Should You Diversify Your Crypto Portfolio?

Not so fast. High asset correlations mean diversifying could bring more risk and less reward.

A commonplace wisdom in crypto markets, as well as common sense, advises wary hodlers to diversify their investments. Cryptocurrencies are extremely risky, according to this reasoning; spreading your wealth means more chances to win big.

As sage as it sounds, this advice is incorrect. The purpose of diversifying an investment portfolio is to decrease risk; assets should be negatively correlated in order to properly optimize a long term portfolio. And if you want to find assets which are negatively correlated, well, you’re probably better off looking somewhere else.

In June 2018, a Crypto Briefing analysis found that diversifying your crypto portfolio could actually be harmful. Because virtual assets were highly correlated at the time, diversifying could increase risk without a significant benefit.

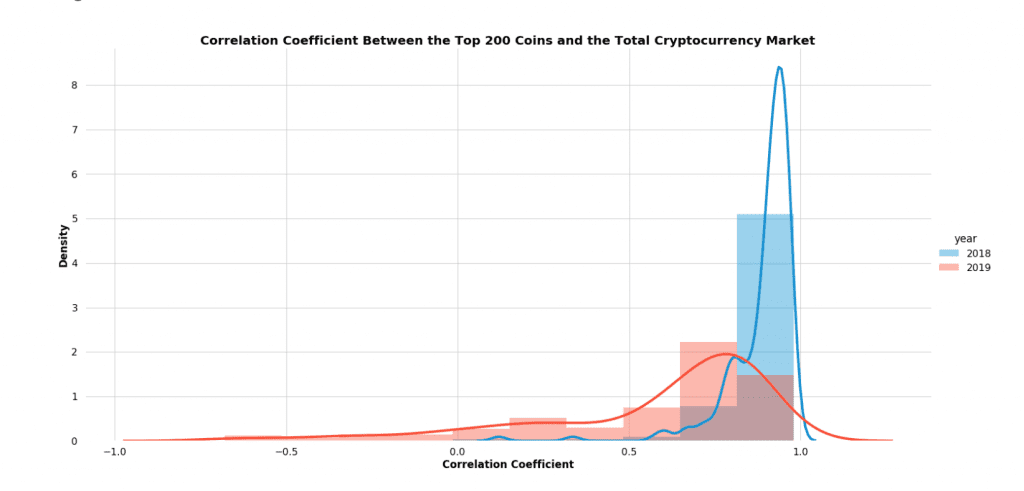

Those correlations are changing, but remain high. Anthony Xie, founder of HodlBot, did a comprehensive investigation that found declining correlations between virtual assets. According to his analysis, the average correlation between coins dropped from +0.89 over 2018 to +0.58 in 2019.

Correlation coefficients range from -1 to +1, where +1 indicates values that move in perfect unison. Anything above +0.5 is considered highly correlated.

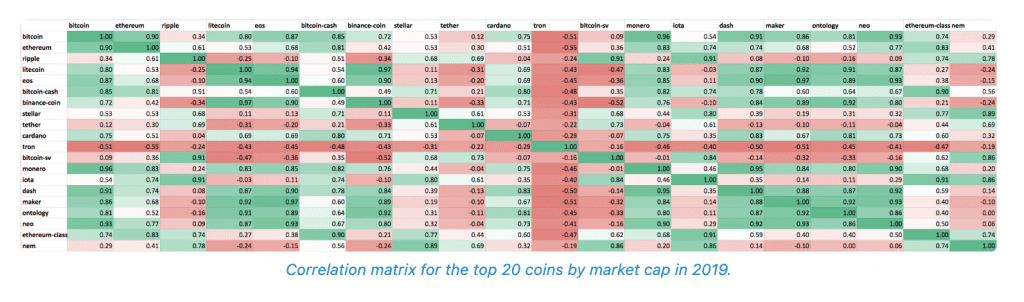

As shown in the matrix below, only a few coins show negative correlations with one another. Positive correlations are shown in green, and negatively correlated assets are marked in red:

Based on these data, TRON (TRX) is a clear outlier, and is negatively correlated to all other listed coins. This is likely because of the bull run beforeo the launch of BitTorrent (BTT).

As Circle Research noted in their Q1 2019 Retrospective, BNB is another strong outlier, since its performance is tied to Binance’s success. Three events in Q1 led to BNB outperforming the market: (1) the launch of its DEX testnet, (2) the general excitement for IEO’s, and (3) the popular BitTorrent offering that required TRX or BNB to participate.

These trends are unlikely to last long, and they are likely the main reason for the decline in digital asset correlations. Other tokens continue to exhibit strong correlations with one another.

Nonetheless, Xie shows that the average correlation coefficient is falling from 2018, when markets exhibited the highest levels of correlation ever seen.

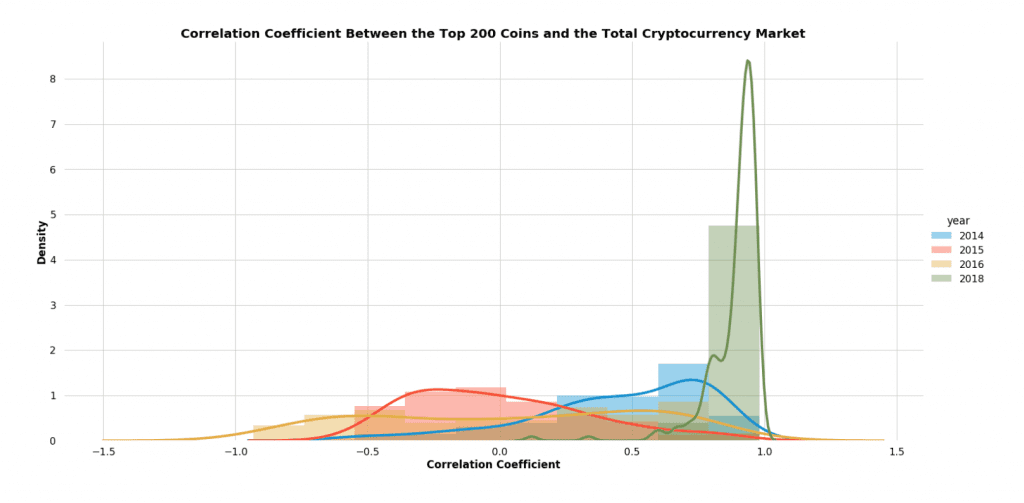

The market was much less correlated between 2014-2016 than it was in 2018, as evident in the histogram below.

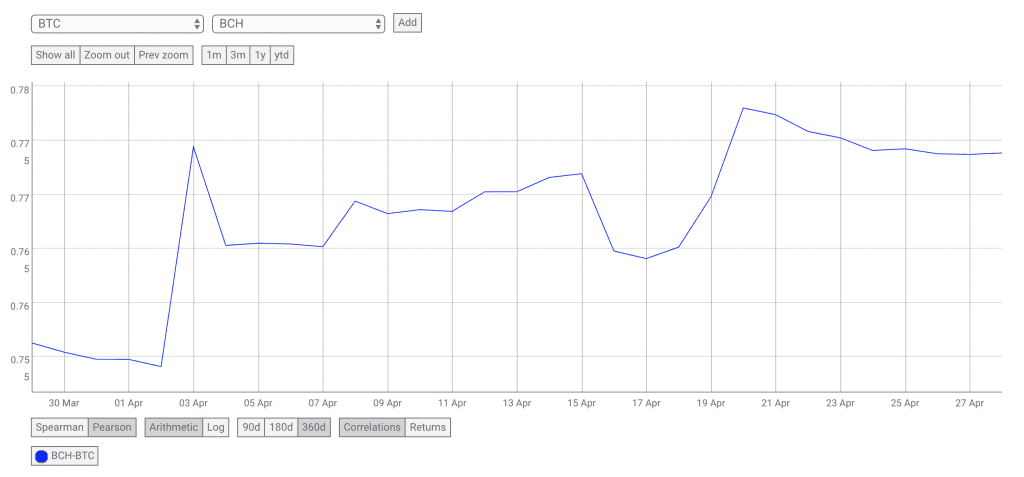

However, Xie notes, this observed decline in cross-correlations among coins should be taken with a grain of salt. Correlations are quite volatile, as demonstrated by the BTC-BCH correlations in the graph below.

So what does this mean for portfolios?

Despite the apparent decrease in correlations, we are not yet at a point where it is financially wise to hold a large number of coins. Increasing the number of highly-correlated assets in a portfolio actually adds risk, and with a correlation coefficient above +0.5 these assets might as well be identical.

Circle Research found that Bitcoin still heavily influences the price direction of large and small cap coins, and has an even higher influence on its “clones” (such as LTC, XMR and Bitcoin forks).

Interestingly, the study also found a declining, and low, relationship between physical gold and large-cap US equities. According to the team at Circle, this suggests that like gold, the entire crypto asset-class could be seen as a hedge against traditional markets.