Who Wants A Free Coinbase Listing?

Share this article

It’s alt season again, and every crypto-community is getting excited at the chance of a new exchange. Coinbase, the biggest exchange of all (except for a few other ones) has thrown open its doors to any project that cares to apply–and they’re not even extorting a listing fee (yet).

This is a big deal, especially for newer projects. Over the past year, most exchanges have made bank from listing fees—which meant that developers had to amass huge budgets through premining. Coinbase isn’t just making crypto easier to buy—it’s also helping projects stay decentralized.

Any digital asset is welcome to apply—provided they pass a “legal and security review.” They also have to meet Coinbase’s Digital Asset Framework, which requires that listed currencies have liquidity, reputable developers, solve real problems, and be “public, decentralized, and [enable] trustless consensus.” That rules out a lot of the projects on CMC—but that won’t stop them from trying.

These are some of the most likely contenders for a new Coinbase Listing–and the hurdles they’re likely to face.

XRP:

Pro: If any crypto seems like it deserves a Coinbase listing, it’s the third—wait, second—nevermind, third—largest cryptocurrency by Market Cap. Moreover, with the promise of new products like xRapid that are aimed at institutional adoption, XRP’s stars seem very bright indeed.

Ripple has a been trying to get XRP listed on Coinbase since at least December, but so far it’s still stuck in the friend zone. It hasn’t got to third-Coin-base yet, but it could be rounding home before we know it.

Cons: It’s not clear whether Coinbase is turned off by Ripple’s centralization or uncertain security status. But it might have something to do with the following requirement:

There is an algorithmically programmed inflation rate which incentivizes security and network effects. Or, if the total supply is capped, then a majority of the tokens should be available for trade when the network launches.

Ripple currently controls over 60% of all XRP, most of it in timelocks. Sorry, Brad.

Stellar:

Pro: We’re not sure what’s on Jed McCaleb’s mind, but fans of XRP’s younger, hotter sister are definitely hoping for a Coinbase listing. The lumen token ticks almost all the boxes—the tech improves on older consensus protocols, it has real-world use-cases and fiat pairings, and the lumens even passes Coinbase’s inflation requirement.

Con: Although it looks better than XRP, ownership of lumens is even more centralized than XRP. By Coinbase’s requirements, it might be a few decades before Stellar is sufficiently decentralized.

Dash:

Pro: If Coinbase doesn’t get an application from Dash, then the entire staff of Dash Core Group should be immediately fired. Despite the comparatively low ranking, Digital Cash is ahead in brick-and-mortar adoption, and has a long-term plan to make crypto as convenient as sending a text.

Con: Although Dash is getting real use, it may have trouble passing Coinbase’s requirements. To an outsider, Dash Core Group looks suspiciously like a “central organizer” and sources hint that its lawyers have sent a postcard to the SEC. That doesn’t mean it won’t be listed, but it will probably require a few second thoughts.

Z Cash:

Pro: ZEC is the likeliest candidate among privacy coins. Although XMR is better known, it also comes with more problems and unfortunate darknet associations.

Cons: Although Z-Cash is based on brilliant engineering, the user experience is still extremely limited.

Doge:

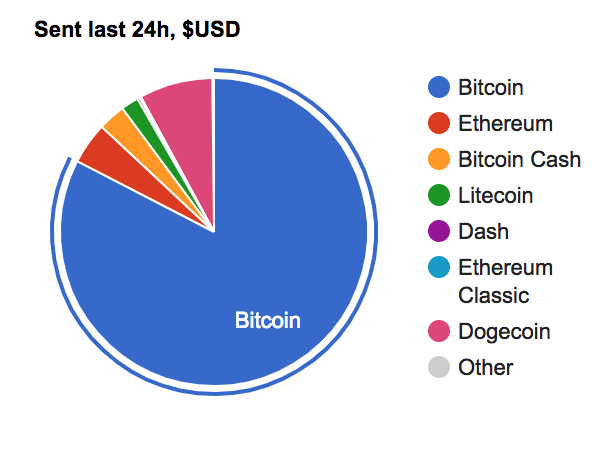

Pro: Despite the comparatively low market cap, Dogecoin is much closer to mass adoption than several larger coins. Shibes regularly send more money in more transactions than current Coinbase listees Bitcoin Cash and Ethereum Classic. Moreover, unlike EOS or VeChain, it’s one of the few cryptocurrencies that your non-tech friends have actually heard of.

Con: We were tempted to trot out all the old doge memes, but you’re probably as sick of them as we are. The truth is that Dogecoin isn’t even the biggest joke on this list.

Nano:

Pro: The Nano community probably has more crossed fingers than any other crypto group. Despite the promise of fast, free transactions with extreme scalability, Nano missed its big chance with the Bitgrail Hack. Since then the development fund seems to be exhausted, with no new listings in sight.

Cons: There are going to be a lot of raised eyebrows when Coinbase reviews this listing application. Besides the fact that 20% of all Nano were stolen, devs will have to explain how Nano meets this requirement:

There are mechanisms (such as transaction fees) which incentivize miners, validators, and other participants to exhibit ‘good’ behavior. Conversely, there are mechanisms which deter ‘bad’ behavior.

Verge:

Pro: Dream on.

Con: We don’t have time.

The author has investments in Bitcoin, Bitcoin Cash, Dash, Stellar and Ripple, which are mentioned in this article.

Share this article