wNews: All Eyes on Biden, Bitcoin, and the Future of Index Funds

High-leverage crypto news, wrapped and bundled every Friday. And sometimes Sunday.

Key Takeaways

- Biden finally moved into the White House, but what does this mean for Bitcoin and the crypto industry?

- Both Bitcoin and Ethereum took steep dives this week, dropping through key support levels.

- The future of index funds paints a bullish picture for the unique ways blockchain technology can improve finance's favorite funds.

Share this article

This week’s wNews column dives into the nitty-gritty of what a Biden administration means for Bitcoin.

So far, many of his appointees and cabinet members appear to be far more tech-savvy than their predecessors. Some even boast experience working directly with cryptocurrencies.

Still, renewed attention, especially amid an eye-watering bull run, may not be as positive as some hope.

Markets took another steep tumble this week, as Bitcoin bottomed out just below the key $30,000 support. Not all altcoins followed the king crypto, however. Some even appreciated during the bloodshed.

Finally, this weekend’s crypto to-do list is all things decentralized index funds.

All that and more, below.

An Economy in Tatters

President Joe Biden was officially sworn in this week. But after a contentious Trump presidency and the crushing effects of the pandemic, the new leader of the free world has his work cut out for him.

Naturally, he won’t be alone in rebuilding the economy.

Throughout the week, crypto enthusiasts have kept close tabs on the various appointees, secretaries, and chairpeople that Biden is putting in place. The most important roles include the Chairman of the Securities and Exchange Commission (SEC), the Chairman of the Commodity Futures Trading Commission (CFTC), and the Secretary of the Treasury.

There is a candidate for each of the three positions, but they have yet to be voted in officially. One can nonetheless glean much from each nominee’s relationship with cryptocurrencies.

— Ben Golub 🇺🇦 (@ben_golub) January 20, 2021

The current nominee for the Secretary of the Treasury is Janet Yellen. Just recently, the Senate Finance Committee voted unanimously to have her fill the role. The next step is a full floor vote, which is also expected to end positively for her.

Her stance on crypto hasn’t been the most bullish, but her recent comments suggest that she is taking an even-measured approach to the industry.

She first made headlines for a soundbite that implied she was fully against crypto due to its nefarious use cases. But later in the week, she added a much more nuanced response. She said:

“I think it important we consider the benefits of cryptocurrencies and other digital assets, and the potential they have to improve the efficiency of the financial system. At the same time, we know they can be used to finance terrorism, facilitate money laundering, and support malign activities that threaten U.S. national security interests and the integrity of the U.S. and international financial systems.”

Though Yellen has been balanced in her latest remarks directly related to cryptocurrencies, she has proposed an extremely contentious tax on unrealized gains. It’s mere consideration for now, but as markets head sky-high, it could be disastrous.

As Secretary of Treasury, Yellen would also play an outsized role in the United States fiscal policy.

Already Biden has proposed another massive round of stimulus to right the economy. He’s also admitted recently that there is very little the government can do to reel in the virus’s current trajectory.

With extreme money printing on the horizon, many institutions are turning to harder and risk-on assets. Thomas Kuhn, an analyst with Quantum Economics, told Crypto Briefing:

“They clearly can’t allow deflation and allow debt levels to increase vs. GDP. They are happy depreciating currency to a point, but it is already having a direct impact on asset prices, which are already historically high. They want managed inflation, but it looks like it is coming along quite broadly in soft commodities and energy.”

He added that central banks worldwide, not just the Fed, are running out of options to get a handle on the current financial environment.

Indeed, combatting inflation has become one of 2021’s biggest consensus trades.

In a survey of large money managers, the Bank of America revealed that the short dollar trade is one of “the most crowded trades” in the market.

The nominated SEC and CFTC Chairpeople are also important to consider. Unlike Yellen, however, both Gary Gensler and Chris Brummer bring extensive cryptocurrency and blockchain knowledge to the table.

Gensler taught a 12-week course at MIT Sloan, MIT’s business school, on cryptocurrencies and has been a vocal proponent of the technology. Likewise, Brummer has presented crypto to Congress on several occasions and has been an active participant in several influential fintech working groups.

At first glance, this all-star team of crypto-conscious financial regulators seems like a dream come true for the industry. But it’s not all roses.

With so many institutions entering crypto, the ongoing Ripple lawsuit, and high-profile SPACs and IPOs, the industry will likely undergo a hefty professionalization period.

That’s not to say that anonymous Twitter accounts won’t abound, but one should certainly expect at least a few new guardrails.

Market Action: Bitcoin (BTC)

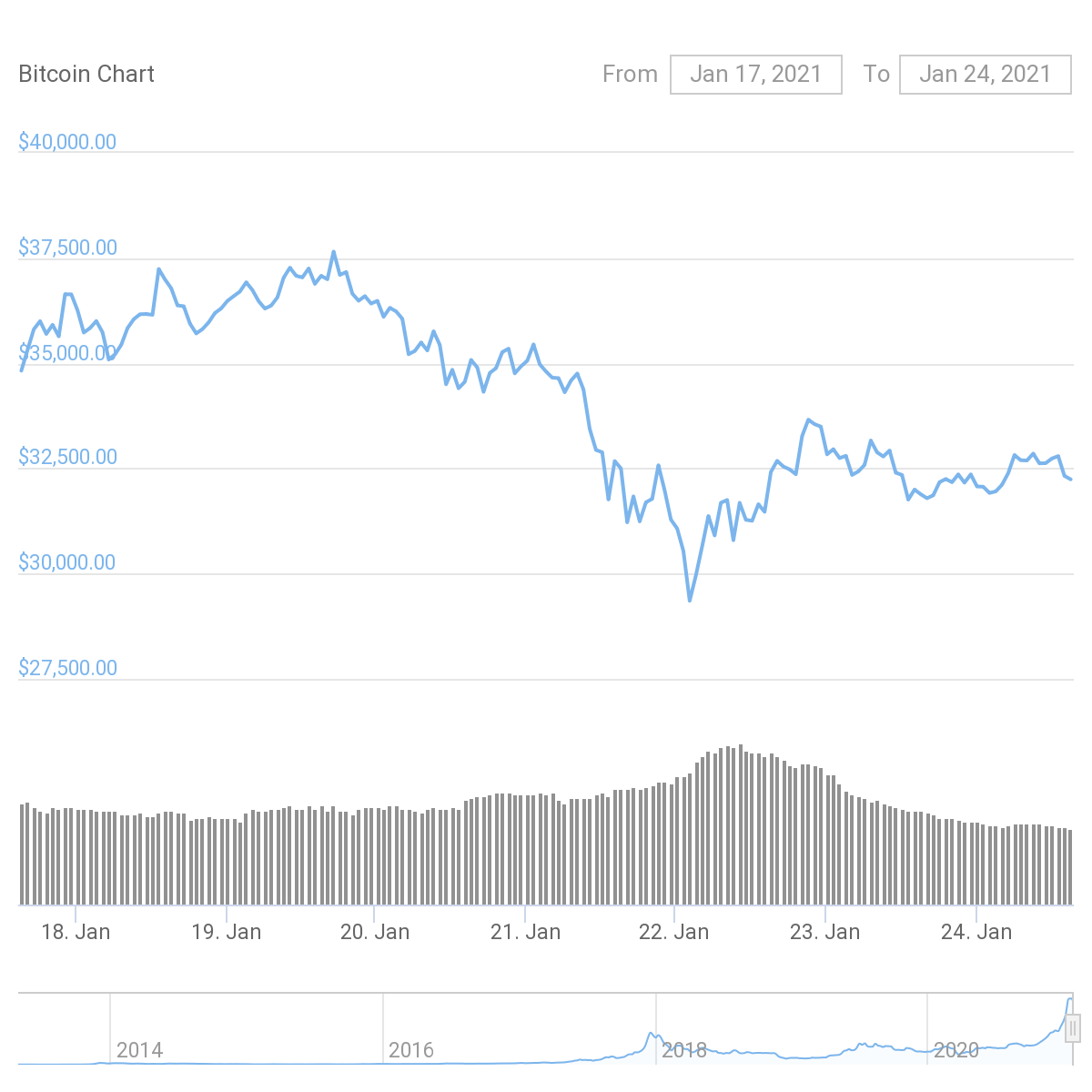

The biggest Bitcoin news this week was that of its calamitous drop below $30,000 on Friday. But like previous drops, on-chain analytics revealed larger investors were busy buying the dip. Even Microstrategy took the opportunity to scoop up even more BTC.

For more insight into what’s next, Crypto Briefing spoke with SIMETRI’s lead Bitcoin analyst, Nathan Batchelor. He said:

“Bitcoin dropped below its 200-period moving average on the H4 time frame for the first time since October, causing a major technical sell-off. This should be the battleground for bulls and bears over the days ahead. BTC also broke under a broadening wedge pattern, around $32,220, so I am watching daily price closes around this area for more clues about the short-term direction of BTC.”

Failing to hold this pattern suggests a steeper correction, but success “suggests $50,000 is still possible,” according to Batchelor.

There are a few other fundamentals to keep in mind as well. On Jan. 29, $3.5 billion in BTC options will expire, the largest ever expiration. Historically, large options expirations have signaled extreme volatility.

OKCoin has also integrated Bitcoin’s Lightning Network for its users. This makes trading on the platform much cheaper and faster, according to the firm.

And as the exchange completes a broad makeover of its UI and a new Earn feature, it could also become a top trading spot for the crypto-curious.

Already, mainstream media has brought renewed focus to Bitcoin — this week, Jim Cramer of CNBC’s Mad Money recommended a 5% allocation in BTC. The program is watched by millions, most of whom are retail investors, all of which likely chomping at the bit to buy a little bit of crypto.

Market Action: Ethereum (ETH)

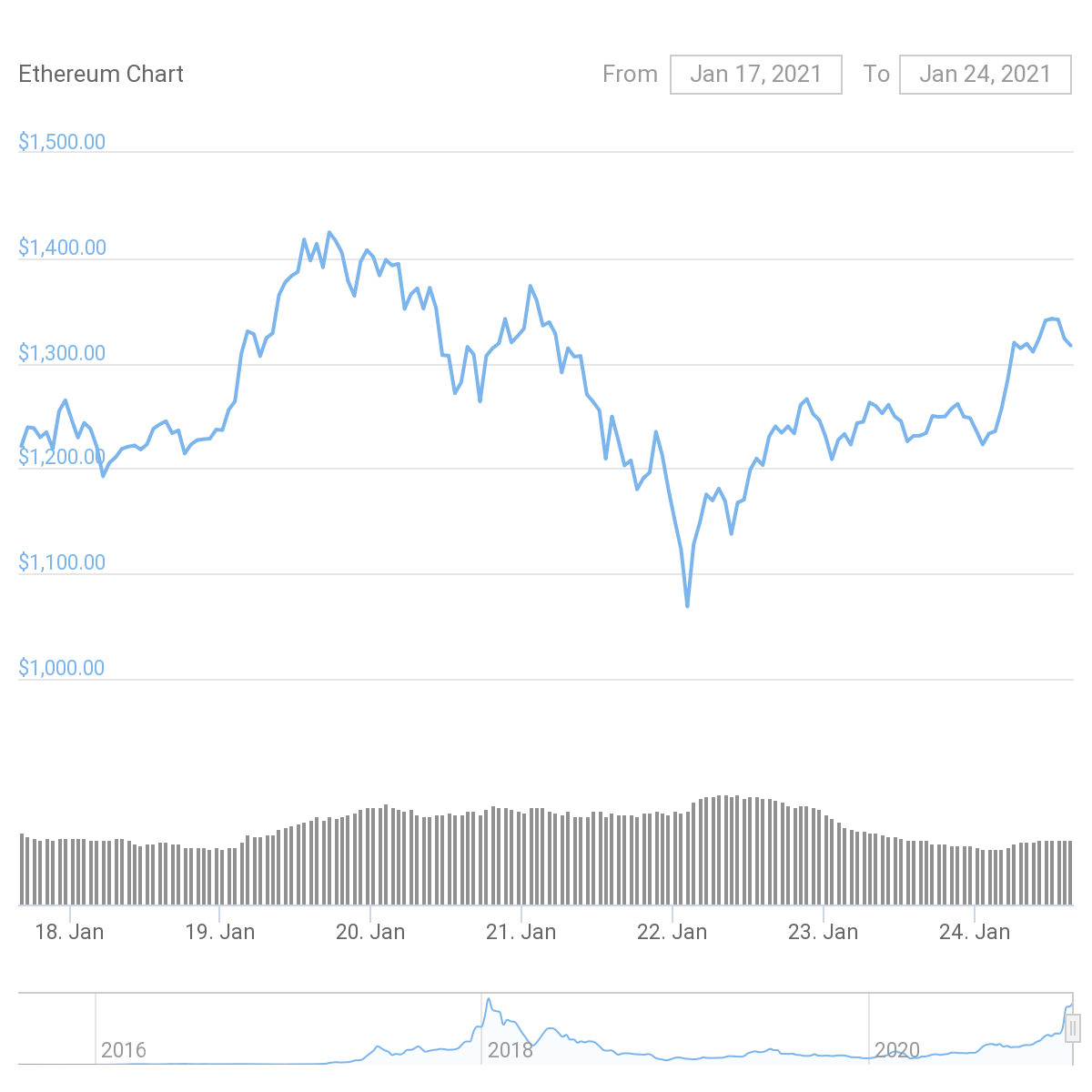

With only a few exceptions, whenever Bitcoin dips, so too does the rest of the market. Ethereum was no different, dropping below $1,100.

Since then, however, the number two cryptocurrency has clawed back to over $1,300.

Alongside Ethereum, many popular DeFi platforms and their respective tokens enjoyed positive price appreciation.

Synthetic (SNX), Uniswap (UNI), and Aave (AAVE) are all officially top-20 cryptocurrencies, according to CoinGecko. Kuhn suggested that platforms like these will be the primary engine for further ETH gains. He said:

“I think that decentralized platforms like Ethereum get bid for most of the year – now that DeFi has been proven as a concept, it comes back to these platforms as the next leap forward.”

There are several other fundamental drivers to keep in mind, including hashrate and ETH 2.0 staking, but DeFi is undeniably the most interesting sub-niche of late.

That and, of course, the booming NFT space. This week, Rick and Morty’s creator sold over $1 million in artwork minted on Ethereum.

11 signs $ETH is going to blow past its all-time high 👇🏼

— Spencer Noon 🕛 (@spencernoon) January 19, 2021

Crypto To-Do List: Decentralized Index Funds

For those just entering the crypto space, separating the winning picks from the losers can be difficult. The same issue plagues traditional finance too. This is one of the primary reasons behind investing in a set-it-and-forget-it index fund.

Index funds are “bundles” of top stocks, bonds, commodities, and cryptocurrencies.

When investors purchase these kinds of funds, they’re essentially purchasing a small slice of the top-performing assets within the fund’s sector. In traditional finance, the Vanguard 500 Index Fund (VFINX) tracks the largest 505 American companies’ equities’ performance.

In crypto, there are several types of crypto indices on offer.

Grayscale, the leading centralized asset management firm in crypto, offers the Grayscale Digital Large Cap Fund of four top cryptocurrencies.

Crypto Briefing also offers a helpful educational tool for setting up an index fund for ten of the leading cryptocurrencies on Coinbase Pro. The CB10 is much more hands-on, however. Users need to purchase each asset as well as rebalance the portfolio manually.

If one narrows down into the DeFi space, in particular, there are a ton of new index funds that users can purchase. The list of providers currently includes:

- Index Coop (Decentralized)

- PieDAO (Decentralized)

- Indexed Finance (Decentralized)

- PowerPool (Decentralized)

- Synthetix (Decentralized)

- FTX Exchange (Centralized)

Like traditional indices, these six let investors buy one asset and earn exposure to various DeFi-centric cryptocurrencies. The key differences between each of these indices revolve around asset allocations, token selection, centralized vs. decentralized, and how the funds are rebalanced.

FTX, for instance, is the primary arbiter of its index’s allocation, whereas a much larger community of token holders decide allocations for the decentralized versions. Each has its advantages and disadvantages.

Friends asked me about which tokens they should buy to invest in #DeFi. I researched some index providers and found @indexcoop, @powerpoolcvp @PieDAO_DeFi, but surprisingly my winner was @ndxfi, a newly launched protocol offering passive portfolio management strategies.

Why? ⬇️⬇️— 0x7761676d69 🫡 (@0x7761676d69) January 18, 2021

With crypto, however, a few other unique experiments are happening in the DeFi world.

First, if an index has a governance token, then the community of token holders decides on the index’s future. “The difference with a centralized index like from FTX is that a decentralized index is governed by $NDX holders,” said Lito Coen, Indexed Finance’s growth lead. Adding:

“Imagine you could decide the policy of the Vanguard index. This is made possible by DeFi.”

Second, each of the underlying assets in the decentralized varieties can be active rather than passively sit in the index. With DPI, Index Coop’s fund, users can yield farm with the token to earn extra profits.

Indexed Finance goes one step further in this regard.

Instead of idly appreciating, the underlying assets are also kept in a Balancer pool to generate fees similar to traditional liquidity providers (LPs). Coen said that since the project’s inception, it has generated over $100,000 in fees. These fees go directly to holders of Indexed’s DEFI5 and CC10 index holders.

For more information on Balancer and how this project operates, readers are advised to read Crypto Briefing’s Project Spotlight feature on the subject.

Indexed also leverages these same pools to adjust for any changes in market conditions and weightings when it comes to rebalancing. Coen said:

“The price and market cap data comes from a Uniswap price oracle. This triggers the AMM pool to set new target weights in the pool which changes the price gradually over time. This creates small arbitrage opportunities that external traders profit from. They buy the tokens we want to reduce our exposure from and sell the ones we want to increase our exposure to. Governance is not required at all for this process.”

Essentially, the pool adjusts its weightings, and lets arbitragers rebalance. It’s a win for the index holders, as well as traders.

That’s all for this week’s edition of wNews, readers. Stay tuned for next week’s dispatch.

Disclosure: At the time of press, the author held BTC, ETH, POLS, DPI, and WBTC.

Share this article