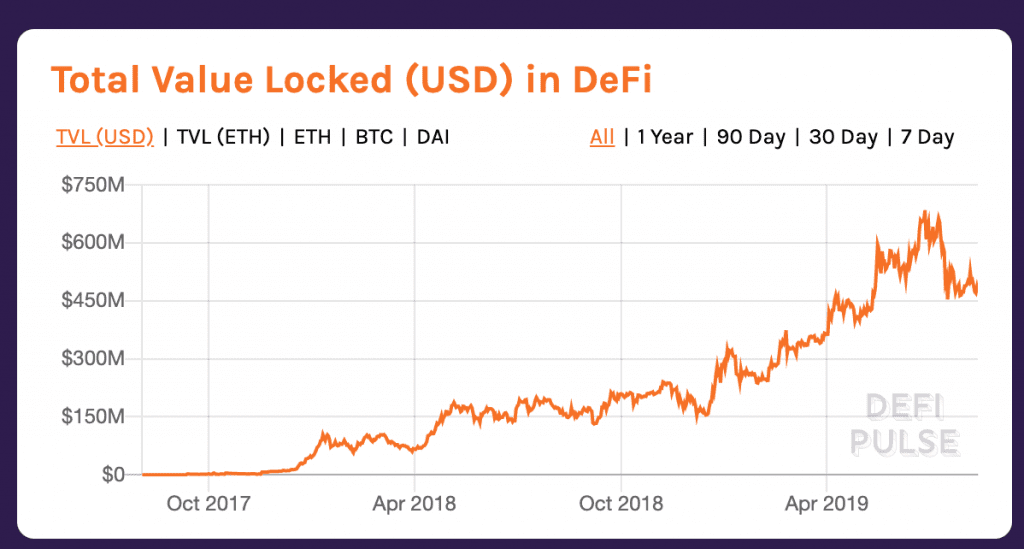

Nearly $500M Locked In DeFi Smart Contracts

Decentralized lending continues to dominate

Share this article

Ethereum-based lending continue to dominate the nascent sector of decentralized finance (DeFi). Nearly half a billion dollars’ worth of assets are locked up in DeFi smart contracts, with stablecoin and CDP provider MakerDAO (DAI) remaining the clear market leader.

According to data from Defipulse, decentralized finance now accounts for $475M in total value, up from nearly zero two years ago. After rapid growth, that figure has fallen somewhat after reaching an all-time high of $683M in late June.

Decentralized finance seeks to create a virtual alternative to real-world lending and borrowing, with the trustless machinery of an immutable blockchain ledger. Using smart contracts, borrowers and lenders can create a binding agreement without having to rely on a centralized third party.

Lending accounts for 87% of the DeFI sector and roughly a third of all live applications. Even excluding the Maker stablecoin system, lending is still the largest bucket for DeFI, with a total value locked (TVL) of approximately $132.3M and an overall market share of 27.8%.

But the biggest single application is the creation of dollar-valued Dai tokens. At present, more than $283.4M worth of Ether are locked in Maker contracts. With total value locked (TVL) standing at $284M, Maker accounts for 59.7% of all DeFi value.

In contrast, derivatives providers – like Nexus and Augur (REP) – only have a market share of 4%. Decentralized exchange protocols, such as Kyber Network (KNC) and Bancor, are marginally larger, comprising 5.5% of the DeFi market. Payment and asset facilities have a combined share of 3.3%.

The vast majority of prominent DeFi applications run on the Ethereum network, except for the Bitcoin (BTC)-based Lightning Network. There are well over 1.8M ETH – roughly $383M – locked in DeFi contracts, compared to approximately $1.97M of Bitcoin.

That could begin to change, as Maker begins to offer multi-collateral DAI later this year. The new system will allow users to create CDPs initially with other forms of cryptocurrency, before expanding into real-world assets.

Because Maker contracts enable ETH holders to preserve value without liquidating their position, the amount of Ether locked up in Maker contracts tends to increase during periods of extended market uncertainty. At the end of March, this figure hit an all-time high of 2.1M ETH but according to MKR tools has since declined to 1.3M.

Share this article