The 20 Crypto Events That Defined 2020

As the year of the most severe pandemic in decades draws to a close, we look back on how the cryptocurrency space pushed forward in the midst of a global humanitarian and economic crisis.

Key Takeaways

- The crypto industry triumphed despite devastation around the world this year, with Bitcoin and Ether leading the charge.

- Crypto believers will remember 2020 as the year that institutional investors finally warmed to Bitcoin, and DeFi started to blossom.

- Signs of mainstream adoption are on the horizon, though there will be regulatory challenges ahead.

Share this article

However you look at it, 2020 was a year of seismic change for the crypto industry and beyond.

The Black Swan that swept the world caused immense devastation, upending life for millions of people on every corner of the globe. To date, Coronavirus has claimed over 1.5 million lives, to say nothing of the economic damage caused by prolonged lockdowns.

Crypto Proves Anti-Fragility

The world’s sociopolitical landscape also had a major upheaval, prompted by a viral social media clip of George Floyd’s death at the hands of a Minneapolis police officer. Outrage over his murder led to large scale protests worldwide in support of the Black Lives Matter movement.

These events impacted everyone. Still, some industries thrived in this unique environment.

Where much of the world was halted due to the pandemic, the cryptocurrency space had one of its biggest years to date. The markets continued to run 24/7, and with Bitcoin refusing to waver alongside the explosion of what we now call DeFi, a wave of new entrants vindicated those who stuck through the crypto winter of 2018 to 2019.

While nothing is foreseeable in the cryptocurrency industry, the last 12 months have left many believers more than excited for the future.

For now, we do know that 2020 was the year that changed the world, and cryptocurrencies are still around – if not flourishing – at the end of it.

Here are the top 20 events that defined the year in the space.

-

End of the Bear?

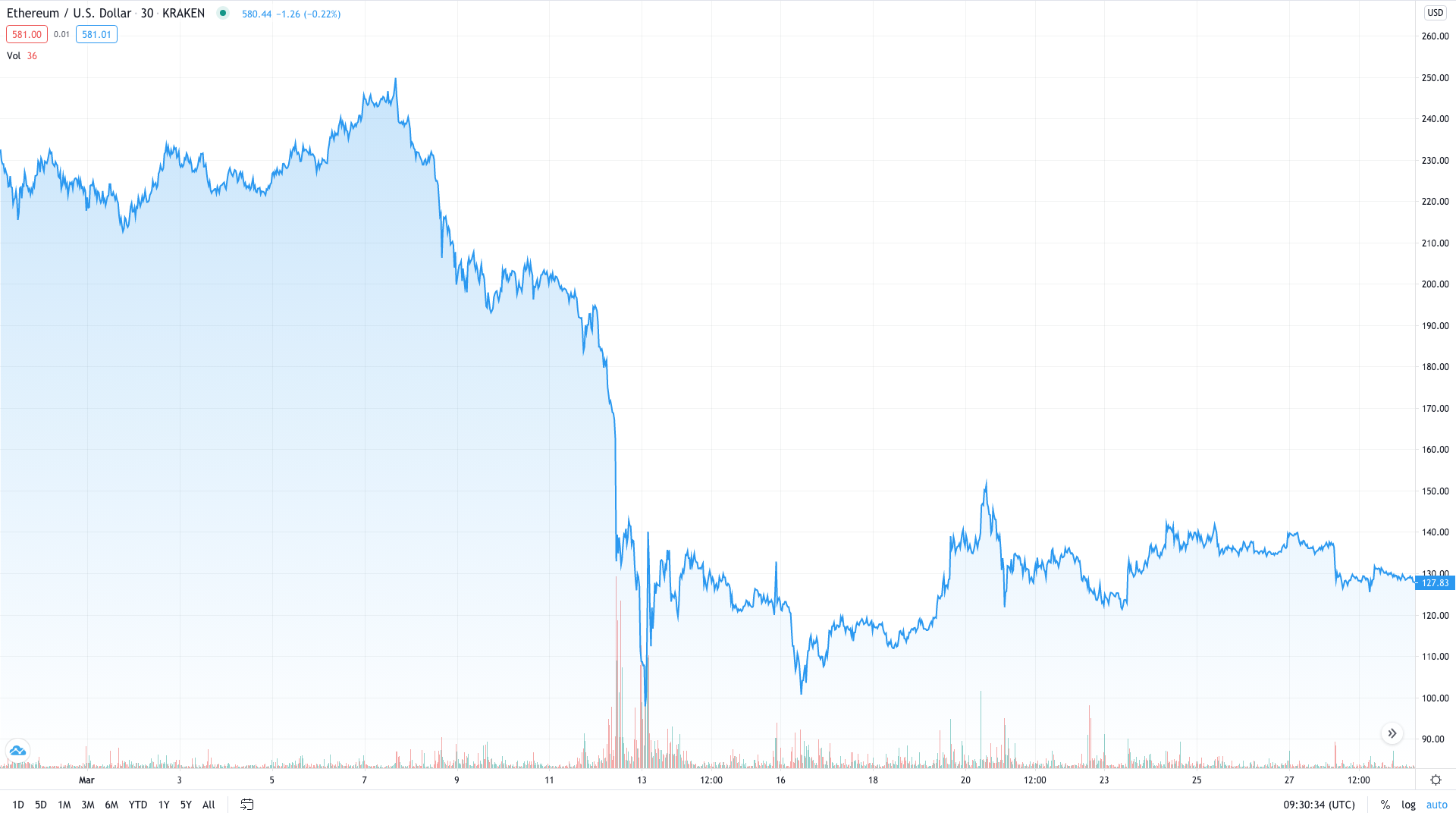

Bitcoin began the year at around $7,195, while Ether was only at $129 – a 91% drop from its all-time high of two years prior.

Neither 2018 nor 2019 were much better for either of the leading cryptocurrencies, marking what many assumed was the death of crypto in the fallout from the 2017 bull run. But the markets picked up at the start of 2020, raising hopes that the bear market had come to an end. Ether had doubled in price by mid-February, while Bitcoin broke its crucial $10,000 resistance barrier.

For those watching closely, it looked like the crypto space was showing signs of life again.

-

bZx Flash Loan Attacks

Flash loans enable DeFi users to borrow unlimited funds without providing collateral, as long as they repay the loan in the same transaction.

The tool raised many discussions this year, not all of it positive. Since the innovation surfaced, several advanced DeFi users have used flash loans to carry out large scale exploits, raising questions over whether they’ll positively or negatively affect the space in the long run.

The debates started after bZx was drained of almost $1 million across two attacks in February, though countless similar attacks have occurred since then.

-

Black Thursday

Patient zero for COVID-19 was recorded in Wuhan, China, in December 2019, but it wasn’t until early 2020 that the rest of the world started to respond to the outbreak.

By Mar. 11, recorded cases had jumped to 118,000 worldwide, leading the World Health Organization to classify the disease as a pandemic. The following day, Donald Trump suspended travel from Europe to the U.S.

Markets reacted with panic, triggering a crypto selloff that became known as “Black Thursday.”

Bitcoin and Ether dropped 50% in a day, and investors scrambled to go risk-off. The crash led to liquidations, as peak network congestion limited many investors from adjusting their Collateralized Debt Positions, and Maker suffered hugely due to DAI losing its peg.

-

China Kicks Off Digital Currency Race

While Europe and the United States went through their first round of lockdowns in April, China kicked off the world’s digital currency race with the launch of its digital yuan.

It’s still unclear what a cashless world means for cryptocurrencies like Bitcoin, but we know that other governments are now following China’s move.

With Coronavirus prompting the shift towards digital money, the need for Central Bank Digital Currencies (CBDCs) became a point of increased focus for leaders worldwide this year.

-

The Halving

Every four years, the block reward paid to Bitcoin miners gets cut in half. “The Halving,” as it’s affectionately known, has become a topic of debate, with divisions over whether the event triggers new highs in the cryptocurrency’s price.

The latest Halving occurred on May 11, and BTC experienced a subsequent price hike in line with the historical data.

Of course, there were several other factors at play that contributed to Bitcoin’s breakout.

-

Compound Launches COMP

DeFi began to blossom through the first half of the year, with Maker dominating the market. That changed when Compound launched its governance token COMP in mid-June, kicking off the “yield farming” craze in earnest.

COMP saw 400% gains in its first week, reaching a high of $372.

Following the token’s release, Compound overtook MakerDAO in Total Value Locked (TVL) in the protocol, though this didn’t last long—at that point, the DeFi boom was only beginning.

-

YFI’s fair launch

When liquidity mining became a key point of focus for DeFi users, Andre Cronje built the aggregator protocol yEarn.Finance to “optimize yield” across various protocols.

yEarn then launched its own token called YFI in July, which earned the community’s favor for its “fair launch” process. Cronje didn’t receive any YFI tokens despite building the protocol—he had to participate in yield farming and the rest of the yEarn community.

The move was applauded by many in the DeFi space, and YFI surged, hitting as high as $43,678 in September. yEarn has since announced several integrations and launched its V2 vaults. YFI is worth around $25,020 at press time.

-

Yield Farming Mania

What started as a yield farming frenzy with Compound had turned into mania by the height of the summer.

A number of protocols using “food tokens” emerged, offering lucrative yields to any DeFi users providing liquidity. One was a fork of the decentralized exchange Uniswap called SushiSwap; another called itself Pickle Finance.

The most notorious food token was an unaudited project called YAM that employed an innovative rebasing mechanism for its base token. YAM hype lasted less than 48 hours, pulling in over $100 million before a bug led to an excess minted supply of the YAM token.

The community rallied to save the project by delegating a supply of their governance tokens, though the project never fully recovered. Yield farming mania came to an end soon after.

-

Institutional Money Pours In

2020 was the year of long-awaited institutional money inflows into Bitcoin.

One of the key turning points was legendary investor Paul Tudor Jones declaring he’d allocated 1% of his portfolio to the leading cryptocurrency, followed by Michael Saylor making a $425 million purchase to add Bitcoin to Microstrategy’s balance sheets (he’s since become a vocal supporter for Bitcoin and bought at least another $50 million worth).

But they weren’t the only ones: notables names including CitiBank, Grayscale, and Stanley Druckenmiller have all advocated for the digital currency this year.

As the Federal Reserve printed trillions of dollars in an attempt to combat Coronavirus, investors saw strength in Bitcoin’s “digital gold” narrative as a hedge against inflation.

#Bitcoin is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.

— Michael Saylor⚡️ (@saylor) September 18, 2020

-

Uniswap Airdrops Stimulus Check

Circulation of the “money printer go brrrr” meme peaked as the U.S. government announced $1,200 stimulus checks to help the population through COVID-19.

Members of the DeFi community later found themselves drawing comparisons when the decentralized exchange Uniswap airdropped 400 tokens to anyone who’d traded on the protocol before Sept 1, 2020.

UNI tokens initially traded at $3, and liquidity providers were also generously rewarded, in what was labeled as one of crypto’s most successful airdrops. The move was executed to hand over governance of the protocol to the community, thus making Uniswap more decentralized.

-

DeFi Hits $10 Billion Locked

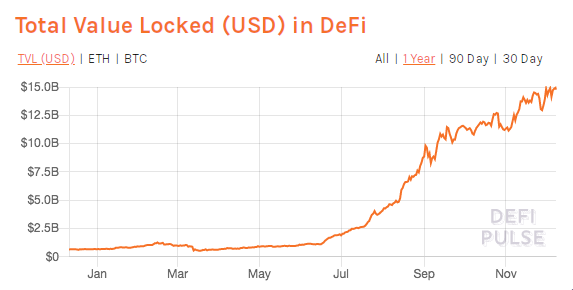

DeFi was growing at the start of the year, with over $600 million in value locked. It wasn’t until the summer that the sub-niche truly soared.

By mid-September, there was over $10 billion locked inside DeFi protocols running on Ethereum. Meanwhile, Metmask hit 1 million monthly active users. Today, DeFi’s TVL is closer to $15 billion.

As the space grew, key indicators suggested that decentralized finance is here to stay.

-

PayPal Turns Bullish on Crypto

In a year of heightened mainstream attention surrounding Bitcoin, perhaps the biggest surprise of all was PayPal’s move to adopt cryptocurrencies. In October, the payments giant announced its plans to integrate options for buying BTC, ETH, LTC, and BCH.

Unprecedented demand for the service led PayPal to raise crypto withdrawal limits before purchases were enabled for all U.S. customers. PayPal CEO Dan Schulman later declared he was “bullish on digital currencies of all kinds.”

The service has stated that it will offer crypto-to-fiat payments soon.

-

Joe Biden Becomes 46th U.S. President

Bitcoin plummeted as news agencies declared Joe Biden the victor of this year’s Presidential election, though the long-term impact Biden will have on the cryptocurrency space remains to be seen.

Nonetheless, crypto enthusiasts are bullish on Biden: FTX, a crypto derivatives exchange run by Sam Bankman-Fried, donated over $5 million to help his electoral campaign (it was the second-biggest donation Biden received).

Notably, the president-elect’s financial policy transition team will be led by Gary Gensler, the former chair of the Commodity Futures Trading Commission (CFTC).

Biden, too, has never publicly denounced Bitcoin like his predecessor has, which could bode well for the future of the space.

I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activity….

— Donald J. Trump (@realDonaldTrump) July 12, 2019

-

Stablecoins Fighting Hyperinflation

Stablecoin adoption soared in 2020, and not just through DeFi users adding collateral to protocols. Arguably the biggest moment for stablecoins was Circle’s partnership with the Bolivarian Republic of Venezuela and Airtm.

Organized with support from the U.S. government, the initiative was conceived to fight hyperinflation in Venezuela by providing medical workers and those in need with a secure form of currency.

It’s the first example of a digital currency being used for foreign aid, though it likely won’t be the last.

-

Coronavirus Vaccine Discovered

A sign of hope came on Nov. 9, when Pfizer and BioNTech announced a COVID-19 vaccine with 90% efficacy. Moderna then announced its treatment was 95% effective before the UK became the first country in the world to approve the Pfizer-BioNTech vaccine.

Whether a successful vaccine could directly impact cryptocurrencies is unclear, though there are a few likely outcomes: big pharma will win, young people around the world will go out to spend money, and markets will stay risk-on.

-

Bitcoin Breaks All-Time High (or Thereabouts)

Bitcoin’s all-time high price is up for debate. While many exchanges recorded highs somewhere around $19,600 in December 2017, some believe that the digital currency needs to break its crucial $20,000 to register a new high.

Depending on who you ask, Bitcoin may have broken its record price in early December, when it peaked at $19,860. At this point, the agreed all-time high isn’t especially important: Bitcoin has maintained a wild run, establishing $10,000 as a key support level since 2017.

It’s doubled in price since August, and with renewed interest in the asset from many respected figures, signs suggest there could be further room for growth heading into 2021.

-

Ethereum 2.0 Launches

Ethereum 2.0 has been talked about in the crypto community for years now. The upgrade to Ethereum was first proposed in late 2018, though Vitalik Buterin was writing about a proof-of-stake mechanism for a blockchain as early as 2014.

Following a number of delays, phase 0 for Ethereum 2.0 was announced in early November, with the Beacon Chain to initiate staking scheduled to go live on Dec. 1.

The deposit contract had to receive 524,288 ETH to go live as planned, and after slow uptake, the Ethereum community united to deposit over 200,000 ETH in the final 24 hours before the cut-off.

The Beacon Chain successfully deployed on Dec. 1, marking the beginning of the road to Serenity.

Over 1 million ETH has now been deposited for staking, and its price is at a yearly high; it’s worth around $600 today. Barring any hitches, Ethereum 2.0 will roll out over the next few years.

-

Visa adds USDC Payments

Visa announced a surprise partnership with Circle, enabling USDC payments to 60 million merchants worldwide. The firm will also issue a card specifically for sending and receiving USDC payments. USDC is an ERC-20 token designed to match the U.S. dollar price, and it runs on Ethereum.

In other words, Visa is slowly beginning to adopt Ethereum, and it’s ready to help the world start using it.

-

S&P Dow Jones Announces Cryptocurrency Indices

S&P Dow Jones detailed its plans to introduce cryptocurrency indexing in 2021, adding to a portfolio that includes the S&P 500 and the Dow Jones Industrial Average. The firm will team up with blockchain company Lukka to receive data on more than 550 cryptocurrencies.

The news indicates one thing above all else: mainstream adoption is coming.

-

U.S. Congress Introduces the STABLE Act

One of the most controversial moments for crypto came towards the end of the year when U.S. Congress introduced the STABLE Act.

Billed as a way of combatting “the risks posed by emerging digital payments,” the act specifically targets Facebook’s Libra currency and stablecoins. Its key proponents have publicly presented dubious arguments such as associated criminal risks and the supposed centralization of Ethereum nodes, prompting backlash from the crypto community.

However positive the outlook may be for cryptocurrencies in 2021 and beyond, the STABLE Act confirms that authorities are keeping a very close eye on the space.

Disclaimer: The writer of this feature owns ETH, UNI, and YAM, among a number of other cryptocurrencies. Andre Cronje is an equity holder in Crypto Briefing.

Share this article