Bitcoin Correlation Fades As Altcoins Find New Direction

Share this article

The more the market changes, the more it stays the same. 2019 may yet be a watershed year for cryptocurrency adoption, but one thing hasn’t changed until now: cryptocurrencies marching in lockstep.

According to the latest report by Binance Research, the vast majority of altcoins are still largely moving in unison, with the largest cryptocurrency, Bitcoin (BTC), leading the movements of the rest of the pack.

But although Binance Research found the top thirty leading cryptocurrencies are still “highly correlated” with the original digital asset, there are signs that certain projects are beginning to assert a more independent nature – especially when measured against Bitcoin itself, and not U.S. dollars.

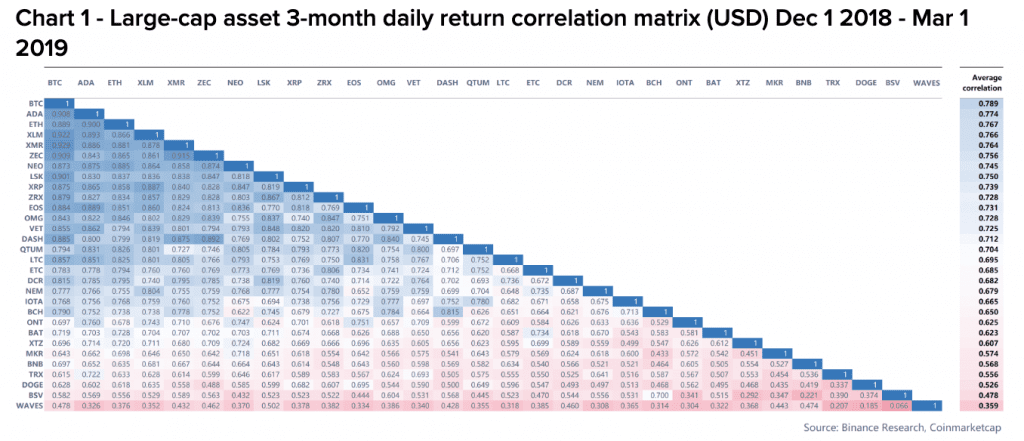

When compared to Bitcoin / USD, and based on average daily returns over the course of three months, Binance researchers determined that altcoins tend to play follow-the-leader, with an average correlation coefficient of 0.78. That figure has increased over the same period last year, when the average correlation was only 0.51.

Some Assets Race Ahead

But that doesn’t mean all alt coins are alike. According to the report, some cryptocurrencies are affected by “idiosyncratic factors” which cause them to depart from the wider trend.

“Examples of assets with the weakest correlations in USD terms include Waves (WAVES), Tron (TRX), Bitcoin Satoshi’s Vision (BSV), Binance Coin (BNB) and Dogecoin* (DOGE).”

While the report does not reach any conclusions, it does suggest recent events which which could have changed the fundamental prospects for these tokens.

For example, Binance Coin found new utility on the Launchpad platform, and Tronix was one of the sole currencies for its BitTorrent token sale. Waves, which raised $120 million last December, may have reduced its risk profile.

Returns in BTC are uncoupling

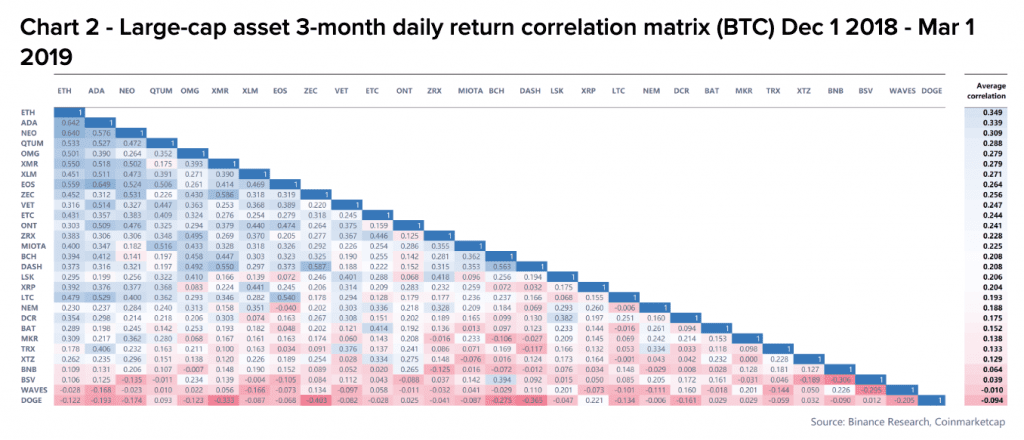

The report also highlighted another anomaly: while altcoin values are becoming more correlated in dollar terms, those correlations are actually decreasing when prices are measured in bitcoin.

In other words, the top thirty cryptocurrencies are exhibiting more variance in their dollar values than in satoshis. The correlation coefficients between altcoin prices vs. bitcoin value actually fell from 0.43 to 0.24.

Yes And No? Any Advance On Maybe?

While the report does not come to any conclusions, there are a few likely explanations. One possibility is the increasing influence of stablecoins, which have negligible variance when measured against dollars but can exhibit strong variance with respect to Bitcoin.

Another curiosity is that cryptocurrencies appear to be grouped by consensus algorithm. “Proof of Work (PoW) cryptoassets seem to exhibit higher correlations with one another than with non-PoW assets,” the researchers found, indicating that alternative consensus algorithms have more in common with one another than they have with mineable coins. The growing influence of non-PoW coins, like Tezos and TRON, could be behind the increased divergence.

In addition, actual use cases for altcoins will almost certainly create divergence – at least until the product reaches a position in the market at which participants agree it is fairly valued, at which point there may be a return to longer-term convergence.

Although the report stops short of making predictions, this observation will certainly draw eyes to Ethereum during the long dance from PoW to PoS.

Although there are no signs of a definitive “altcoin uncoupling” that will undermine Bitcoin dominance in the near future, the gradual decline of crypto- correlations appears to suggest that some virtual currencies are starting to slip from Bitcoin’s orbit.

As the marketplace for virtual assets continues to develop, and more projects bring products to the market that have perceptible value, we are likely to see more divergence from the original digital currency.

*One Doge continues to be worth one Doge, perhaps the strongest correlation of all.

The author is invested in digital assets, including Bitcoin and Ethereum which are mentioned in this article.

Share this article