Culprit Behind Ethereum Congestion? Forsage Ponzi Scheme, Not DeFi

The popular opinion is that DeFi congests Ethereum, but the data shows that a Ponzi scheme is responsible.

Key Takeaways

- Transaction and gas costs on Ethereum have surged in 2020

- While the increase in Gas costs coincided with the DeFi craze, data shows that the sector is not the primary reason behind Ethereum’s clogged network

- The Ethereum-based Ponzi scheme Forsage drives transaction fees up because of its expensive registration procedure

Share this article

This year has become the year of DeFi. While the top Layer 1 blockchains compete for uses in the niche, Ethereum remains the king. The surge in daily active addresses and transaction fees on Ethereum suggests that DeFi is pushing the network to its limits.

While the network’s congestion brings Ethereum’s years-old scalability problem back to the table, the excessive demand for DeFi is favorable for the ecosystem development. Now, new data shows that contrary to popular belief, DeFi is not the major reason behind Ethereum’s clogged network.

Meet the Forsage Ponzi

On its website, Forsage positions itself as an “international crowdfunding” platform. However, it doesn’t showcase any projects that try to raise funds. Instead, users see how much partners can earn along with referral tiers.

A look at the project’s team information raises another red flag. There are no founders or team members, just two lines saying that Forsage “belongs to the community.”

The project’s videos promising daily payouts in ETH evoke memories of BitConnect. Albeit, without the infamous Carlos Matos, they are much less entertaining. In other words, Forsage is almost surely a Ponzi scheme. While a crypto Ponzi is nothing new, Forsage played a crucial role in distorting the organic dApp usage on Ethereum.

Recommended article: learn more about how to identify potential cryptocurrency scams.

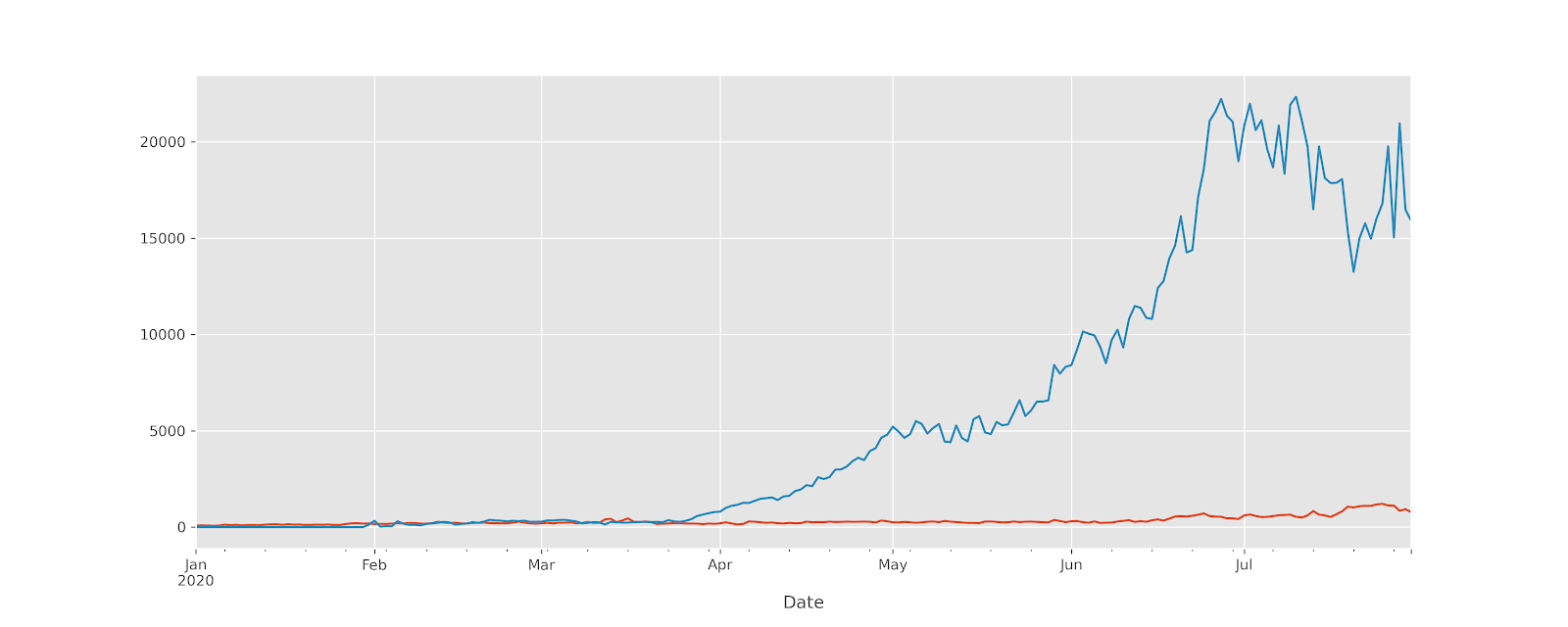

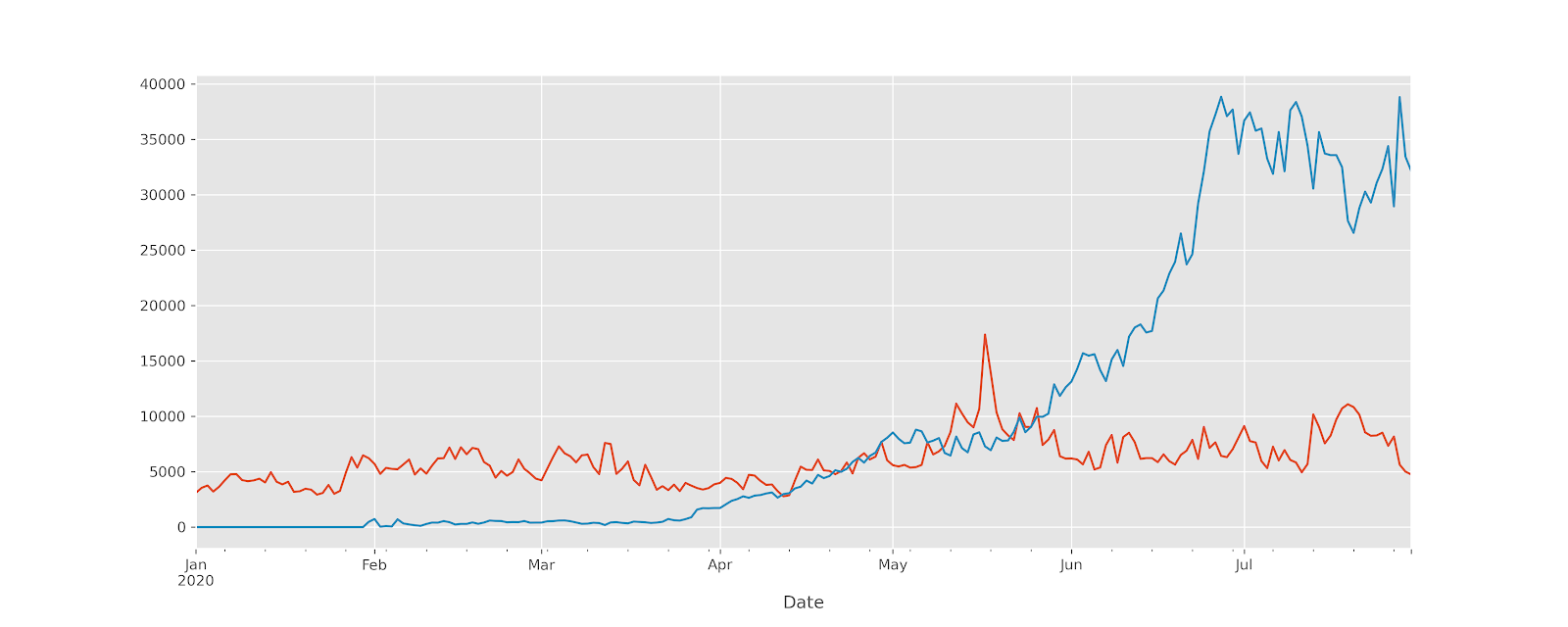

The project currently ranks first by the number of users and the number of transactions on DappRadar, leaving the closest competitors behind by a large margin. A closer look at the on-chain data reveals that calls to Forsage’s smart-contract started to pick up in Q2, 2020, and significantly outpaced top-performing decentralized exchanges (DEXes).

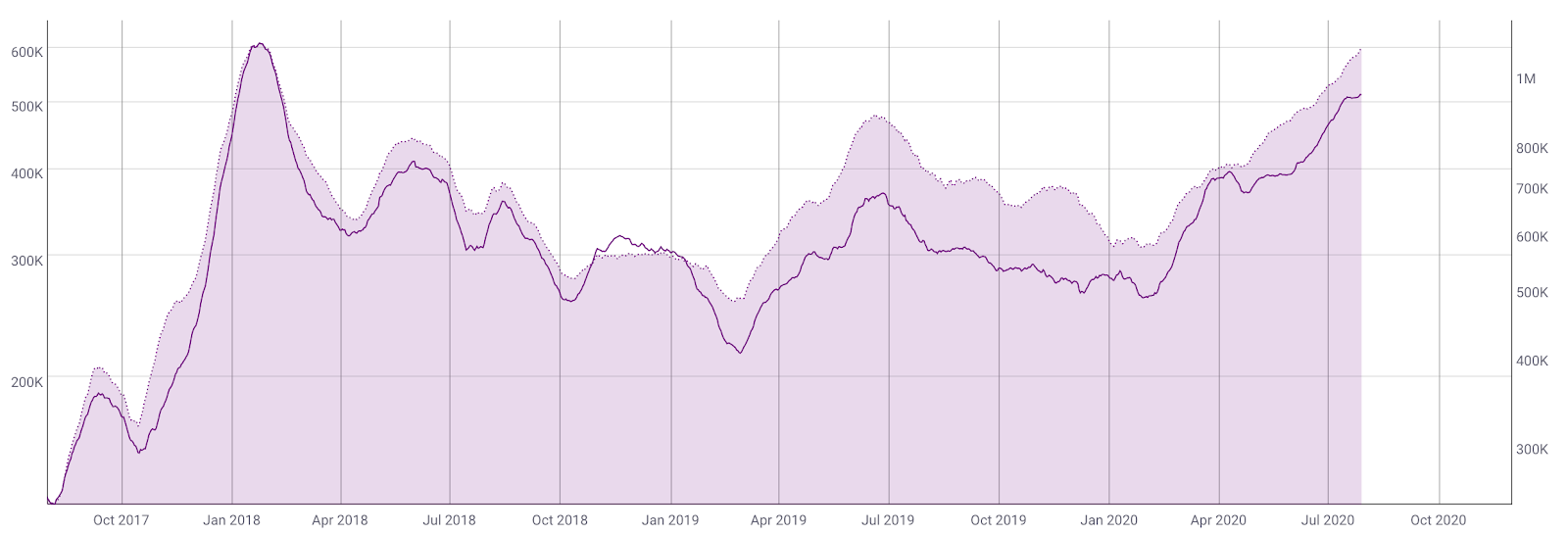

Curiously, the mean USD value of Ethereum daily transaction fees started to pick up beginning in April 2020, shortly after interactions with Forsage surged in the second half of March 2020.

How Does Forsage Clog Ethereum?

While Forsage is far from the top-performing Ethereum-based DeFi apps like Compound in terms of the processed volume, it doesn’t mean that its impact on the network is marginal.

Transaction costs on Ethereum don’t depend on the amount sent as much as they rely on the operation type. A mere transfer between two accounts costs relatively cheap even given the currently high Gas prices. On the other hand, interactions with smart-contracts require paying for computationally-intensive tasks, which involves paying more Gas than is consumed for transacting.

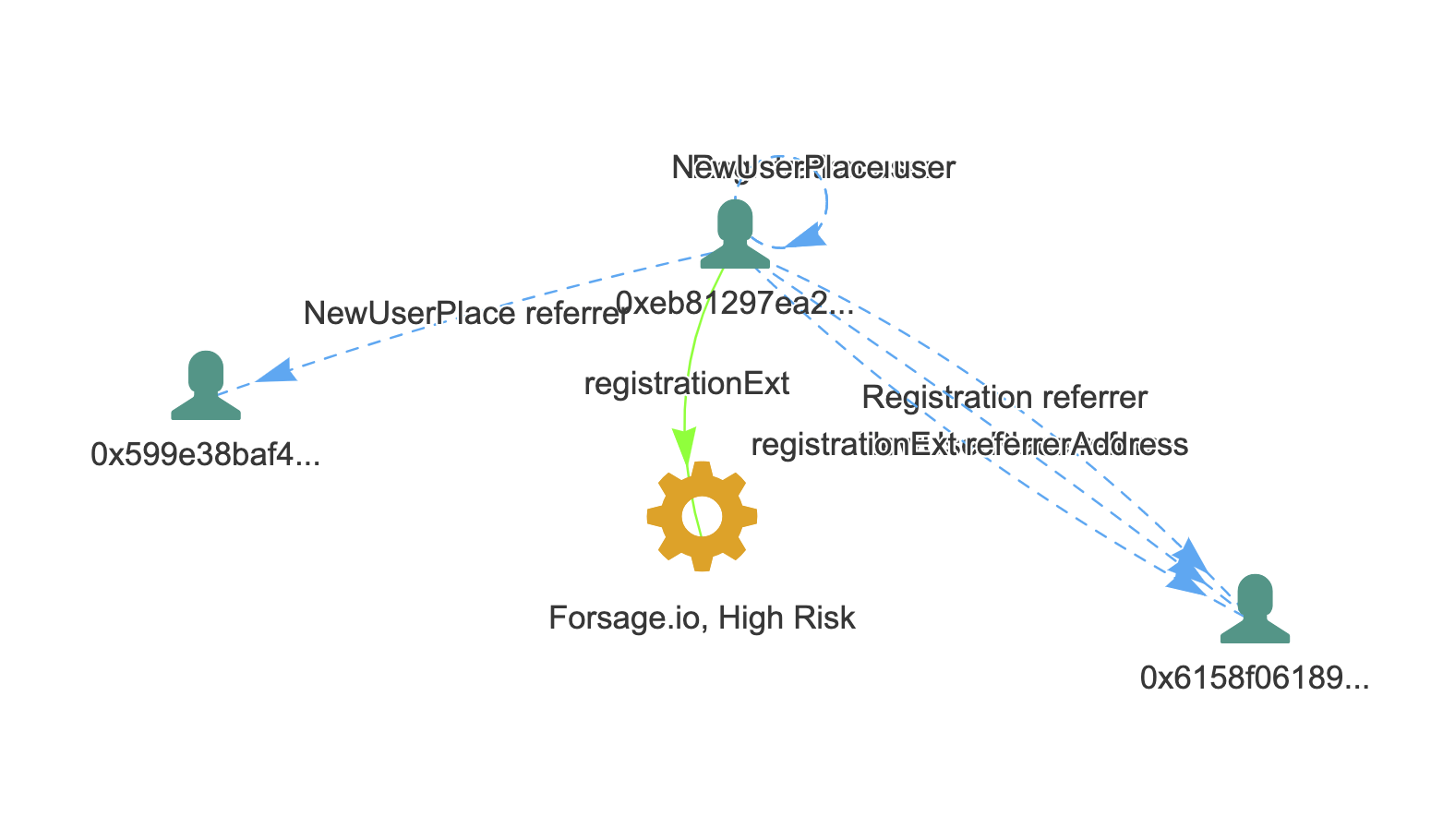

A look at Forsage’s smart-contract shows that it only has two methods that a user can call: “buyNewLevel” and “registrationExt.” While the first method consumes around 150,000 Gas units like other DeFi smart contracts, the second consumes almost four times as much.

Forsage uses a “registrationExt” contract to create new accounts for referrals. Hence, the more people the scheme attracts, the more computationally-intensive transactions will be processed on the network, contributing to further congestion.

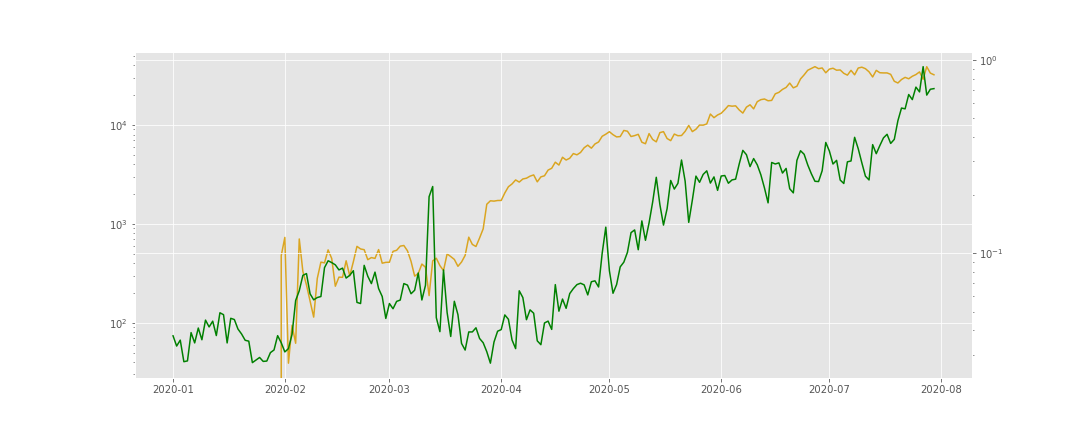

Meanwhile, the interest in Forsage is on the rise, as evidenced by the increasing number of page visitors. The continuing influx of new users to the Forsage smart-contract spells trouble for ETH Gas prices down the road.

How the Ponzi Impacts Ethereum

Although there is a growing organic interest in DeFi products, data shows that they are not the primary moving force behind the jump of transaction costs on Ethereum.

Forsage doesn’t create any benefits for the network, yet it consumes a significant chunk of its resources. This dynamic is not healthy. It hampers DeFi growth because legitimate platforms like 1Inch and Compound become prohibitively expensive for retail users with smaller cryptocurrency holdings.

At a certain point in time, Forsage will come to an end, just like BitConnect. Until then, however, it will likely continue to clog Ethereum, hindering DeFi development.

Share this article