Why Crypto Dad Wants to Digitize the Greenback

Crypto Dad sees a need for a CBDC.

Share this article

Crypto Dad wants to digitize the greenback. His new venture, the Digital Dollar Project, is a foundation set up to advocate for a U.S. central bank digital currency (CBDC). But is it necessary?

What Libra Did

Interest in CBDCs has been growing since Facebook threatened to undermine the international monetary order with the creation of its highly centralized, corporate-dominated stablecoin, Libra.

Libra faced immediate backlash from governments and the cryptocurrency industry alike.

While Congress was grilling Zuckerberg in the U.S., France and Germany spared little time banning the currency. The speed with which governments poured cold water on the project suggested the crypto industry’s suspicions were warranted.

Crypto communities were opposed because they saw Libra as antonymous to everything they’d spent a decade building in the push for decentralized currencies and money for the internet. It was feared Libra would do little more than attract the ire of regulators.

Soon, the Libra Association, a not-for-profit conglomerate of various companies supporting the project, began to crumble amid high-profile departures.

In the latest, the Association formed a five-member “Technical Steering Committee” to oversee development and design. Except for this, the project has yet to announce any further progress.

Despite the controversial entry into crypto, Libra did draw the general public and central banks’ attention to cryptocurrencies.

The Argument for CBDCs

While there had been discussions surrounding CBDCs before, central banks only began genuinely exploring them when a major U.S. corporation threatened to effectively make a private version of one.

An EU draft document of late last year suggested that:

“The ECB and other EU central banks could usefully explore the opportunities as well as challenges of issuing central bank digital currencies including by considering concrete steps to this effect.”

China is also reportedly on the verge of launching a digital yuan, although it has been set to do so for quite some time.

Back in the U.S., Former CFTC Commissioner J. Christopher Giancarlo, affectionately known as “Crypto Dad” for his progressive stance toward blockchain technology and crypto, thinks it is time to “future-proof the greenback.”

A Digital Dollar with Three Use Cases

On Jan. 16, Giancarlo announced the launch of the Digital Dollar Project. The think tank will advocate for a digitized U.S. dollar in partnership with Accenture. He followed up the initial announcement with his thoughts on what such a dollar would look like.

With a lack of innovation in central banking “since the printing of bank notes during the nineteenth century,” a digital dollar would enable the Federal Reserve to “enhance scope, access, diversification and resilience in dollar payments,” reads the project’s official initiative.

Central bank money is excluded from online retail transactions, whereas bank notes can still be used at brick and mortar retailers. The declining use of cash notwithstanding, the Digital Dollar Project sees a CBDC as being able to:

“offer a new choice for digital transactions, offer instantaneous peer-to-peer payments, and provide diversification of payment rails in particular to grant greater autonomy, especially in times of heightened financial distress.”

Directly accessing digital central bank money for retail spending would render e-commerce markets more efficient for consumers.

However, the think tank still prefers a digital dollar that is distributed by commercial banks and other trusted third parties. The advocacy project does not appear to be seeking to remove banks from the retail market.

The Digital Dollar Project sees a digital greenback as democratizing the wholesale payments architecture that is currently the domain of inter-bank clearance mechanisms. That would open up access to large value transactions, which it considers important to “support the emergence of digital financial market infrastructures.”

Securities and other big-ticket value transfers would no longer be the sole domain of intermediary institutions.

While a U.S. CBDC could afford the central bank improved monetary policies and provide greater stability for the wider domestic economy, Giancarlo seems to have his sights set on the international arena.

The Dominance of the US Dollar

Crypto Dad appears most concerned with the falling dominance of the U.S. dollar on the global stage, as well as the threat the Chinese yuan poses as a potential rival reserve currency.

Despite central banks around the world holding three-fifths of their reserves in USD, Giancarlo’s project is keenly aware of the “incentives, geopolitical pressures, and even generational preferences to replace the dollar as an international payment medium,” at the same time as China appears to be seeking “renminbi internationalization […] at the expense of the dollar’s primacy.”

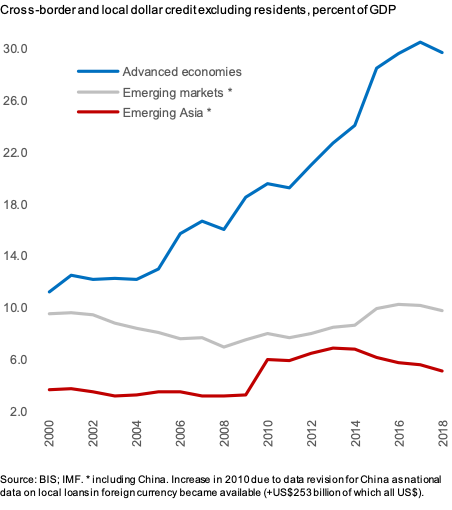

Allowing international payments to be conducted digitally in U.S. dollars would restore the greenback’s dominance. Current evidence suggests that the dollar is dropping in global liquidity, especially among emerging markets and Asia in particular.

A Threat to Banks?

Crypto Dad is not seeking to cannibalize the U.S. banking sector, which CBDCs have the potential to do by removing the need for an intermediary. Rather, his foundation is seeking to shore up support for the greenback as the default international currency.

There may be some collateral damage in the financial services sector nonetheless. The more seamless movement of U.S. dollars and better access to wholesale markets could undermine the need for domestic legacy banking infrastructure.

The Digital Dollar Projects discusses “deficiencies of the existing correspondent banking model.” In this regard, Giancarlo’s proposed CBDC threatens to remove the need for at least some of the functions of the current banking system.

Share this article