DeFi’s Favorite Growth Metric Is Broken, Here’s Why

Investors using total value locked to compare DeFi protocols are using the wrong metric to evaluate growth.

Total value locked (TVL) is the most popular metric to track DeFi and its corresponding growth. There’s just one problem: It doesn’t apply to every protocol.

Here’s why crypto needs to find an alternative.

One Metric Does Not Fit All of DeFi

Within the DeFi ecosystem, there are several sub-niches like DEXes, money markets, asset aggregators, and synthetic asset issuers. With so much variety, attempting to apply one, cookie-cutter metric to evaluate success quickly becomes problematic.

For an automated market maker, TVL is the total amount of liquidity available against which traders can swap. But for a lending and borrowing marketplace, the metric represents the amount of funds available to borrow.

Let’s examine another example.

If Aave is ahead of Compound in total value locked, does that mean that it’s growing faster than Compound?

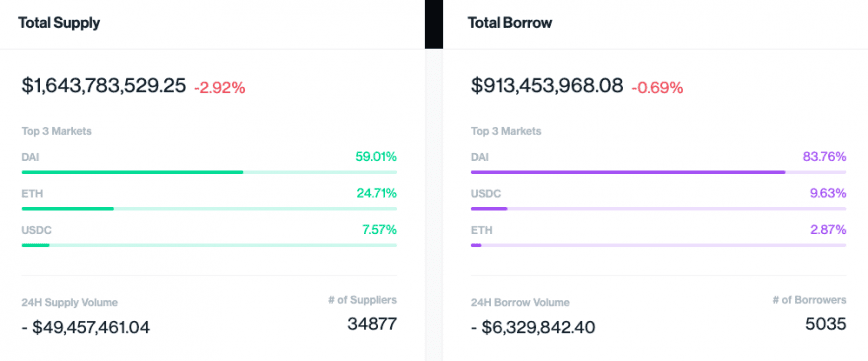

Compound currently has $1.64 billion of capital supplied, with $913 million in borrowings. This implies a capital utilization rate of 55.5% and roughly $730 million of supply that can be tapped by future borrowers.

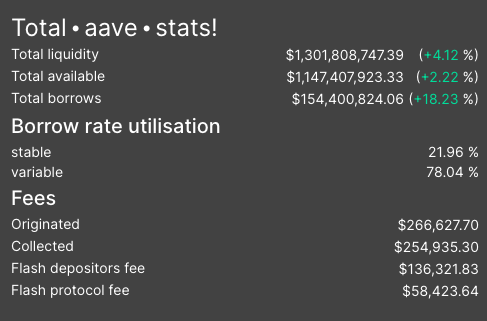

Aave, however, has $1.3 billion in supply and $154 million in active borrowings, with a difference of $1.15 billion available for borrowers.

Capital utilization on Aave is a mere 11.76%

Compound’s growth stems from liquidity mining, while Aave has achieved success without any meaningful token incentive. Regardless of whether the growth is induced by yield farming, Compound’s numbers evidence it has a larger and more utilized market than Aave.

Essentially, if Compound has $100 billion in supply and $99 billion was taken by borrowers, but Aave has $10 billion in supply and borrowers utilized $ 1 billion, TVL would still rank Aave above Compound.

The TVL metric penalizes Compound for having more loan originations – the primary use case of the platform. This is akin to saying one bank is better than the other because it has issued fewer loans and thus has more liquidity to cater to future borrowers.

With Synthetix, TVL is the product of SNX staked in the protocol and the market price of SNX.

If activity on Synthetix was stagnant, but the price of SNX rose by 30%, TVL would also increase by 30%, assuming the amount of SNX staked remained the same. Similarly, if the percentage of SNX staked decreased, TVL would fall by a similar figure.

Growth in the Synthetix protocol is not primarily determined by how much collateral is in the ecosystem, but rather the amount of synths that have been minted and trading volume on the exchange.

While collateral locked is essential because it inherently increases the amount of synths that can be issued, TVL is the wrong metric to track growth and usage of the protocol.

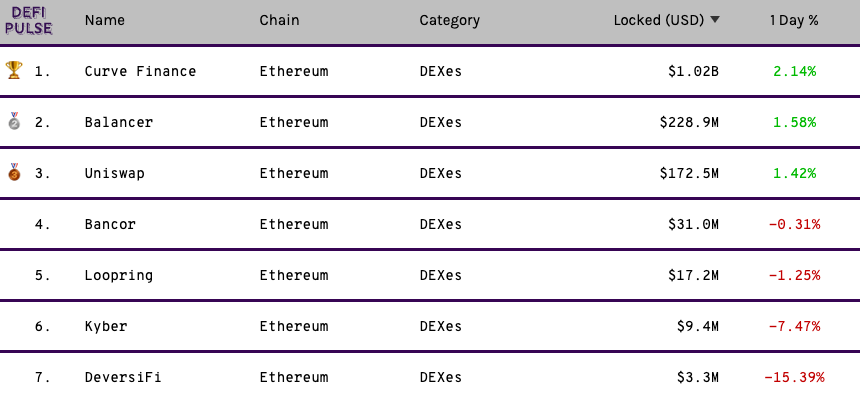

For automated market makers like Uniswap, Curve, and Balancer, TVL measures the amount of liquidity traders can utilize. While this is important, it does not inherently measure value created.

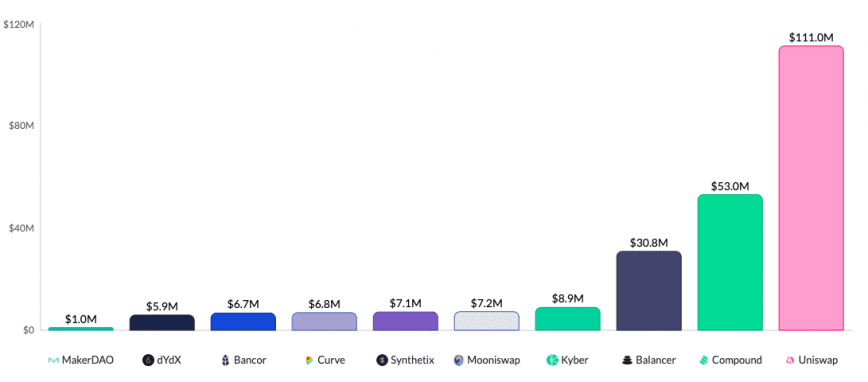

TokenTerminal shows annualized revenue (based on the last 30 days) for Uniswap at $111 million versus $30.8 million for Balancer. This is despite Balancer having 33% more TVL than Uniswap.

Further, liquidity aggregators, like Kyber Network that are wired into a large number of DeFi dApps, draw liquidity from these sources, so the liquidity isn’t locked in the protocol.

But Kyber routinely facilitates more volume and generates more revenue than Bancor, whose TVL is 3x that of Kyber.

On a positive note, TVL does depict protocol growth in a few isolated cases.

Asset aggregators like yEarn Finance are a prime example. YFI holders capture a fee from yVault investors when they exit, so the project’s revenue flow and TVL are directly correlated. Still, there are only a few DeFi primitives can capture value from TVL.

Synthetix token holders are rewarded with fee income when there is more trading volume on the protocol, and Aave’s stakers are issued fees earned by the protocol similarly.

The bottom line is that TVL is irrelevant unless it indicates growth and value capture.

Potential Alternatives

Instead of TVL, using a more pervasive financial metric, like revenue, offers much more clarity.

All protocols generate revenue, whether for token holders, validators, or other participants. The total revenue a protocol generates is a direct indicator of how much value it is creating for people.

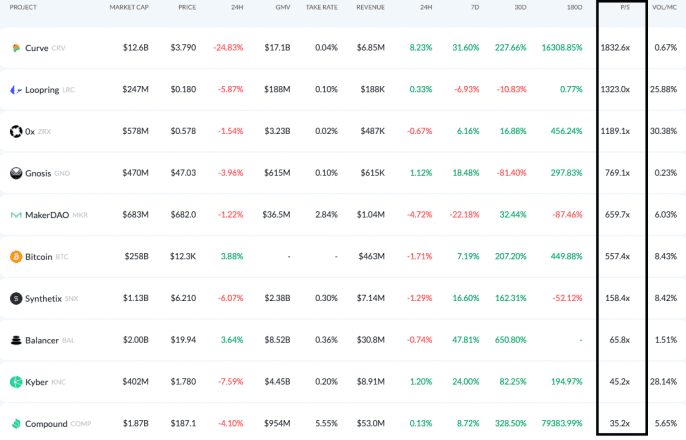

For relative valuations, one can turn to the price to sales ratio, which is the token’s market cap divided by annualized revenue.

Whether one should use the current market cap or fully diluted is another element to consider. But even this varies from investor to investor.

Despite the above evaluation, the TVL metric can still be used to evaluate liquidity in an AMM or collateral from which liquidity can be generated for a synthetic asset issuance platform.

When used carelessly, however, TVL fails to offer an accurate representation of growth in a DeFi protocol. And until an alternative emerges, users should take value locked in with a large grain of salt.

Earn with Nexo

Earn with Nexo