What is Bakkt? The Bitcoin Futures Trading Platform

Bakkt is a Bitcoin futures trading platform and a global digital asset ecosystem.

Key Takeaways

- Bakkt primarily serves as a Bitcoin futures trading platform.

- Right now, it primarily serves financial institutions and institutional investors.

- It also plans to expand its services with custody solutions and payment tools.

Share this article

Bakkt is a trading platform that primarily offers Bitcoin futures, a type of financial contract and derivative that allows investors to buy and sell BTC at a certain date and price.

Prior to its 2019 launch, Bakkt was seen as a highly promising and innovative platform. Though the hype has faded since then, it remains highly notable and it is still expanding its offerings.

History of Bakkt

Bakkt was first announced by the Intercontinental Exchange (ICE) in August 2018. Though it has always intended to provide a full ecosystem of digital services, that announcement made it clear that Bitcoin futures trading would become its initial flagship service.

Much of the anticipation around the trading platform arose from the fact that its parent company, ICE, also operates the New York Stock Exchange and several other major exchanges. Bakkt also secured several high-profile partners and supporters, including Boston Consulting Group (BCG), Microsoft, and Starbucks.

Though ICE intended to launch Bakkt in December 2018, the platform’s launch date was delayed to January 2019, then postponed indefinitely. These delays were attributed to regulatory uncertainty specific to Bakkt and to the broader U.S. government shutdown that was then underway.

The project finally went live in September 2019 and has been in operation since then. Since then, it continues to attract industry support. During the market crash of March 2020, Bakkt competed a a $300 million funding round with contributions from Microsoft, Pantera, and several other high-profile investors.

Bitcoin Futures

Unlike retail exchanges, Bakkt does not allow users to buy Bitcoin and store it in a wallet address. Instead, it offers futures contracts that can be settled for Bitcoin or cash at a later time.

Futures contracts are appealing to institutional investors and traders because they allow hedging, risk management, and price discovery. It also offers full regulatory compliance and physically delivered settlement, two more features that are important to institutional investors. In addition to daily Bitcoin futures, the platform has also launched monthly options.

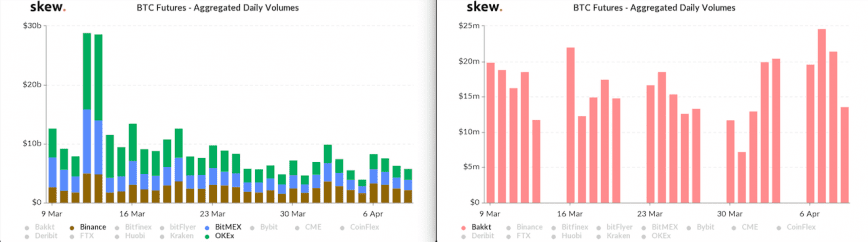

Because the company caters to institutional investors, its trading volumes are fairly low. As of March 2020, daily volume on the derivatives platform is just over $12 million, 200-times less than leading retail exchanges that offer futures contracts. BitMEX and OKEx, for example, handle $2.5 billion in derivatives per day.

Despite Bakkt’s niche appeal, retail users may be able to use Bakkt indirectly. Executives have suggested that the company plans to make futures contracts available through retail brokerages.

Physical Bitcoin Settlement

One of Bakkt’s key features is physical settlement and delivery of Bitcoin. In theory, this means that the firm has sufficient Bitcoin in reserve to pay investors. These coins are securely stored in “Bakkt Warehouse.” As the name “Bakkt” suggests, contracts are physically “backed” by Bitcoin.

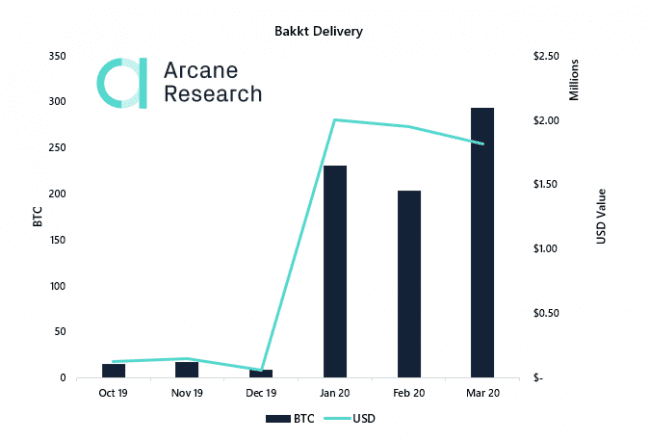

However, the company has admitted that futures contracts are also backed by cash and Treasuries. Furthermore, there appears to be little demand for Bitcoin settlement. Most of Bakkt’s futures contracts are settled in cash, not in Bitcoin. Arcane Research observed in January 2020 that physically settled Bitcoin futures make up “a small amount to what the daily trading volumes are on Bakkt.”

This means that Bakkt’s derivatives offerings are similar to what’s available on the Chicago Mercantile Exchange—cash settled Bitcoin options, which may also explain Bakkt’s low volumes.

As of March 2020, about 300 BTC, or $2 million, of Bakkt’s volume is physically delivered—significantly more than last year, but still a small amount overall. Demand for this feature may grow over time.

Custody Services

The Bakkt Warehouse was originally intended for use with Bitcoin futures settlement, but it has been extended to serve as a general custody service since November 2019.

Like most custody services, the Bakkt Warehouse stores assets in a way that is acceptable to institutional investors. It implements crypto security strategies such as cold (offline) storage, combined with standard financial security practices such as auditing and insurance policies.

The service has gained approval from the New York Department of Financial Services (NYDFS), allowing it to provide custody in a way that complies with major regulations.

Bakkt cites Pantera Capital, Galaxy Digital, and Tagomi as firms that are using the service. Its custody services may grow larger as well. In April 2019, Bakkt acquired the Digital Asset Custody Company, a custody provider that supports 13 blockchains and over 100 assets.

Payments and Rewards

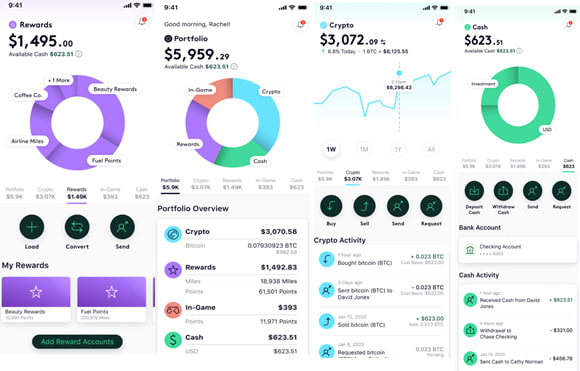

The company’s latest effort is “Bakkt App,” a mobile application for spending and managing digital assets.

Though the app will support Bitcoin balances, it is not meant to handle cryptocurrency exclusively. It will also support loyalty points, game points, and cash balances.

Bakkt App is not available to general users as of April 2020. However, it is possible to sign up and gain early access, and Bakkt has suggested that the app will be available more widely in summer 2020.

Some developments related to the app are already underway. Bakkt’s partnership with Starbucks, one of its longest-running efforts, has come to fruition through the app. Starbucks has begun to support Bakkt Cash payments for some users as of March 2020.

The company also plans to acquire Bridge2 solutions, a loyalty and rewards company, which will allow it to give its users payment options for a wide variety of companies and retailers.

However, competition in the mobile payments and rewards space is fierce. Incumbents like CashApp and loyalty app Fivestars could make it difficult for the company to gain market share.

Summary

Though Bakkt’s initial launch was highly anticipated, it did not have as profound an impact on the cryptocurrency market as many commentators expected. Bakkt exists in a highly volatile crypto market, and the launch of the product did not seem to have a lasting impact on Bitcoin’s price.

However, Bakkt is successful in its own right. Even though its futures trading volumes are modest, the platform seems to fill a niche, and the company seems to be delivering on its promises.

It is possible that Bakkt’s payments and reward app will help it attract greater attention from general users, but since the app has not launched yet, its future is uncertain.

Share this article