Shutterstock cover by BrandonKleinPhoto

Long Bitcoin, Short Dollar Trades “Most Crowded,” Says Bank of America Survey

Fund managers with Bank of America have expressed bullish sentiment towards Bitcoin.

A survey of investment managers with over $500 million under management shows the majority are bullish on Bitcoin and stocks but expect the dollar to succumb to inflationary pressures.

A Bitcoin, Risk-On Investment Environment

The result of the fund manager’s survey revealed that investors are highly optimistic about the recovery in the global economy, despite rising COVID-19 numbers.

The percentage of fund managers that expect positive tidings in the stock market is the highest in 11 years.

Further, Bitcoin has beaten technology stocks, which held the top spot since October 2020, in long order interest, making BTC the most crowded trade. More than 92% of the investors who took part in the survey expect inflation to run high; hence, they have crowded short-dollar orders.

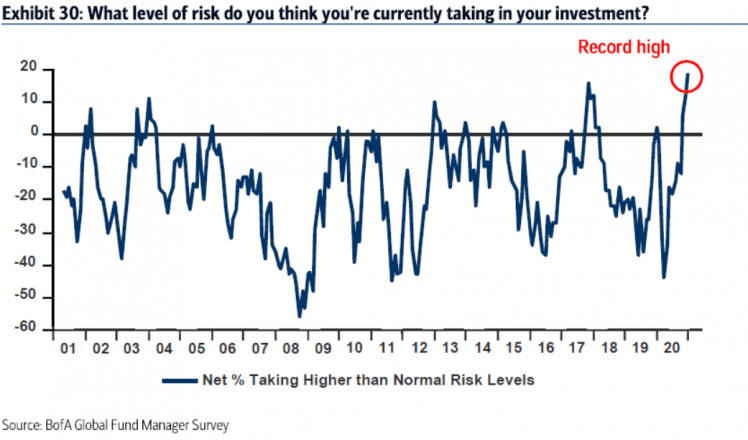

The risk appetite of investments is at record high levels, converging towards stocks and Bitcoin.

The biggest scares for the markets are the slow rollout of vaccines (30% of participants), less fiscal and monetary stimulus (29%), and a blowout of the Wall Street bubble (18%).

Leading hedge fund managers and economists globally are concerned about the forthcoming inflation in the U.S. dollar. Bitcoin is slowly emerging as a resilient alternative.

Disclosure: This author held Bitcoin at the time of publication.

Earn with Nexo

Earn with Nexo