,000 when its funding rate on BitMEX peaked at a high of 0.102%. Since long traders were funding short traders, a sell signal developed.

What came next was a 24% correction that pushed Bitcoin’s market value below $29,000.

Following the massive bearish impulse, Bitcoin perpetual swaps’ funding rate on BitMEX dropped to -0.019%. As short traders were funding long traders, the market was signaling that it was time to buy the dip.

Subsequently, BTC’s price rebounded by more than 17% towards the $34,000 mark.

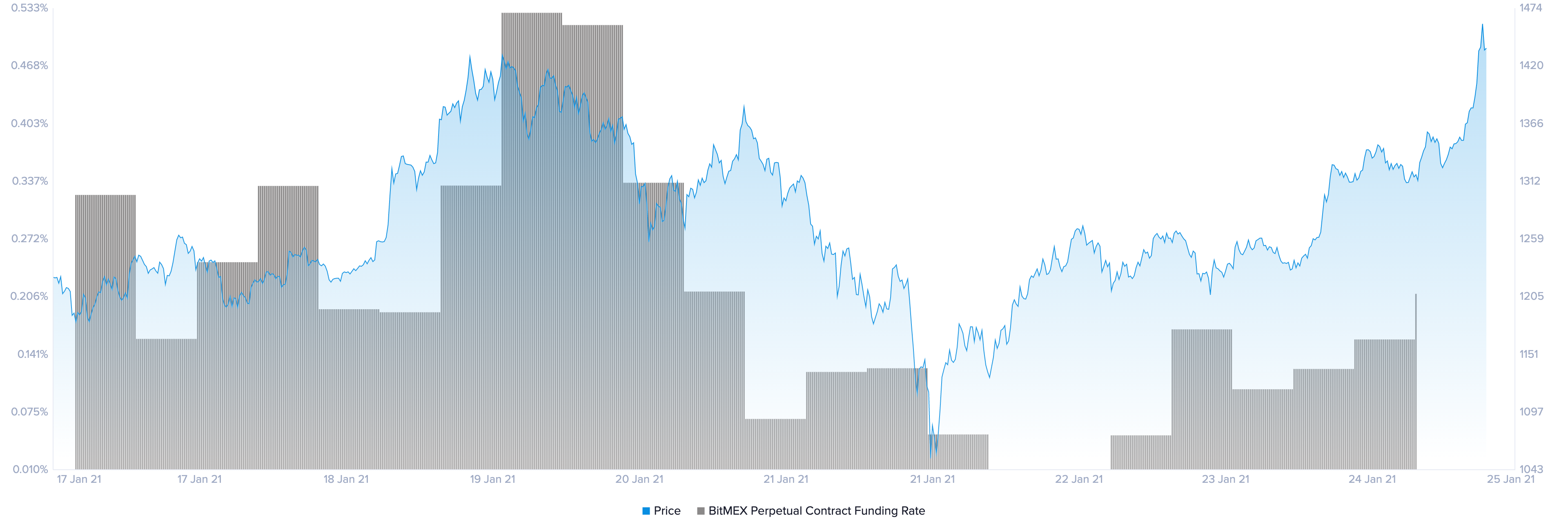

Ethereum appears to have had a similar price reaction to its perpetual swaps’ funding rate over the past week.

After Ether’s price rose to a new all-time high of over $1,440 on Jan. 19, its funding rate on BitMEX skyrocketed to 0.53%. Such an elevated rate was a concerning sign for those trading this altcoin since it suggested a high probability of a market top.

Indeed, ETH reached exhaustion in its uptrend and quickly lost over $400 in market value.

It was not until Jan. 22 that Ethereum’s funding rate on BitMEX dropped to 0.01%, indicating that it was time to buy the dip.

Sidelined investors who could take advantage of the bullish signal to reenter the market could have profited thanks to this strategy. Since then, Ether’s market value has risen by more than 33% to make a new all-time high of $1,480.

Cryptocurrencies to Watch

Digital assets analytics firm ViewBase provides a free-to-use tool for traders to use this crypto trading strategy of the top 60 cryptocurrencies by market capitalization across multiple futures exchanges.

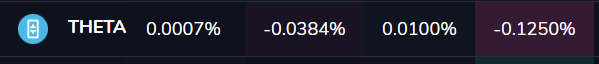

Based on the data collected from this platform, Theta Network (THETA) could be presenting an opportunity for investors to buy the dip since its funding rate is currently negative across the board. For instance, THETA’s funding rate is hovering at -0.0007% on Binance, -0.0384 on FTX, and -0.0100% on OKEx. On Huobi, it sits at roughly -0.125%.

If this crypto trading strategy proves right, then THETA could be preparing to break out of a symmetrical triangle where its price has been contained over the past month.

By slicing through the pattern’s upper trendline, the odds will drastically increase for a neat 42% upswing towards $3.00.

This target is determined by measuring the distance of the symmetrical triangle’s widest range and adding it to the breakout point.

It is worth noting that a spike in sell orders that pushes Theta below the triangle’s lower trendline will jeopardize the bullish outlook. Falling through the $1.70 support level could be catastrophic for this altcoin as it will likely lead to a downswing to $1.00.

Disclosure: At the time of writing, this author held Bitcoin and Ethereum.

Earn with Nexo

Earn with Nexo