Free Flash Loans and Volatility Attract Traders to dYdX

dYdX has proven its worth during the latest market downturn. DEX traders may also find the feeless flash loans more appealing than the minor fee needed on Aave's platform.

Key Takeaways

- dYdX’s business model is relatively immune to market conditions when compared to other DeFi subsets.

- The protocol set record daily trading volume on ETH’s worst trading day in history.

- Feeless flash loans have helped dYdX achieve higher borrowed volume relative to Aave between February and March 2020.

Share this article

dYdX, a DeFi-native margin trading protocol, witnessed record growth as crypto markets crashed earlier this month. The platform’s business model, particularly free flash loans, gives it an edge in all market conditions, but not without its limitations.

Leveraged Trading on DeFi

dYdX has a wide moat as one of DeFi’s few margin trading protocols with leverage.

Users have the ability to take long or short positions, which gives the protocol a degree of immunity to market conditions.

When ETH’s price dropped by over 43% in a single day, DeFi was flung into a crisis-like situation. In this turmoil, several protocols like Compound and Uniswap saw their inherent respective liquidity drop by 19% and 53% in a single day.

Meanwhile, dYdX registered a drop of just 13.5%, and trading volume hit a high of nearly $50million. The protocol’s daily volume accounts for the amount of borrowed funds used by levered traders.

From January to mid-February 2020, the price of ETH jumped over 125%. During this time, dYdX went from 460 monthly active users to more than 1,500 monthly active users.

Between Mar. 1 and Mar. 3, ETH price swung between a 10% range. In these three days, dYdX saw it’s market share increase from 34.3% to 53.3%, per data from Dune Analytics.

Together, all of this builds a very compelling case for dYdX. Its margin trading facility gives it an edge against regular DEXes when the market is volatile, but it is not immune to decreases.

Chainalysis reported that almost 70% of accounts that sold Bitcoin during the Mar. 12 drop came from large speculators that were highly levered. Speculators that entered crypto during the January swings between $6,400 and $10,500 fled for cash, causing crypto markets to drop sharply.

With speculators leaving the market, dYdX has seen activity dwindle, excluding highly-volatile days. One day after setting a record daily volume, dYdX served only $16.4 million of trade activity.

Daily active users, which was 509 on Mar. 12, fell to just 216 on Mar. 23. However, a similar trend can be seen across the DEX ecosystem.

Free Flash Loans

dYdX made its way into the limelight as a lending and borrowing protocol. Before the launch of Aave, Nuo, and other such protocols, it was the sole competitor to Compound as a money market product.

In February 2020, the protocol introduced flash loan capabilities using their pool of liquidity. Flash loans, pioneered by Aave, have become an essential part of DeFi. They help arbitrageurs make money and borrowers save collateral from liquidation.

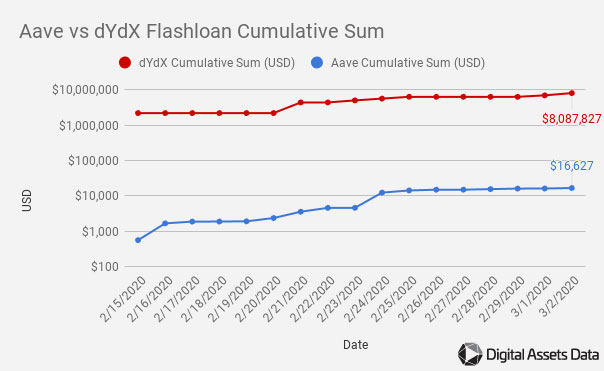

dYdX flash loans have gained traction over Aave since then, however. Between Feb. 15 and Mar. 2, the sum of flash loans borrowed was $16,627 and $8.09 million for Aave and dYdX respectively, per Digital Assets Data.

This an interesting development given Aave has higher liquidity and usage for their flash loans.

However, dYdX offers feeless flash loans, making it a much more desirable venue for those seeking larger flash loans.

At 0.09% on Aave versus 0% on dYdX, a $1,000 flash loan would pay a $9 fee on Aave and $0 on dYdX. The difference is not material, but the data suggests the $9 saving per $1,000 borrowed is enough of an incentive to shift larger borrowers to dYdX.

Overall, dYdX has cemented its place in the DeFi ecosystem, but the project has a long way before it can challenge centralized giants like BitMEX.

Share this article