Crypto Crapfest: The Facepalms And Epic Fails Of 2018

Share this article

Developers for Bitcoin Private have acknowledged a critical bug in the currency’s algorithms, enabling an unknown hacker to award themselves about forty percent of the BTCP total supply.

You’d expect that to be the end of the currency, but the truth is it’s not even the biggest screwup in the past month. If comedy were a cryptocurrency, 2018 had a higher inflation rate than Venezuela. As the crypto market girds itself for another year, it’s an occasion to remember some of this year’s most epic fails.

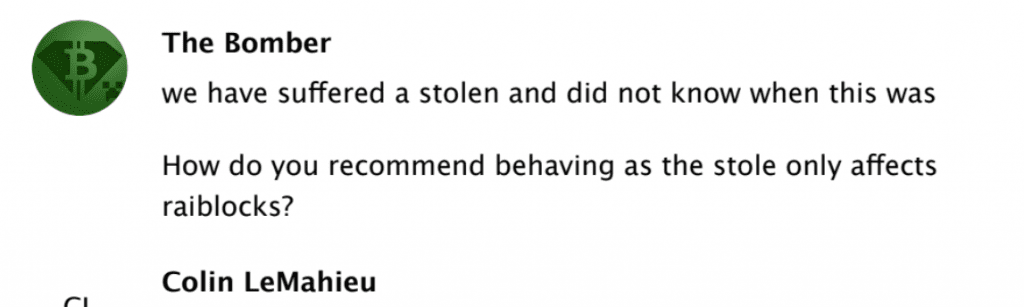

No. 4: “We have suffered a stolen.”

It’s frequently claimed that Nano is the fastest cryptocurrency, so it’s only fair that it reached 2018 before anyone else. While the rest of the market was still chasing imaginary bulls, Nano managed to soar, pop, and lose 96% of its value—all before the rest of the cryptocurrency market slept off its hangover.

The story begins in December, 2017, when the mysterious word “RaiBlocks” began appearing on Bitcoin forums. The new currency was fast, feeless, infinitely scalable—and only available on BitGrail, an Italian exchange that was apparently coded by a monkey chained to a typewriter.

Despite—or many because—of the warning signs, prices soared to an impossibly high 30$ on January 2nd, pushed upwards by the illiquidity of the single exchange.

Then things got interesting:

Fifteen million Nano coins disappeared from Bitgrail’s wallet, representing ~8% of the entire supply, between November 2017 and February 2018. Although the owner of the exchange cast the blame on the Nano code, and demanded a fork to rescue the missing funds, later investigations revealed weaknesses in the BitGrail interface, which approved transactions on the clients’ side rather than the servers’.

Outcome: RaiBlocks, rebranded Nano, is now trading for about a dollar. Bitgrail and its remaining assets are now under control of Italian courts.

No. 3: “Don’t complain when a banana costs $5,000.”

In a market full of tulips, the Oyster Project was a Semper Augustus: a wacky plan to reinvent advertising and online storage, using the power of cryptography.

Never mind that the tech wasn’t really there, or the numbers didn’t add up: thanks to the alchemy of Tangle and blockchain, everyone was going to get rich.

There was just one teensy little problem: the CEO, who went by the pseudonym Bruno, refused to reveal his identity, which was a bit of a sticking point for old-fashioned investors. And, when Bruno was pushed aside for the good of the company, he kept the private keys which controlled the token contract.

You can guess what happened next:

There is something terribly wrong with the Oyster token contract. People are sending Ether to the contract at a rate of 1 ETH to 5000 PRL tokens (0.0002 Eth per PRL), which means that they can sell it for higher on Kucoin.

Having the CEO run with the funds would put an end to most startups. But for PRL, that was just the beginning:

Go learn about peak oil and the fractional reserve banking system [Bruno posted after the theft] …. I believe in Oyster as a product, but I don’t believe there will be a future to host it. I will program it since the program is a promise from me, but don’t complain that Oyster isn’t running when a banana costs $5,000.

These antics turned an ordinary exit scam into the most WTF moment in crypto. Instead of running with the money, Bruno accused his colleagues of insider trading, and announced that he would continue the project alone.

Outcome: Bruno went nuts and fired his staff, continuing the project on his own. The rest of the team forked the protocol under a new name and awarded themselves 21% of the supply. Bananas.

No. 2: The Verge Saga

Verge (XVG) has been a running joke for so long that it’s hard to remember when it wasn’t a punchline. It’s hard to believe that, less than a year ago it ranked seventeenth by market cap, with a total valuation over $2.6 billion.

Verge (which in French slang means penis) was a privacy coin which used multiple hashing algorithms for ASIC resistance. The coin got an unexpected plug from McAfee, and an even bigger boost when developers announced a mysterious partnership with “a global organization”— a partnership which, incidentally, could only be secured by users’ contributions.

In the end, the privacy-protecting, ASIC-resistant algorithm provided to be neither, when an unknown party hacked the blockchain using rented hash power. Since the hacker was mining empty blocks, you couldn’t even sell your coins. Then the lead developer panicked and pushed an update, which caused an unexpected hard fork.

By the time the partnership was finally announced, Pornhub had apparently seen enough; the “exclusive” partnership only lasted about a month.

Outcome: some much needed lessons about the wisdom of trusting a one-man development team. Pornhub got a lot of free press, as well as several million dollars.

No. 1. Craig Wright’s BS Vision

We love a good drama, but last month crypto went crazier than a telenovela. It had everything: months of built-up tension and nail-biting suspense, surrounding a life-and-death struggle for control of one of the biggest cryptocurrencies.

To recap-itulate: Craig Wright, who once pretended to have invented Bitcoin, developed a new protocol with which he attempted to hijack the Bitcoin Cash Network. The resulting hash war was like something out of Lord of the Rings: after overwhelming attacks from nChain and CoinGeek, the day was rescued by a last-minute arrival of Bitmain eagles.

The aftermath was like all five stages of grief at once. After refusing to admit defeat, the BSV side tried bargaining, suing, and crashing the market, before turning their currency into what Vitalik described as a “dumpster fire.”

Outcome: Besides causing crypto prices to tank, Craig Wright has also closed off his Twitter profile, depriving the world of a much-needed fountain of comedy gold.

Honorable Mention:

John McAfee may still have to eat… ah, never mind.

The author has investments in Bitcoin and Bitcoin Cash, which are mentioned in this article.

Share this article