Should You Store Crypto on an Exchange?

Keeping your precious Bitcoin on a crypto exchange may seem like a good idea if you plan on buying and selling crypto on the fly. But given the number of critical hacks in the space, an offline, non-custodial wallet is far more secure.

Key Takeaways

- There are various methods of storing cryptocurrency, and offline wallets are the safest option.

- Traders taking short-term spot and derivatives positions tend to keep their funds on exchanges.

- Non-custodial exchanges eradicate the need to choose between safety and efficiency.

- Leverage is a powerful tool to reduce custodial risks for sophisticated traders that can continuously monitor and manage risk.

Share this article

Your cryptocurrency is only as safe as the method you use to store it. Exchanges are considered the least secure venue to store cryptocurrency, while offline wallets are the safest. But there’s a trade-off between the ease of entering and exiting positions and the security of your holdings.

How to Store Your Crypto

There are two choices for a cryptocurrency investor when it comes to storing their crypto holdings: custodial or non-custodial.

When users store their holdings on a platform like an exchange, that is considered custodial. Users hand over security measures to the exchange.

But when a user holds their funds in a wallet that only they can access, it is non-custodial and free from platform risks.

Both of these methods have their merits and flaws and the best option varies for different types of investors.

Non-custodial is more secure but inefficient, as it takes time to deposit funds in a trading avenue, and a trading opportunity could be missed.

Custodied funds are subject to many more risks, such as hacks, but offer better trading efficiency as funds are stored on an exchange.

As a rule of thumb, long-term holdings should be stored in a non-custodial fashion. But for short-term traders with an open position, keeping it on the exchange is the smarter option.

For non-custodial storage, offline wallets are the safest bet, as they aren’t connected to the internet and susceptible to hacks. Think of it like cash: online hackers can’t touch physical currency notes because they don’t exist online.

Hardware and paper wallets are offline storage methods, offering the highest degree of security for self-custodial investors.

Is It Okay to Store Crypto on an Exchange?

Crypto markets are infamous for their volatility, and this has created a breed of traders that lack long-term conviction but play the crypto markets during short or mid-term swings.

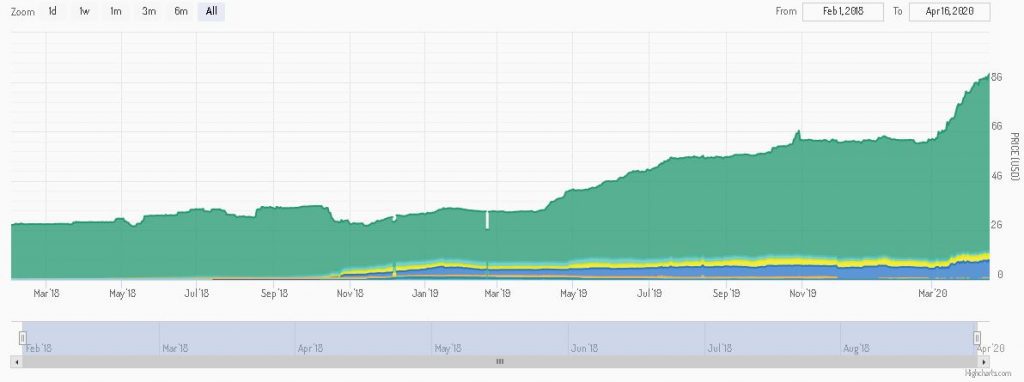

These traders usually hold short-term positions, but the rest of the time they hold their capital in a stablecoin like USDT or USDC. Tether’s USDT is by far the most popular stablecoin on the market.

For a trader like this, holding funds on an exchange makes more sense for when they’re in a speculative position. However, if on the sidelines awaiting an opportunity, it is still best practice to hold their funds offline, or at the very least, in a non-custodial wallet.

For derivatives trading, traders need to guarantee their solvency by depositing collateral that acts as a security deposit for the exchange. Those using platforms like BitMEX, Binance Futures, FTX Exchange, and other derivative-centric exchanges need to comply with these collateral requirements to trade.

Beyond the types of trades a user may make, the must also consider the differences between exchanges. The risk of storing funds on Bitstamp as opposed to HitBTC or BitForex, for instance, is worlds apart.

If users have done their due diligence, what is safe and what isn’t becomes clear. Coinbase, for instance, keeps only 2% of its total crypto holdings in a hot wallet; the rest is in cold storage. The exchange also has insurance that covers any loss from the hot wallet, adding another degree of safety.

Binance has been hacked for nearly 7,000 BTC, but they bore the burden of the loss by compensating investors through the exchange’s insurance fund.

Conversely, Cryptopia was also a fairly reputed exchange, and it is now in the process of being liquidated.

Regardless of the exchange, leaving coins on an exchange should only be done if one is a short-term trader looking to exit an existing position.

It’s always better to be safe than sorry.

How the Pros Reduce Custody Risk

There are several ways to minimize the risk of custody. In the last year, there has been an eruption in the use of non-custodial exchanges, sometimes called decentralized exchanges (DEXes).

DEXes like Uniswap and Kyber Network offer traders strong liquidity and anonymity backed by the number two blockchain network: Ethereum. For spot traders that are looking for positions in ETH or liquid ERC-20 tokens, DEXes are one of the best choices, as funds are always in the user’s control.

ShapeShift is another top non-custodial exchange, but it isn’t a DEX because it has a single point of failure. The exchange is run by a limited liability company, unlikeUniswap, which is just a smart contract written in Ethereum’s programming language, Solidity.

DEXes offer a non-custodial way to trade fairly large positions, and they are gradually gaining liquidity to serve a larger audience.

When it comes to derivatives trading, there’s a tactic used by sophisticated traders that lets them reduce their custodial risk, but requires steadfast risk management.

If a trader wants to buy ten BTC worth of Bitcoin Futures, but they want to keep custody risks to a minimum. In this specific trade, the trader would need to hand over ten BTC of collateral to a centralized exchange. This is undesirable.

- At 2x leverage, only 5 BTC is needed for 10 BTC of exposure.

- At 5x leverage, only 2 BTC is needed for 10 BTC of exposure.

- At 10x leverage, only 1 BTC is needed for 10 BTC of exposure.

By using leverage, a trader can reduce the amount of collateral needed for their derivative positions. This also means that the liquidation price – the price at which the exchange closes out the positions and the collateral posted is lost – for the position is higher.

In this arrangement, users would need to actively manage the position and account risk at all times. With more leverage, there is a reduced ability to withstand wild swings of volatility, which is very common in crypto.

The question of whether one should store their crypto on an exchange doesn’t have a binary “yes or no” answer. It depends on the situation, the amount, and whether it is more important to have quick access to one’s funds or to protect these funds from security risks.

Share this article