Deflationary Coins: Can These Tokens Explode In Price, Or Just Burn Out?

Some new cryptocurrencies are fighting inflation by relentlessly burning their token supply. Is this a viable strategy?

Share this article

Inflation is a favorite antagonist in the cryptocurrency community. Most investors are probably familiar with the graphs showing how much value the U.S. dollar has lost since 1933, when the Federal Reserve left the gold standard. For hard-money advocates, the deflationary properties of gold or cryptocurrencies form a built-in guarantee of long-term value.

Bitcoin’s supply is algorithmically limited to 21 million tokens, but it still experiences inflation as the token supply grows. For most cryptocurrencies, inflation is barely noticeable against the backdrop of everyday price volatility, but it is very commonplace – blockchain networks need to generate new tokens to reward mining or staking nodes.

But any currency will lose value if supply exceeds demand. As such, many cryptocurrencies combat inflation by destroying tokens. Ripple’s XRP burns a small number of tokens with every transaction, and some, like Binance Coin, intentionally burn tokens to raise prices.

Some new tokens take coin burning to an extreme, and cause their token supply to shrink over time. This should make these coins very valuable – right? Well, maybe not. Let’s look at a few examples.

The BOMB Token

Earlier this year, BOMB kicked off a trend of Ethereum-based deflationary tokens. In every BOMB transaction, 1% of the tokens used in that transaction are destroyed. There are just 1 million BOMB tokens in existence, and that number is falling fast. At this rate, by 2034, there will be virtually no BOMB tokens left.

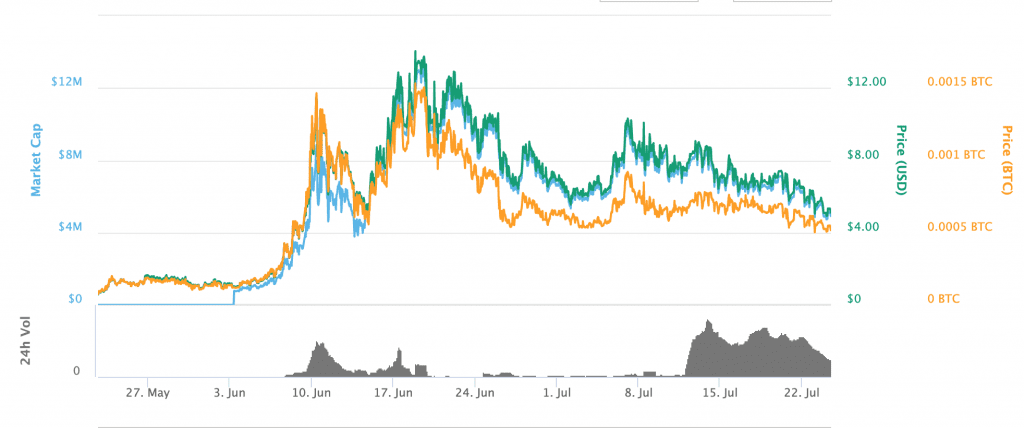

Based on BOMB’s price action, the market does not seem to believe that deflation automatically equates to an increased price. After jumping sharply since the project launched in May, the price is now declining.

By its own admission, BOMB is more of a social experiment than an attempt at an everyday currency. It’s also a response to the fact that so many ICOs have failed to maintain value over time despite receiving so many investments. BOMB alone doesn’t really solve these problems, but it has certainly made some early investors very happy. It’s also inspired a lot of copycats…

The NUKE Token

NUKE is another Ethereum-based token, and it attempts to beat BOMB at its own game by offering a 1 million token supply with a 2% burn rate. Unlike BOMB, NUKE will stop burning tokens at a certain point, meaning that the supply won’t be entirely depleted in fifteen years. By the project’s own estimate, it will stop burning tokens sometime around 2036.

NUKE thinks that its token has real applications: creators call it the “first deflationary currency with utility,” and are planning to introduce a native DEX and DApps to prove it. Still, it’s easy to dismiss it as a copycat of BOMB, along with countless other Ethereum- based deflationary tokens like Ethplode and MOAB that make very few changes to the original algorithm.

The Void Token

Void takes deflation even further: it’s a TRON-based token that puts a 3% burn rate on every transaction. Though it has a fairly high max supply of 10 million tokens, this shouldn’t make a difference. Void is also hesitant to predict how long it will take for the token supply to run down: “Only time will tell,” it says in its whitepaper.

Like the NUKE token, Void is trying to produce real applications. So far, it has created “Texas Void’em Poker,” which is, well, not very impressive given the landslide of crypto-based gambling sites that already exist.

Void also has a staking app that distributes rewards, which doesn’t result in inflation, as staking rewards come from Void’s original supply.

OptiToken

OptiToken does things a little differently – or at least it tries to. The idea is that the OptiToken team is investing in baskets of other cryptocurrencies, and then using the profits to buy back Opti tokens and burn them. This means that OptiToken isn’t just being airdropped – it actually ran an ICO, unlike so many other deflationary token projects.

On the other hand, OptiToken is ultimately just burning a lot of tokens, much like every other deflationary token project. It doesn’t make any promises about when the token supply will be depleted, but otherwise, it’s hard to distinguish OptiToken from BOMB and its cousins.

Is It Even Worth It?

Deflationary tokens could run into some serious issues before they have a chance to prove themselves. Real utility is hard to engineer, and investors and merchants may not want to buy or accept these tokens in the far-flung future. Deflationary tokens could be more promising as way for investors to hedge against inflation – but only slightly.

It’s not entirely clear what end goal these projects have. Most deflationary token projects aren’t running ICOs; instead, they seem to be running airdrops and referral schemes. And although these tokens are being distributed for free initially, they are also traded on exchanges.

A cynical investor might consider these hyper-deflationary tokens to be just a fad, like the smart contract pyramid games which briefly came into vogue last year. Given their limited adoption, and even more limited utility, it’s hard to tell if BOMB and company will be remembered at all when 2025 rolls around, to say nothing of 2035. Deflationary tokens may be an explosive trend for 2019, but they could fizzle out quite quickly.

Share this article