How This Millionaire Economist Trades Crypto Prediction Markets

Prediction markets allow users to bet on political and real-world events, and often to swing-trade shares in the likelihood of these events taking place.

Key Takeaways

- Crypto Briefing privately confirmed this trader's account holdings and betting activity before conducting the interview.

- The trader has a Ph.D. in economics, working as a lecturer and an options trader as well as researching events markets.

- The methodology in events betting requries heavy research, discussion, and often the creation of models and charted data to make an informed decision.

Share this article

An anonymous trader with a Ph.D. in economics walked Crypto Briefing through the risks and methodology of being a big player in the crypto prediction markets.

How to Predict the Future

Insight_Predict, henceforth referred to as IP, is a seasoned options trader who became active on the PredictIt and BetMoose betting platforms years ago, recently moving into the Polymarket crypto prediction platform. They now have over half of their net worth on these prediction markets.

Turns out yesterday was a good day to take profits on my calls. Here's a sampling of the profits I booked yesterday. The biggest profits were on Exxon-Mobil calls. I am basically treading water on BP calls, but wanted to lighten my load and reduce risk. https://t.co/wdVqx7pNM5 pic.twitter.com/WUnt2d8DHV

— Insight Prediction (@Insight_Predict) February 17, 2021

IP explained the logic behind the move towards crypto sites, saying, “I think peer-to-peer betting markets are a great innovation relative to the old-fashioned ‘betting against the house’ [system].”

Centralized platforms are notorious for issuing low betting limits and often banning or limiting successful users to ensure profits.

However, sites like Polymarket don’t have risk management features like setting a stop loss. This particular trader embraces these risks but backs up bets with extensive research.

“I place extremely high-risk wagers both when I’m trading options, and when I’m trading on Polymarket generally.”

The trader added that they also placed low-risk bets on Biden to be inaugurated, with a 9% return and President Trump not to become President after losing the election.

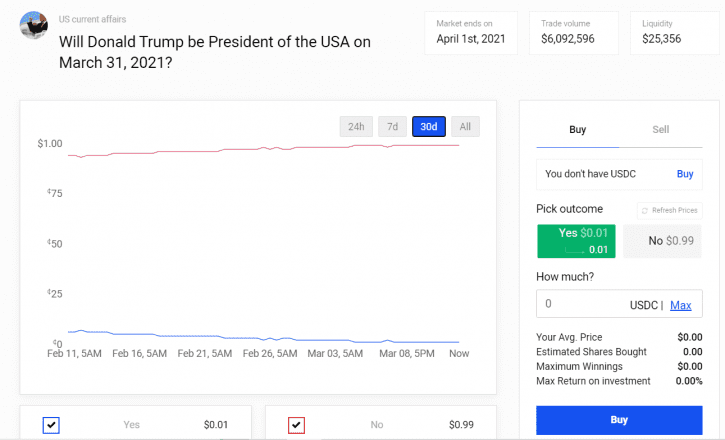

Curiously, as of March 2021, traders can still bet that Donald Trump will become president of the USA by the end of the month.

The odds are now so low that Polymarket’s 2% fees would outweigh the 1% gain. Still, traders could have made 7% minus fees as recently as February, highlighting the difference between the “house always wins” platforms and less centralized crypto markets.

Research Methods

Research and risk management consists of reading about and discussing the topic online, including discord servers for each betting site. IP also sets Google Alerts for relevant market topics.

“Thus far this year, I’ve made more money on Polymarket than in my salaried day job, and I’m not doing it full time, which hurts my performance. Doing well on Poly generally requires staying on top of the news and doing research.”

The research is, of course, crucial to long-term success. One popular prediction market is now taking bets on whether the Biden administration will vaccinate 100 million people before Apr. 1.

Traders keep an eye on CDC cutoff times for vaccine reporting each day and calculate the moving average of vaccinations to predict results.

“For the vaccine markets, for example, it’s helpful to really dive into the data. I’ve run some regressions using the vaccine data but it’s mostly just looking at the trends in the data and in taking a big-picture perspective.”

It turns out that the number of vaccines administered has a pretty close relationship with the number of unused vaccines distributed. This suggests that should the # of vaccines increase the next few weeks, doses should rise roughly in proportion. pic.twitter.com/n1UBOFz28Q

— Insight Prediction (@Insight_Predict) March 9, 2021

Some Polymarket traders have programmed and released their own models to forecast trends in the vaccination rollout.

I have a model at https://t.co/VZoPABtf2C that predicts how many 2nd doses will be needed based on month-ago first doses, and therefore how many will be left for first doses. pic.twitter.com/1nbY7zsSXk

— Scott Leibrand (@scottleibrand) March 7, 2021

Shortcomings of Prediction Markets

The lack of risk management features makes it imperative that traders rely on automated alerts and constant vigilance for such volatile markets. These prediction markets are still in their infancy in relative terms, with limited features and events to bet on.

The underlying technology also comes with drawbacks as well as benefits. Polymarket and major competitor Augur have both been affected by ongoing congestion on the Ethereum network.

Polymarket actually runs on Polygon, an Ethereum sidechain. However, deposits and withdrawals of USDC, the only supported currency, have been slow and expensive of late due to high Ethereum traffic and fees. This issue is widespread throughout Ethereum and the DeFi ecosystem.

IP aims to tackle these issues by launching a new predictions market in the coming year, allowing users to buy and sell crypto directly, among other features.

The space will likely see the launch of increasingly sophisticated platforms and features. With so much demand and money on the line, truth-seekers and market researchers should keep a close eye.

Disclosure: The author held Bitcoin at the time of writing

Share this article