Not Just a Novelty: NFT Volumes May Be Bigger Than You Think

NFT trading volumes are finally gaining significance - they're not just cute collectibles anymore.

Share this article

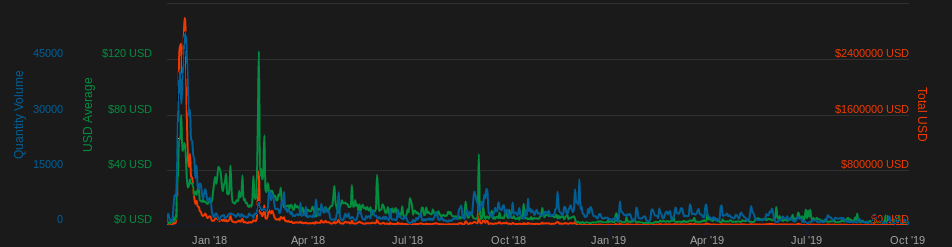

By now, you probably know the story of CryptoKitties by heart. The trading game pioneered non-fungible tokens (NFTs) in 2017, and buyers were eager to get in on the craze. Early on, the average CryptoKitty cost $80—but then, the NFT’s trading volume and average price dropped like a rock. Today, the average CryptoKitty is worth just $1.50.

But although CryptoKitties are struggling, non-fungible tokens have gained traction elsewhere. Decentraland, for example, is using NFTs to represent parcels of virtual land, while companies like Enjin are using NFTs for in-game items. Even the Ethereum Name Service is using NFT tokens—in this case, tokens represent unique domain names.

However, there has been little investigation into the size of the NFT market. NFTs are not as obscure as they were two years ago, but they are still largely overlooked: most major exchanges and market aggregators have ignored the trend. To find out how big the NFT market is, we dug into the data—and the numbers may surprise you.

How Big Is the Biggest NFT Marketplace?

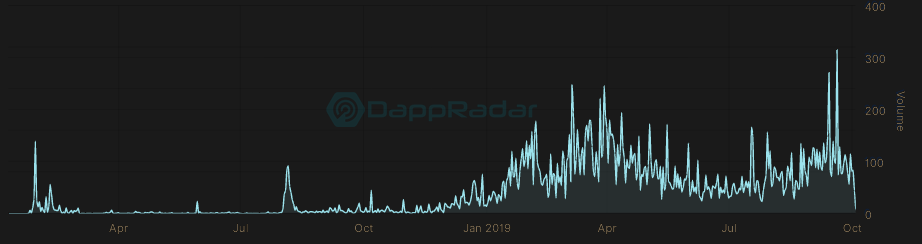

OpenSea is the largest NFT marketplace by trading volume. It first went live in January 2018, and it has handled over 25,000 ETH, or $4.5 million, since then. Typically, the site trades about 50-150 ETH ($9000-$27,000) of NFTs per day. These numbers are even more impressive in light of the fact that most of its trading took place this year:

Right now, OpenSea has a daily volume of 80 ETH, or $15,000. If OpenSea were a traditional exchange, it would rank at #180 on CoinMarketCap. This isn’t massive, but it is a good start. For scale, OpenSea’s daily volume is about 1/10th of Waves DEX’s daily volume, or 1/5th of Switcheo‘s daily volume—two minor but well-known exchanges.

OpenSea fares even better when it is compared to other NFT markets. Auctionity has slightly more users at the moment, but OpenSea beats Auctionity’s daily trading volume fifteen times over (5 ETH vs 80 ETH). There are other NFT marketplaces, such as Rare Bits, which do not publish data—but in any case, OpenSea appears to dominate.

How Big Are the Biggest NFTs?

There are currently two tokens vying for the title of “most valuable NFT.” Nonfungible.org suggests that Decentraland’s land parcel tokens, which have a weekly trading volume of $42,000, lead the market by this measure. OpenSea, however, suggests that MyCryptoHeroes, a series of battle tokens, have a weekly volume of 350 ETH ($60,000).

In any case, weekly trading volumes for the largest NFT token are currently somewhere in the ballpark of $50,000. Though subject to change, this is on par with the current weekly volume of a few middling cryptocurrencies. For example, Bytecoin experienced a $57,000 trading volume this week, while Aragon traded $68,000 this week.

Meanwhile, minor NFTs have somewhat lower trading volumes—typically, they move less than 100 ETH per week. But collectively, they are impressive: if OpenSea’s top twenty NFTs were combined, they would have a weekly trading volume of 1120 ETH ($200,000), which is roughly equal to the weekly volume of Factom ($250,000/week).

The Need For Better Statistics

It’s unlikely that CoinMarketCap and other market aggregators will begin to rank NFTs and NFT marketplaces any time soon. Even dedicated sites like OpenSea and Nonfungible.com only collect data for a few dozen NFTs. Plus, there are no standard practices for dealing with artificial and unusual market activity when it comes to NFTs.

There are already irregularities: for example, OpenSea’s Ethereum Name Service tokens increased in value by more than 30,000% this week. This rapid change was due to the fact that initial auctions took place over several weeks and were finalized at once. (The auction was exploited as well, but this occurred on a small scale and had no effect on price.)

More broadly, market cap may be a poor measure of an NFT’s success, as it extrapolates average NFT prices to a supply of tokens that may never sell at their listed auction price. We chose to observe trading volume, as it only concerns tokens that have been sold. To account for price changes, long-term trading volumes may be an even better measure.

Are NFTs Big Enough to Go Mainstream?

NFTs aren’t as big as they are often made out to be. Reports of a multi-billion dollar annual market for cryptocollectibles are likely overblown: this estimate seems to be based on data about physical collectibles ($200 billion per year) and the video game industry ($50 billion per year). Cryptocollectibles won’t take over these markets entirely.

Still, the fact that OpenSea can handle millions of dollars in NFTs per year is a good start. Plus, the market for NFTs may get bigger: OpenSea only handles NFTs based on Ethereum’s ERC-721 standard. Other blockchains, such as EOS and NEO, already have NFT standards—which means the market may be bigger than what we’ve estimated.

To be even more optimistic, it is possible that a single NFT will become too big to ignore. Many current NFTs, such as Decentraland property, have largely speculative value, but it may only be a matter of time until a non-fungible token becomes as sought-after as leading cryptocurrencies.

Then, everyone will want a piece of the action.

Share this article