Ripple Is Becoming a Dumping Ground for Bitcoin Spam Transactions

There has been a spike of BTC issuance and transactions on Ripple blockchain. However, it appears to be a hoax.

Key Takeaways

- Despite its high transaction speed and low fees, Ripple is not favored as a Layer 2 for BTC.

- A significant percentage of the daily payments on Ripple is spam, highlighting the extent of low activity on the network.

- Lack of smart-contracts reduces Ripple’s transparency and bars it from participating in the DeFi and the stablecoin sectors.

Share this article

As Ethereum attracts more and more precious Bitcoin into its network, Ripple is attempting something quite similar. The results, however, appear far from convincing.

Everyone Wants a Piece of Bitcoin

Bitcoin has the largest market cap, along with the dominance of over 60% on the crypto market. Moreover, it is reported to be the most recognized brand in the space. Any project interoperable with Bitcoin has a chance to draw a substantial portion of the market’s attention.

So far, Ethereum has enjoyed the most interoperability with Bitcoin.

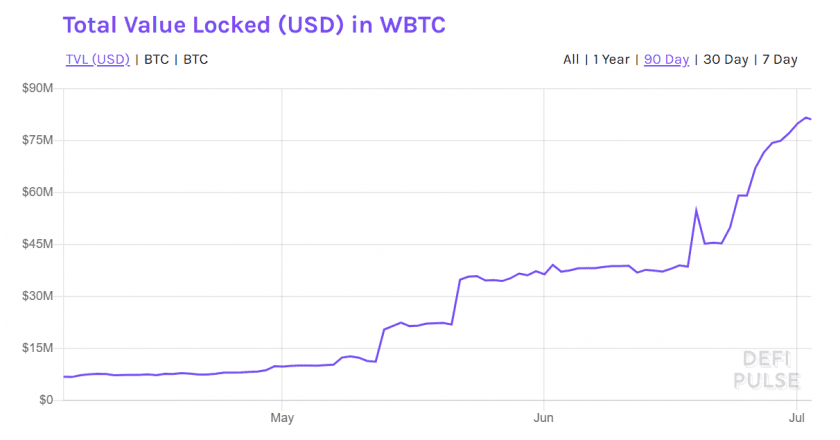

With apps like Compound, Bitcoin hodlers can enter the growing field of decentralized finance (DeFi) and earn passive income on their idle coins. This opportunity drove significant traffic to the platform, specifically to wrapped Bitcoin (WBTC).

WBTC is a pegged token, meaning that for each token held by a custodian, there is one ERC-20 token minted on Ethereum. Now it looks like the XRP Ledger is attempting a similar initiative.

While Ripple can’t extend Bitcoin’s computational capabilities, it can increase Bitcoin’s speed and reduce transaction fees.

Cheapness and speed of transacting can make pegged Bitcoin on the XRP Ledger useful for arbitrage, with traders driving on-chain activity. An influx of minted BTC on Ripple, with some accounts holding hundreds of thousands of tokens, points to a potential surge in demand.

Unlike Ethereum, however, the XRP Ledger won’t be able to ride the decentralized finance wave because of its limitations.

Trusted Setups in a Trustless World

Like WBTC, Ripple utilizes trusted token arrangements to mint pegged tokens. These custodians on the Ripple network are called “gateways.”

There are a handful of these reputable gateways. Given their BTC capitalization dynamics, it’s obvious that they didn’t issue any significant quantities of BTC lately. Moreover, BTC trading volumes remain dismal.

Unlike WBTC, which only has one custodian, BitGo, Ripple can have an unlimited number of gateways.

Technically, any account can act as a gateway and issue non-XRP tokens like BTC, ETH, and USD. Ultimately, it is up to users to decide which gateways they trust.

There is no ceiling on how many tokens an account can issue; the only limitation is the number of tokens other users want to hold. Moreover, an issuer can block issued tokens from being transacted by the broader Ripple community.

As a consequence, one can issue tokens without actually holding BTC and transfer them between accounts.

A reputable gateway has numerous connections to other accounts because they are actively used. A fraudulent one is likely to have much fewer connections. In the example below, the amount of BTC on an account connected with just three others topped 30,000 BTC.

Another suspicious factor is frequent transactions of similar amounts coming in and out between the same accounts.

Ripple is flooded with these kinds of spam transactions.

According to the on-chain data analyzed by Crypto Briefing, there are more than ten addresses constantly generating large pegged BTC payments between each other.

A cumulative number of daily payments for just three of them exceeds 9,000, more than 1% of the network’s current daily transactions.

Importantly, these addresses use trust lines that are not controlled by any means. Hence, the pegged BTC issued for them is not necessarily backed by real bitcoins. As a consequence, this activity does not represent genuine interest in Ripple from the Bitcoin community.

The Real State of Affairs

While Ripple’s pegged BTC numbers are inflated by spam, the real on-chain activity is also disappointing. For instance, daily transactions declined more than three times from the levels seen at the beginning of 2020.

A similar, but worse situation is observed with payments that declined from millions in 2019-2020 to tens of thousands.

Meanwhile, Ethereum’s daily transaction volume is on the rise due to the growing popularity of DeFi. Besides, more USDT are minted in response to the market’s demand.

Unlike Ethereum and Tether, Ripple struggles to find its use in the current market circumstances.

Why Not Ripple?

Since the first altcoin appeared, the game was always to offer a better alternative to Bitcoin. And, providing a better option was easier before the market became saturated with thousands of altcoins.

Now, the fixation on the transactions per second race is coming to an end with the release of Ethereum 2.0. It’s no longer compelling enough to be a faster version of Bitcoin.

Ripple has the potential to improve its market position with a smart-contract layer called Flare.

Flare is focused on bringing XRP Ledger to the dApp space; it’s currently in the testnet stage. Though, for now, its weakness is showing.

Speculation alone cannot buoy XRP’s price. Combined with sell-side pressure from the Ripple corporation and other insiders, the price will continue to decline until it can regain legitimate footing in the market.

Right now, traders are loading up on more conservative portfolios comprised of Bitcoin and stablecoins to hedge against the crypto market’s recent correlation with the stock market. Hot trends like DeFi are the exception to the norm, providing outsized returns.

Unfortunately for XRP, it’s tech can’t offer much to capitalize on either of these trends.

Share this article