How Many Satoshis Are in a Bitcoin?

A satoshi is the smallest indivisible unit of Bitcoin, representing its 100 millionth part.

Key Takeaways

- The denomination received limited attention until Bitcoin’s price began rising and it became clear that it could be used to facilitate micropayments.

- A community-led effort to create a sign for the satoshi began last year, fueled by the belief that the sign could be to crypto what the “@” sign was to the internet.

- While the industry is still far from making micropayments an everyday thing, the satoshi will be the key piece that helps make that a reality

Share this article

The satoshi, the smallest amount of Bitcoin, is more than just a unit of measurement.

What’s a Satoshi?

What began as a cypherpunk niche has now become a global phenomenon that’s set to disrupt the financial industry.

However, despite their growing influence, cryptocurrencies, in general, are still far from mainstream.

Bitcoin managed to become more of a household name thanks to its presence in the media and mooning price. However, the general public still lacks an understanding of what makes Bitcoin valuable.

One underrated aspect of Bitcoin is the satoshi, the smallest denomination in BTC.

Named after Satoshi Nakamoto, the anonymous creator of Bitcoin, the satoshi is BTC’s smallest indivisible unit. It represents one 100 millionth of a Bitcoin.

While it’s by far the most important aspect of Bitcoin, which we’ll address later, it isn’t its only denomination. Bitcoin has a multi-level hierarchical structure—it has 1,000 millibitcoins (mBTC), 1,000,000 microbitcoins (μBTC), and 100,000,000 satoshis (SAT).

Satoshi Nakamoto himself set the existence of satoshis as a unit. By deciding that the value of a single Bitcoin could be divided into 100 million parts, regardless of the price of Bitcoin, it would still be practical to use as a medium of exchange.

However, it wasn’t until 2010 that the then relatively small Bitcoin community began discussing potential names for the coin’s smaller denominations.

It was initially proposed that the one-hundredth of a Bitcoin, or 0.01 BTC, be called a satoshi.

After a few months of deliberation, the term satoshi caught on and was widely adopted by the community instead to mean the one 100 millionth part of a Bitcoin.

In Bitcoin’s early days, when it’s market cap was well below $2 billion, satoshis as a unit of currency received relatively little attention. With Bitcoin’s price still minuscule at the time, few of its holders were concerned with dividing it into such small units.

The Rising Importance of Satoshi

As Bitcoin rose in popularity and expand its influence beyond its small niche, the importance of satoshis increased proportionally.

The conversation around Bitcoin’s real-world utility became more prominent both in and out of the crypto industry. Still, the question of how to facilitate transactions with an abstract, decentralized, and complex coin remained.

Why would people want to invest in a coin that’s been notoriously hard to scale, highly volatile, and only accepted by a relatively small set of merchants around the world?

The answer to this comes down to Bitcoin’s smallest indivisible part—the satoshi.

If the satoshi became a more widespread denomination for Bitcoin, it would bring micropayments closer to a wider array of people. Take a cup of coffee, for example—a $5 takeaway would cost 0.00053 BTC at the time of price. The small amounts and multiple decimal points are challenging to keep track of.

If the same cup of coffee cost instead 53,000 satoshis or sats, it would make it easier to understand.

Many believe that the higher denomination would not only make it easier to comprehend but also easier to spend. Bringing the importance of the satoshi to the fore is also a critical portion of a newcomer’s education. Sam Blackmore, the CEO and founder of Vimba, an auto BTC investing service, told Crypto Briefing:

“While there is clearly a need in the bitcoin community in terms of educating the public about Bitcoin, an industry-wide switch to satoshis as bitcoin’s value measurement may make sense – provided new users are being adequately informed about what the difference between one bitcoin and one satoshi is. At Vimba, we show the value of our users’ bitcoin holdings in mBTC.”

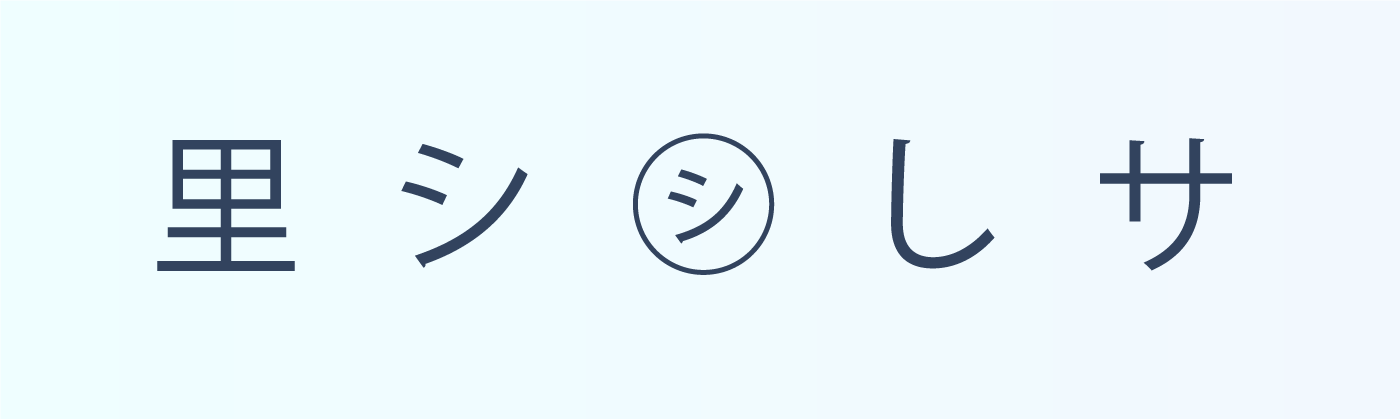

This was the idea behind the mass movement that arose last summer, advocating for the creation of a symbol for the satoshi. The campaign centered around the belief that if the symbol for Bitcoin’s smallest denomination was modeled after the “@” sign, it could change the way people transact and use Bitcoin in general.

Hundreds of people joined the discussion around the design of the sign, much like they did when the design for the Bitcoin logo was first discussed on the BitcoinTalk forum back in 2010.

While the designs varied, almost everyone agreed that just like the “@” sign simplified and sped up internet communication, the satoshi sign would change the way Bitcoin is transferred.

While there is not yet a consensus on the satoshi symbol, the movement generated a lot of press and brought some much-needed attention to the smallest unit of Bitcoin.

Bitcoin has been the best performing asset of the last decade, with its price appreciating millions of percent from 2009.

If one BTC was the lowest unit of Bitcoin, then most of the daily goods would today cost in decimals. $100 today is 0.0107 BTC, for example. Our society is not familiar with dealing with the entire currency in decimals.

Bitcoin’s deflationary model not only limits the total number of Bitcoins, which can be mined to 21 million but also ensured that miner rewards are cut periodically to make Bitcoin more scarce.

Even if the entire wealth of the world gets converted in Bitcoin, which is currently $360 trillion, with a fixed supply of 21 million, one Bitcoin will be priced at nearly $17 million. One satoshi at that price would be equivalent to 17 cents.

Today, one satoshi is worth a meager $0.0000928881. It is from this reasoning that the idea of “stacking sats” has gained so much popularity.

This idea follows the premise that cryptocurrencies are still very early. And though it may not seem like much today, any satoshis that users can gather via working for Bitcoin, earning interest, or otherwise is still very valuable. It is also from this idea that dollar-cost averaging (DCA) services by the likes of Coinbase and its competitors have popped up.

DCA services are helpful because they remove much of the emotion that comes with investing in cryptocurrencies. Users can set a recurring time at which point Bitcoin is bought. This could be a small amount every day, bi-weekly, or twice a month. It also offers a steady, cost-efficient entry into the Bitcoin space. Blackmore added:

“Dollar-cost averaging bitcoin enables you to grow your BTC stack over time even if you only have little investable capital available. It alleviates the arduous task of trying to buy the dip every time the price drops and gets you in the habit of stacking sats regularly no matter what. Moreover, if you use an auto-DCA service like Vimba, you can set-it-and-forget-it, and stack sats automatically. So for anyone who believes in the future of bitcoin, dollar-cost averaging simply makes sense.”

Whether it’s adding a convenient symbol or creating easy-to-use onramps to crypto, there is still much work to be done in this field. One mustn’t forget that the technology that would facilitate the micropayments is also still lagging.

However, the satoshi symbol and its growing popularity are incredibly important steps that will help fast-payment channels like Lightning Lab’s Lightning Network and Blockstream’s Liquid turn their ambitious models into an every-day reality.

Share this article