Market Commentary: Tether Reaches 4th Place As Bitfinex Scores A Point

While BUSD trades at a significant premium.

Share this article

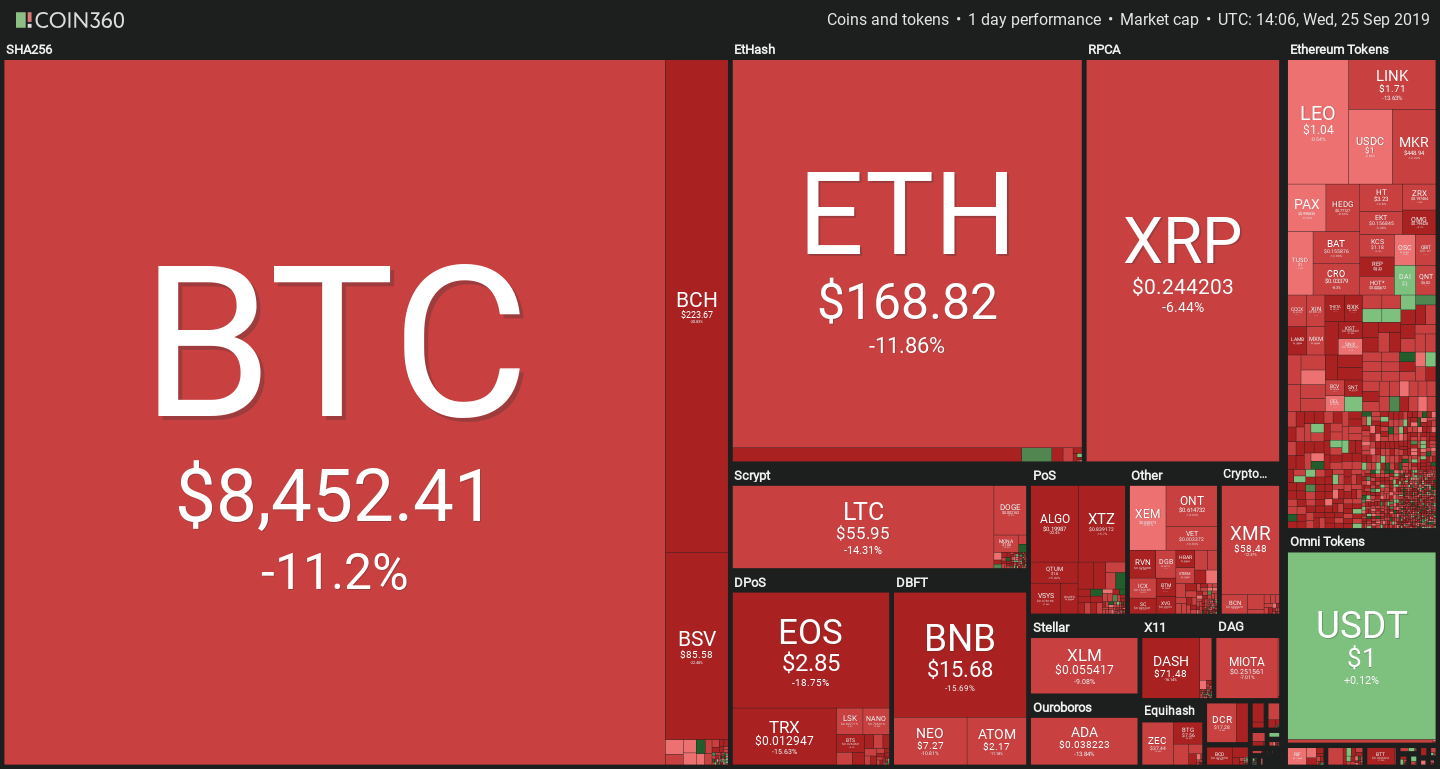

Not everyone’s in the red today. As virtual asset markets slide into double-digit hell, Tether, fiat’s leading cryptocurrency incarnation, is asserting dominance over its digital subjects.

All cryptocurrencies suffered tremendous losses yesterday afternoon, with Bitcoin ultimately stabilizing at $8400 (-12%), while altcoins range from -8% losses to -20%. Bitcoin Cash’s larger than average loss allowed USDT to become the fourth-largest digital currency by market capitalization.

The causes for such dramatic losses are usually to be found in a multiplicity of causes. While Bakkt likely served as the immediate catalyst, a number of bearish developments and an extremely narrow trading range likely added force to the breakout.

But there’s no easy way to explain the fall, noted Soravis Srinawakoon, CEO of Band Protocol.

“While the people are always looking for a narrative, the reality is that the market is irrational and what we are observing is simply more sellers than buyers. It is as simple as that,” he said, while giving a glimmer of hope for the future. “The technology fundamentals are still advancing in a upward direction and that’s what matters in the long run.”

Tether climbs the ranks, and Bitfinex sighs with relief

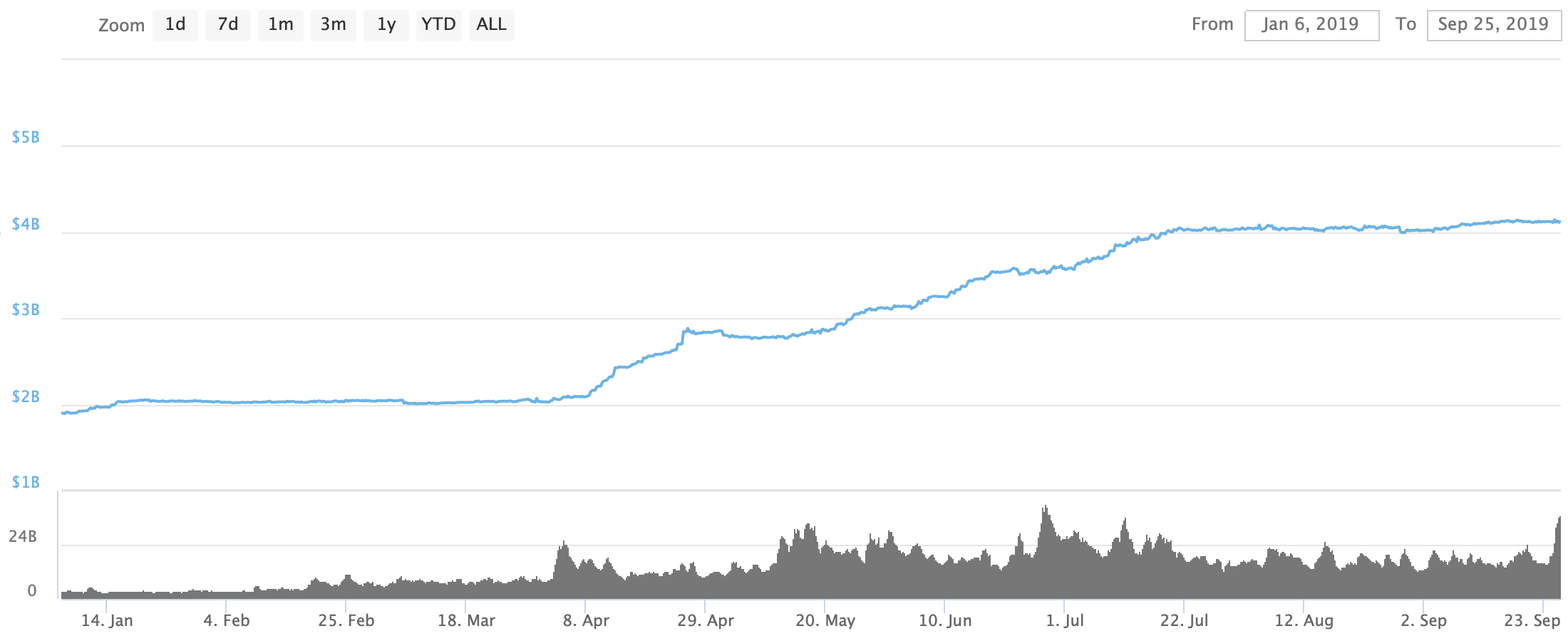

USDT remains by far the most dominant stablecoin. Thanks to the rise of ERC-20 USDT, Tether’s market cap has been growing steadily since the summer. The USDT-ETH token now accounts for nearly two billion tokens, almost half of the total Tether supply in circulation.

Tether’s market capitalization has increased steadily over the course of the 2019 bull run, rising from 2bn in April to more than 4.11bn at the time of writing.

An unconfirmed Forbes report claims that Bitfinex and Tether won a motion in their case against the NYAG. If lost, the two companies would’ve been required to surrender all documents pertaining to the use of Tether.

Rival stablecoins like Binance USD have a lot to be envious about: while Tether prices remained fairly even, Bitcoin traded for as little as 1800 BUSD during the crash.

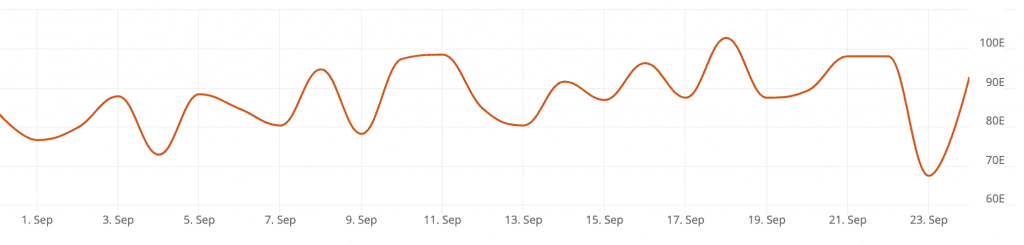

Bitcoin hashrate makes speedy recovery

After yesterday’s ominous loss of up to 30% of BTC’s hashrate, mining activity has made a partial recovery today to 92.8 EH/s.

While the debacle may have been a simple data error, today’s extreme price drop puts even more pressure on miners. As reported yesterday, profit from old ASICs is rapidly dwindling as new ones enter the network.

Bitcoin’s hashrate will likely continue to grow as long as mining with the new Bitmain S17 remains profitable.

Bitcoin Commentary By Nathan Batchelor

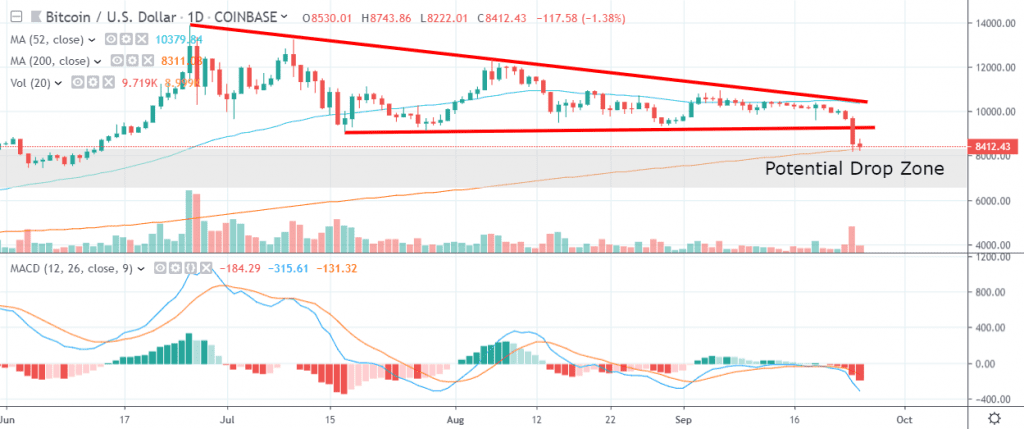

The much-awaited breakout in Bitcoin finally happened, with the cryptocurrency experiencing its largest single day drop since January 2018. The BTC / USD pair came under tremendous one-way selling pressure after breaking through the $9,300 support level and taking-out the July 2019 trading low.

How far can BTC / USD fall? According to the invalidation target of the previously mentioned inverted head and shoulders pattern, Bitcoin could soon reach the $7,600 level. Below the $7,600 level, Bitcoin’s 52-week moving average of $6,600 is a huge downside level to watch.

BTC/USD bulls need to hold the cryptocurrency above the 200-day moving average ($8,300) on multi-day basis to avoid a drop to the bearish targets.

The fact that the large decline in one-day volume did not create obvious MACD price divergence is a bearish sign. Furthermore, the weekly RSI has turned bearish for the first time since March this year.

In yesterday’s article, I mentioned that if the market capitalization of the entire market drops below the $230,000,000,000 level then we could see a major market sell-off. The drop came, and with the market falling below its 200-day moving average the $190,000,000,000 level becomes a possible bearish target.

If the BTC / USD pair fails to rally above the $9,150 in fairly rapid fashion, then the selling pressure is likely to remain in place. Furthermore, if the market capitalization does not recover above its 200-day moving average, we could see double-digit declines ahead for the many of the altcoins.

* The breakout below the descending triangle pattern is a medium-term game changer, bulls must stage a huge rally over the coming sessions or Bitcoin could soon hit $7,600. *

SENTIMENT

Intraday bullish sentiment for Bitcoin is extremely weak, at 20.00%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency has dipped slightly to 64.40%, but remains positive.

UPSIDE POTENTIAL

Bulls face a massive challenge today to regain control of the BTC / USD pair. They need to stabilize price above the $8,300 technical area and force a rally towards the $9,000 level, which is currently the most important near-term swing-high.

The descending triangle pattern on the daily time frame is the strongest form of resistance around the $9,150 level. Bulls would send a statement of intent if they could recover price above the critically important $9,300 level today.

DOWNSIDE POTENTIAL

As previously mentioned, the downside target of the invalidated inverted head and shoulders pattern is around the $7,600 level. This target could easily be reached if sellers force price under the BTC / USD pair’s 200-day moving average.

Additional weakness under the $7,600 level could see Bitcoin sold even lower towards its 52-week moving average, around the $6,600 level. This should be expected over the medium-term if a recovery is not forthcoming over the next few trading sessions.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.

Share this article